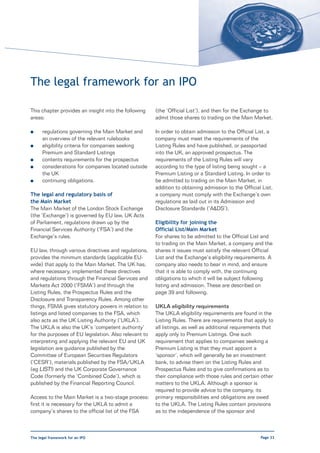

This document provides an overview of listing on the London Stock Exchange's Main Market. The Main Market has over 1,400 companies from over 60 countries and a combined market capitalization of £3.7 trillion. Listing on the Main Market demonstrates a commitment to high standards and provides access to capital from international investors. Key benefits of joining the Main Market include raising capital for growth, creating a market for a company's shares to broaden its shareholder base, and placing an objective market value on the business. The listing process involves approval from the UK Listing Authority and admission to trading on the London Stock Exchange Main Market.