Hdfc morning note

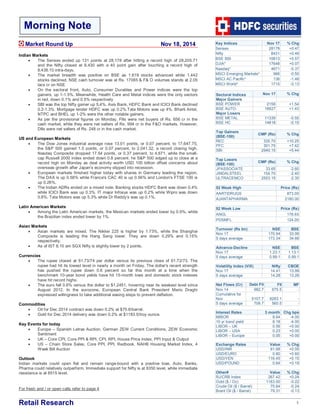

- 1. Retail Research 1 Key Indices Nov 17 % Chg Sensex 28178 +0.47 Nifty 8431 +0.49 BSE 500 10813 +0.57 DJIA* 17648 +0.07 Nasdaq* 4671 -0.37 MSCI Emerging Markets* 986 -0.50 MSCI AC Pacific* 136 -1.48 MSCI World* 1715 -0.13 Sectoral Indices Nov 17 % Chg Major Gainers BSE POWER 2156 +1.54 BSE AUTO 18927 +1.43 Major Losers BSE METAL 11339 -0.55 BSE HC 14818 -0.15 Top Gainers (BSE-100) CMP (Rs) % Chg REC 335.70 +10.25 PFC 301.75 +7.42 SBI 2940.15 +5.44 Top Losers (BSE-100) CMP (Rs) % Chg JPASSOCIATE 33.65 -2.60 JINDALSTEEL 154.70 -2.40 ULTRACEMCO 2553.15 -2.35 52 Week High Price (Rs) AARTIDRUGS 873.00 AJANTAPHARMA 2180.00 52 Week Low Price (Rs) ANGL 178.65 PDSMFL 124.00 Turnover (Rs bn) NSE BSE Nov 17 170.94 33.99 5 days average 173.34 34.66 Advance-Decline NSE BSE Nov 17 1.23:1 1.13:1 5 days average 0.99:1 0.99:1 Volatility Index (ViX) Nifty CBOE Nov 17 14.41 13.99 5 days average 14.28 13.28 Net Flows (Cr) Debt FII FII MF Nov 14 982.7 675.5 - Cumulative for Nov 5107.7 8283.1 - 5 days average 709.7 560.5 - Interest Rates 3 month Chg bps MIBOR 8.64 -4.00 10 yr bond yield 8.18 -4.00 LIBOR – UK 0.56 +0.00 LIBOR – USA 0.23 +0.00 LIBOR – Europe 0.05 +0.00 Exchange Rates Value % Chg USD/INR 61.68 +0.05 USD/EURO 0.80 +0.60 USD/YEN 116.45 +0.15 USD/POUND 0.64 +0.19 Other# Value % Chg RJ/CRB Index 267.42 +0.24 Gold ($ / Oz) 1183.00 -0.22 Crude Oil ($ / Barrel) 75.64 -0.24 Brent Oil ($ / Barrel) 79.31 -0.13 Market Round Up Nov 18, 2014 Indian Markets The Sensex ended up 131 points at 28,178 after hitting a record high of 28,205.71 and the Nifty closed at 8,430 with a 40 point gain after touching a record high of 8,438.10 intra-days. The market breadth was positive on BSE as 1,619 stocks advanced while 1,442 stocks declined. NSE cash turnover was at Rs. 17085 & F& O volumes stands at 2.05 lacs cr on NSE On the sectoral front, Auto, Consumer Durables and Power indices were the top gainers, up 1-1.5%. Meanwhile, Health Care and Metal indices were the only sectors in red, down 0.1% and 0.5% respectively SBI was the top Nifty gainer up 5.4%. Axis Bank, HDFC Bank and ICICI Bank declined 0.2-1.3%. Mortgage lender HDFC was up 0.2%.Tata Motors was up 4%. Bharti Airtel, NTPC and BHEL up 1-2% were the other notable gainers. As per the provisional figures on Monday, FIIs were net buyers of Rs. 656 cr in the cash market, while they were net sellers of Rs. 994 cr in the F&O markets. However, DIIs were net sellers of Rs. 248 cr in the cash market. US and European Markets The Dow Jones industrial average rose 13.01 points, or 0.07 percent, to 17,647.75, the S&P 500 gained 1.5 points, or 0.07 percent, to 2,041.32, a record closing high. Nasdaq Composite dropped 17.54 points, or 0.37 percent, to 4,671, while the small- cap Russell 2000 index ended down 0.8 percent. he S&P 500 edged up to close at a record high on Monday as deal activity worth USD 100 billion offset concerns about overseas growth after Japan's economy