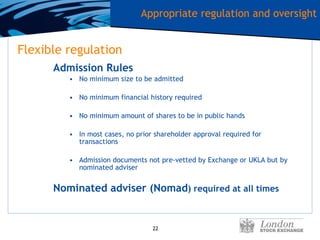

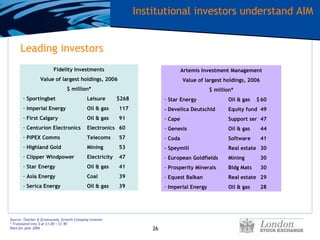

The document discusses the London Stock Exchange as a listing location for companies. It notes that the LSE provides access to global institutional investors and has high standards of regulation. The LSE has over 2,500 domestic companies listed and over 675 international companies listed, with a combined market capitalization of trillions of dollars. The Alternative Investment Market (AIM) has over 1,675 companies listed, including 343 international companies, and has raised over $115 billion since 1995. The document argues that the LSE provides a more flexible regulatory environment compared to exchanges like the NYSE or Nasdaq.