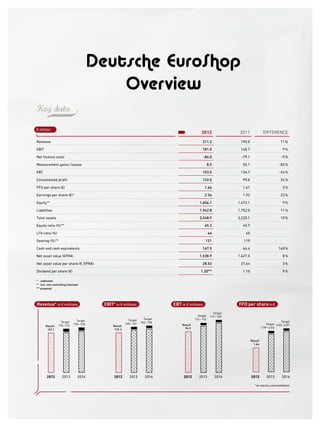

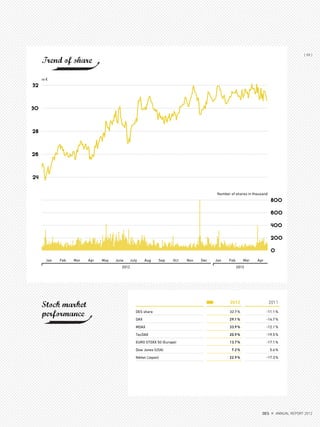

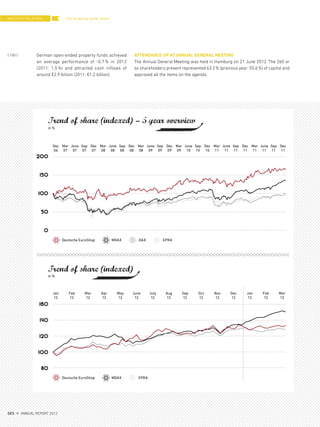

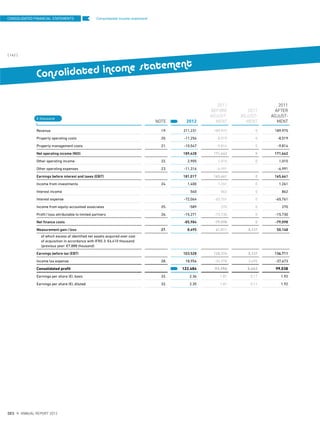

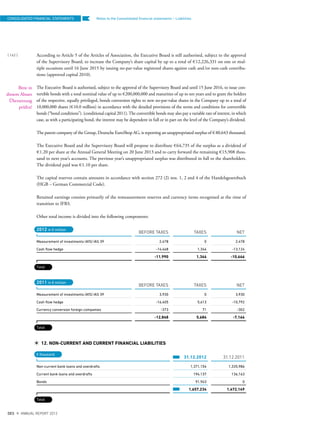

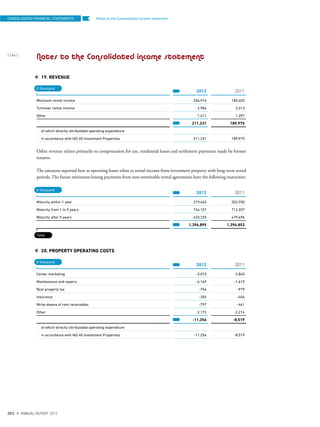

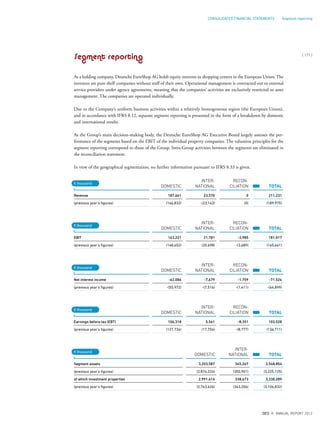

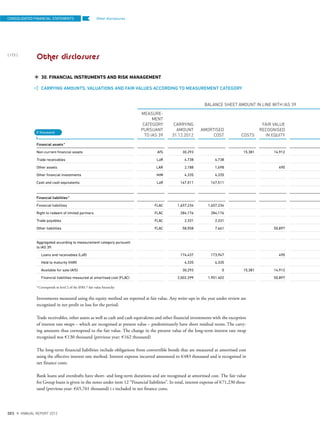

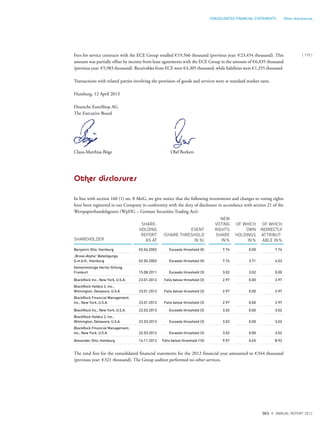

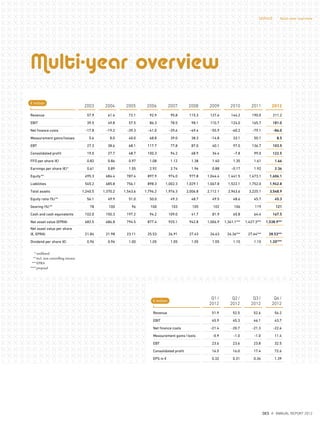

The document discusses Deutsche EuroShop's restructuring in response to a tax court ruling, their acquisition of the Herold-Center shopping center, and their financial results for 2012 which met forecasts. It also covers their plans to increase the dividend to €1.20 per share and forecasts a small dip in revenue and EBIT for 2013 due to one-time fees incurred from refinancing and restructuring activities in 2012.