slipped into recession. European markets finished higher today with shares in Germany leading the region. The DAX is up 0.58% while France's CAC 40 is up 0.56% and London's FTSE 100 is up 0.26%. The Indian ADRs ended on a mixed note. Banking stocks HDFC Bank was down 0.4% while ICICI Bank was up 0.3%. IT major Infosys was up 0.2% while Wipro was down 0.8%. Tata Motors was up 5.3% while Dr Reddy’s was up 0.1%. Latin American Markets Among the Latin American markets, the Mexican markets ended lower by 0.9%, while the Brazilian index ended lower by 1%. Asian Markets Asian markets are mixed. The Nikkei 225 is higher by 1.73%, while the Shanghai Composite is leading the Hang Seng lower. They are down 0.29% and 0.15% respectively. As of IST 8.10 am SGX Nifty is slightly lower by 2 points. Currencies The rupee closed at 61.73/74 per dollar versus its previous close of 61.72/73. The rupee had hit its lowest level in nearly a month on Friday. The dollar's recent strength has pushed the rupee down 0.6 percent so far this month at a time when the benchmark 10-year bond yields have hit 15-month lows and domestic stock indexes have hit record highs. The euro fell 0.6% versus the dollar to $1.2451, hovering near its weakest level since August 2012. In the eurozone, European Central Bank President Mario Draghi expressed willingness to take additional easing steps to prevent deflation. Commodities Oil for Dec 2014 contract was down 0.2% at $75.6/barrel. Gold for Dec 2014 delivery was down 0.2% at $1183.5/troy ounce. Key Events for today Europe – Spanish Letras Auction, German ZEW Current Conditions, ZEW Economic Sentiment UK – Core CPI, Core PPI & RPI, CPI, RPI, House Price Index, PPI Input & Output US – Chain Store Sales, Core PPI, PPI, Redbook, NAHB Housing Market Index, 4 Week Bill Auction Outlook Indian markets could open flat and remain range-bound with a positive bias. Auto, Banks, Pharma could relatively outperform. Immediate support for Nifty is at 8350 level, while immediate resistance is at 8515 level. For fresh and / or open calls refer to page 4 Morning Note

- 2. Retail Research 2 Technical Analysis – Market Pulse Nov 18, 2014 After showing sideways consolidation pattern for the last many sessions, Nifty has moved up yesterday and is now placed at the verge of staging upside breakout of the whole consolidation pattern (as per daily timeframe chart). Nifty opened yesterday with slight weak bias and has slipped into intraday decline soon after the opening. It held nicely around the key intraday support of 8350 levels and showed recovery from the day’s low. Nifty has formed a new all time swing high of around 8438 levels yesterday and closed near the day’s high. After moving into a 100 points high low band in the last 7-8 sessions, the Nifty has now placed on the edge of showing sharp upside breakout of the whole sideways consolidation. On the clear upside breakout of the pattern one may expect upside pattern target of around 8515 levels (size of