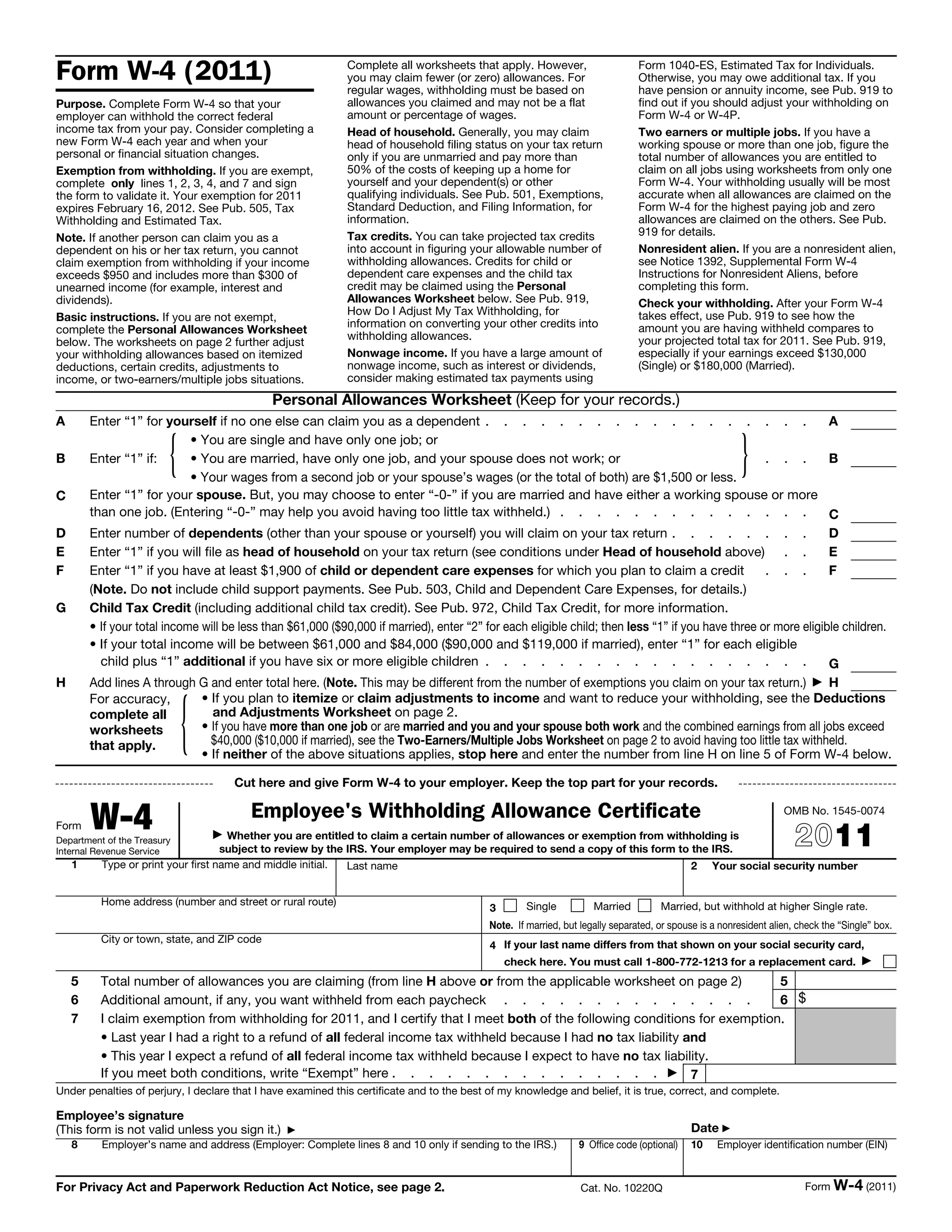

1) This document is the Form W-4, which employees complete so their employer can withhold the correct amount of federal income tax from their paychecks.

2) Key aspects of the form include claiming allowances to reduce withholding, considering your filing status and deductions, and whether you have multiple jobs or two earners in your household.

3) It provides worksheets to help calculate allowances based on your situation, and notes you may need to adjust your withholding or make estimated tax payments if your income exceeds certain thresholds.