the consolidation) for near term The consolidations normally are a process of regeneration of energy for further moves and these patterns more often leads to sharper moves in either side. The current technical setup is signifying the upside breakout in Nifty above the consolidation band, hence one may expect sharp upside moves in the market for the next couple of sessions. Daily momentum oscillator like 14 period RSI has turned up after shifting into flat for many sessions. From the current reading of 74 levels, the daily RSI is expected to move up to 80-85 levels for near term. This expected action of daily RSI could possibly have positive impact on the trend of Nifty. Nifty Perspective Support Resistance 8430 Bullish 8350 8515 Nifty Trend Target Reversal Near Term (1-2 days) Up 8515 8349 Short Term (7-21 days) Up 8610 8290

- 3. Retail Research 3 For forthcoming Board Meeting on Nov 18, 2014 click on the following link http://www.bseindia.com/mktlive/board_meeting.asp#1 News Flash Nov 18, 2014 Economy News Trade deficit in October rose to $13.35 billion from $10.59 billion last year, according to the data released today. In September it had widened to $14.25 billion. Merchandise exports in October contracted by 5.04% at $26.09 billion from $27.48 billion same month last year. Imports, on the other hand, rose by 3.62% reaching $39.45 billion compared to $38.07 billion in October last year. In October, gold imports soared by a whopping 280.39% reaching $4.17 billion as against $1.09 billion. The department of food has estimated a total production of 25 million tonnes of sugar in the new sugar season starting October 2014 – September 2015, similar to the production level last year. This is higher than the first advance estimate of 24.5 mn tonne and the increased production is estimated due to higher acreage in Maharashtra and Karnataka and carries over stock of 3-4 lakh tones. Corporate News The Adani group's proposed plan to build a $7-billion coal mine was cleared by Australia's Queensland state which also announced a major investment in rail infrastructure to support the Indian conglomerate's mega project. The Bombay High Court today refused to grant an interim stay on FMC's order which declared Financial Technologies and Jignesh Shah not fit. Last year, FMC passed an order on 17 December which stated FTIL is not fit to hold stake in any of the exchanges in the country therefore forcing FTIL to divest its stake in all its exchanges in India and abroad. Indiabulls Asset Management, part of Indiabulls group, said it has appointed Ambar Maheshwari, as chief executive officer of its alternate investment funds business which it is setting up. Ashok Leyland has bagged orders worth $79.2 million from Tanzania and Zimbabwe. The company will supply trucks, buses, LCVs, spares and allied supported services (including training and development consultancy) as part of the deal. Confident of a high sustained demand for the Jaguar Land Rover range, India’s biggest vehicle manufacturing company Tata Motors may look at building a facility in the US. The company, which is fast exhausting production capacity at its UK plants thanks to robust demand for almost all its products, is forced to debottleneck production lines to extract additional output. Shares of Suven Life plunged 15 percent intraday after it reported disappointing September quarter results. The biopharmaceutical company's net profit fell 45 percent to Rs 24.8 crore in the quarter ended September 30. Its revenue also declined 6.8 percent to Rs 141.2 crore. Bulk Deals Scrip Name Quantity (in lakhs) Fund Name Price PATELSAI +0.30 THERM FLOW ENGINEERS PVT.LTD. 161.08 POKARNA -0.40 NALINI HARSHAD GORADIA 501.35 Key Corporate Action SCRIP NAME BC/RD BC/RD FROM EX-DATE PURPOSE FRL RD 19/11/2014 18/11/2014 Right Issue of Equity Shares FRLDVR RD 19/11/2014 18/11/2014 Right Issue of Equity Shares FRLDVRSL RD 19/11/2014 18/11/2014 Right Issue of Equity Shares FRLQF RD 19/11/2014 18/11/2014 Right Issue of Equity Shares FRLSL RD 19/11/2014 18/11/2014 Right Issue of Equity Shares SURYAMARK RD 19/11/2014 18/11/2014 Stock Split from Rs 10 to Re 1

- 4. Retail Research 4 Stock Ideas Nov 18, 2014 Update of Index Futures Date B/S Positional Call Entry at Sloss Targets Exit Price / CMP Exit Date % G/L Comments Time Horizon Avg. Entry Abs. Gain/Loss 14-Nov-14 S Nifty Nov Fut. 8,385.00 8425.0 8320.0 8425.0 14-Nov-14 -0.5 SL 1-5 Days 8,385.00 -40.0 Update of Stock and Nifty Options Calls: Date B/S Positional Call Entry at Sloss Targets Exit Price / CMP Exit Date % G/L Comments Time Horizon Avg. Entry Abs. Gain/Loss 17-Nov-14 B Reliance 1000 Call 8.15 4.15 17.5 10.55 29.4 Hold 2-3 days 8.15 2.4 14-Nov-14 B BHEL 240 Put Nov 8.10 5.0 14.0 5.0 17-Nov-14 -38.3 Stoploss Trig. 3-5 Days 8.10 -3.1 13-Nov-14 B PNB 1000 Call 6.85 3.85 14 8 17-Nov-14 16.8 Premature Profit Booked 2-3 days 6.85 1.2 13-Nov-14 B Axis Bank 450 Put 2.55 1.75 4.5 1.85 14-Nov-14 -27.5 Stop Loss Triggered 2-3 days 2.55 -0.7 13-Nov-14 B KTK Bank 135 Put Nov 3.10 2.0 6.0 4.4 13-Nov-14 41.9 Premature Profit Booked 3-5 Days 3.10 1.3 13-Nov-14 B Rel Infra 620 Put Nov 14.25 9.0 25.0 19.0 13-Nov-14 33.3 Premature Profit Booked 3-5 Days 14.25 4.8 12-Nov-14 B ICICI Bank 1650 Put 12.3 7.5 25 14.65 13-Nov-14 19.1 Premature Profit Booked 2-3 days 12.3 2.4 10-Nov-14 B Bharti Airtel 400 Call Nov 8.50 5.5 16.0 5.5 11-Nov-14 -35.3 Stoploss Trig. 3-5 Days 8.50 -3.0 10-Nov-14 B Axis Bank 460 Put Nov 9.30 5.7 18.0 11.40 10-Nov-14 22.6 Premature Profit Booked 3-5 Days 9.30 2.1 10-Nov-14 B Century Textile 580 Put Nov 15.75 10.3 30.0 15.60 10-Nov-14 -1.0 Premature Exit 3-5 Days 15.75 -0.2 Update of Momentum / Intra Day/Futures Calls: Date B/S Positional Call Entry at Sloss Targets Exit Price / CMP Exit Date % G/L Comments Time Horizon Avg. Entry Abs. Gain/Loss 17-Nov-14 B Aarti Drugs 825, 845.05 815.00 900.00 875.05 17-Nov-14 3.6 Premature Profit Booked 2-3 days 845.05 30 17-Nov-14 B Pidilite Ind. 418.95-412 404 455 427.9 17-Nov-14 2.1 Premature Profit Booked 3-5 Days 418.95 8.95 17-Nov-14 B Rcom 103.5-105.25 102 112 105.3 0.0 Hold 1-5 days 105.25 0.05 17-Nov-14 B HSIl 384-393.8 375 435 392 -0.5 Hold 1-5 days 393.8 -1.8 17-Nov-14 B Shoperstop 510.2 495.0 545.0 507.8 -0.5 Hold 3-5 Days 510.20 -2.4 17-Nov-14 B D B Realty 74.00-73.00 71.1 80.0 74.1 0.1 Hold 3-5 Days 74.00 0.1 14-Nov-14 B Castrol Ind 433.00 418.00 460.00 444.30 14-Nov-14 2.6 Premature Profit Booked 3 - 7 Days 433 11.3 14-Nov-14 B KITEX 560.00 540.00 600.00 577.80 14-Nov-14 3.2 Premature Profit Booked 3 - 7 Days 560 17.8 14-Nov-14 B Bajaj Auto 2630-2658.35 2,580.0 0 2,820.0 0 2,657.6 5 0.0 hold 1-5 days 2658.35 -0.7 13-Nov-14 B MT Educare 140.80 134.9 150.0 134.9 17-Nov-14 -4.2 Stop loss Triggered 2-3 days 140.80 -6.0 13-Nov-14 B Tata Coffee 933.65 899.0 998.0 958.9 17-Nov-14 2.7 Premature Profit Booked 3-5 Days 933.65 25.3 13-Nov-14 B Eros Media 305-301 294.0 325.0 311.6 14-Nov-14 2.2 Premature Profit Booked 3-5 Days 305.00 6.6 13-Nov-14 B Shasun Pharma 210.00 200.00 225.00 215.75 14-Nov-14 2.7 Premature Profit Booked 3 - 7 Days 210 5.8 13-Nov-14 B ALHUCONS 158.00 152.50 172.00 152.50 13-Nov-14 -3.5 Stop loss Triggered 2-3 days 158 -5.5 13-Nov-14 B HCL Tech 1600-1636 1582.0 1750.0 1619.7 -1.0 hold 1-5 days 1636.00 -16.3 12-Nov-14 B TNPL 148 142.7 160.0 142.7 13-Nov-14 -3.6 Stop loss Triggered 2-3 days 148.00 -5.3 12-Nov-14 B Enginers India 237.5 229.0 255.0 231.4 13-Nov-14 -2.6 Premature Exit 3-5 Days 237.50 -6.1 12-Nov-14 B ALSTOM T&D 382.85-379 367.0 415.0 392.0 13-Nov-14 2.9 Premature Profit Booked 3-5 Days 380.93 11.1 12-Nov-14 B Mastek 282 274.0 304.0 294.7 12-Nov-14 4.5 Premature Profit Booked 2-3 days 282.00 12.7 12-Nov-14 B Axis ENG 125 120.9 136.0 134.0 12-Nov-14 7.2 Premature Profit Booked 2-3 days 125.00 9.0 12-Nov-14 B J K Tyre 518 499.0 556.0 537.5 12-Nov-14 3.8 Premature Profit Booked 3-5 Days 518.00 19.5 12-Nov-14 B KITEX 546.00 525.0 575.0 560.0 12-Nov-14 2.6 Premature Profit Booked 3 - 7 Days 546.00 14.0 12-Nov-14 B Fin Cables 253 - 247 241.0 267.0 259.2 12-Nov-14 2.5 Premature Profit Booked 3 - 7 Days 253.00 6.2 11-Nov-14 B GPPL 179.30 174.0 190.0 176.0 13-Nov-14 -1.8 Premature Exit 2-3 days 179.30 -3.3 11-Nov-14 B Syndicate Bank 127-129.1 124.0 139.0 131.7 12-Nov-14 2.0 Premature Profit Booked 1-5 days 129.10 2.6 11-Nov-14 B IIFL 176.10-173 170.5 188.0 180.5 12-Nov-14 2.5 Premature Profit Booked 3-5 Days 176.10 4.4 11-Nov-14 B MAX 407-402 392.0 440.0 433.8 12-Nov-14 6.6 Premature Profit Booked 3-5 Days 407.00 26.8 11-Nov-14 B Autoline 97.70 94.0 105.0 102.6 11-Nov-14 5.0 Premature Profit Booked 2-3 days 97.70 4.9 10-Nov-14 B Dishman 162.05 156.00 174.40 156.0 12-Nov-14 -3.7 Stop loss Triggered 2-3 days 162.05 -6.1 10-Nov-14 B Tata Power 92-93.1 90.00 100.00 92.2 12-Nov-14 -1.0 Premature Exit 1-5 days 93.10 -0.9 7-Nov-14 B Geometric 137.00 132.0 144.0 132.0 13-Nov-14 -3.6 Stop loss Triggered 3 - 7 Days 137.00 -5.0 7-Nov-14 B NRB Bearings 133, 138.3 129.50 150.00 142.0 12-Nov-14 2.7 Premature Profit Booked 2-3 days 138.30 3.7 7-Nov-14 B Graves Cotton 144.50 139.00 155.00 147.9 10-Nov-14 2.4 Premature Profit Booked 2-3 days 144.50 3.4 7-Nov-14 B Bajaj Ele 291.00 284.85 302.00 295.5 10-Nov-14 1.5 Premature Profit Booked 2-3 days 291.00 4.5 3-Nov-14 B NHPC 20.5-21.3 20.1 25.0 20.4 13-Nov-14 -4.5 Premature Exit 1-5 days 21.30 -0.9 31-Oct-14 B MAGMA 121.8 115.0 132.0 115.0 10-Nov-14 -5.6 Stoploss Trig. 3-5 Days 121.80 -6.8 Update of Positional Calls: Date B/S Positional Call Entry at Sloss Targets Exit Price / CMP Exit Date % G/L Comments Time Horizon Avg. Entry Abs. Gain/Loss 17-Nov-14 B Redington 103.85 99.0 112.0 103.7 -0.1 Hold 5 Days 103.85 -0.1 14-Nov-14 B Deltacorp 102.90-101 97.5 113.0 98.9 14-Nov-14 -3.0 Premature Exit 3-5 Days 101.95 -3.1 14-Nov-14 B Hotel Leela 25.6-25 24.1 28.0 25.5 -0.4 Hold 3 - 7 Days 25.60 -0.1 13-Nov-14 B DCM Shreeram 224, 231.5 217.0 255.0 217.0 13-Nov-14 -4.7 Stop loss Triggered 5-7 days 227.75 -10.8 13-Nov-14 B Renuka Sugar 18.20 17.0 20.5 18.1 -0.5 Hold 3-14 days 18.20 -0.1

- 5. Retail Research 5 13-Nov-14 S DLF Nov Fut. 138.1-143 149.0 115.0 141.7 -0.8 Hold 3-14 days 140.55 -1.1 12-Nov-14 B Cox & Kings 306-314.5 301.0 350.0 301.0 17-Nov-14 -3.0 Stop loss Triggered 5-10 days 310.25 -9.3 11-Nov-14 B Astec 104, 109.4 101.5 124.0 101.5 17-Nov-14 -4.9 Stop loss Triggered 5-7 days 106.70 -5.2 11-Nov-14 B Electrosteel Cast 20.55 19.5 23.0 22.0 12-Nov-14 7.1 Premature Profit Booked 3-14 days 20.55 1.5 10-Nov-14 B BEML 670-707 660.0 850.0 745.0 10-Nov-14 5.4 Premature Profit Booked 5-10 days 707.00 38.0 10-Nov-14 B Zuari Global 98, 103 94.9 114.0 98.8 -1.7 Hold 5-7 days 100.50 -1.8 7-Nov-14 B KSK 77.5 - 74.5 72.5 85.0 74.8 13-Nov-14 -1.6 Premature Exit 3-14 days 76.00 -1.3 7-Nov-14 B Crisil 1850-1890 1800.0 2200.0 1941.4 12-Nov-14 2.7 Premature Profit Booked 5-10 days 1,890.0 51.4 5-Nov-14 B Vijaya Bank 49.30-48.25 47.5 54.0 51.40 12-Nov-14 4.5 Premature Profit Booked 5-7 Days 49.2 2.2 5-Nov-14 B Fin Pipe 334-338 318.0 380.0 327.70 11-Nov-14 -2.5 Premature Exit 5-10 days 336.0 -8.3 5-Nov-14 B Zee Learn 35, 36.3 34.5 42.0 34.5 10-Nov-14 -3.2 Hold 5-7 days 35.65 -1.2 31-Oct-14 B BGR Energy 161-166.9 155.0 200.0 155.00 17-Nov-14 -7.1 Stop loss Triggered 5-10 days 166.9 -11.9 31-Oct-14 B Graphite 90, 94.7 87.9 105.0 87.9 10-Nov-14 -4.8 Stop loss Triggered 5-7 days 92.35 -4.4 29-Oct-14 B PFC 285.15-282 274.0 305.0 274.0 10-Nov-14 -3.4 Stoploss Trig. 3-5 Days 283.6 -9.6 22-Oct-14 B ABIRLANUVO 1685.00 1609.0 1810.0 1755.0 10-Nov-14 4.2 Premature Profit Booked 3-5 Days 1685.00 70.0 HDFC securities Limited, I Think Techno Campus, Building –B, ”Alpha”, Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Fax: (022) 30753435 Disclaimer: This document has been prepared by HDFC securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for Retail Clients only and not for any other category of clients, including, but not limited to, Institutional Clients This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd.