1. GST is a single, unified indirect tax levied on the supply of goods and services that replaces multiple taxes levied by the central and state governments. It is a destination-based tax collected by the government of the consumption state.

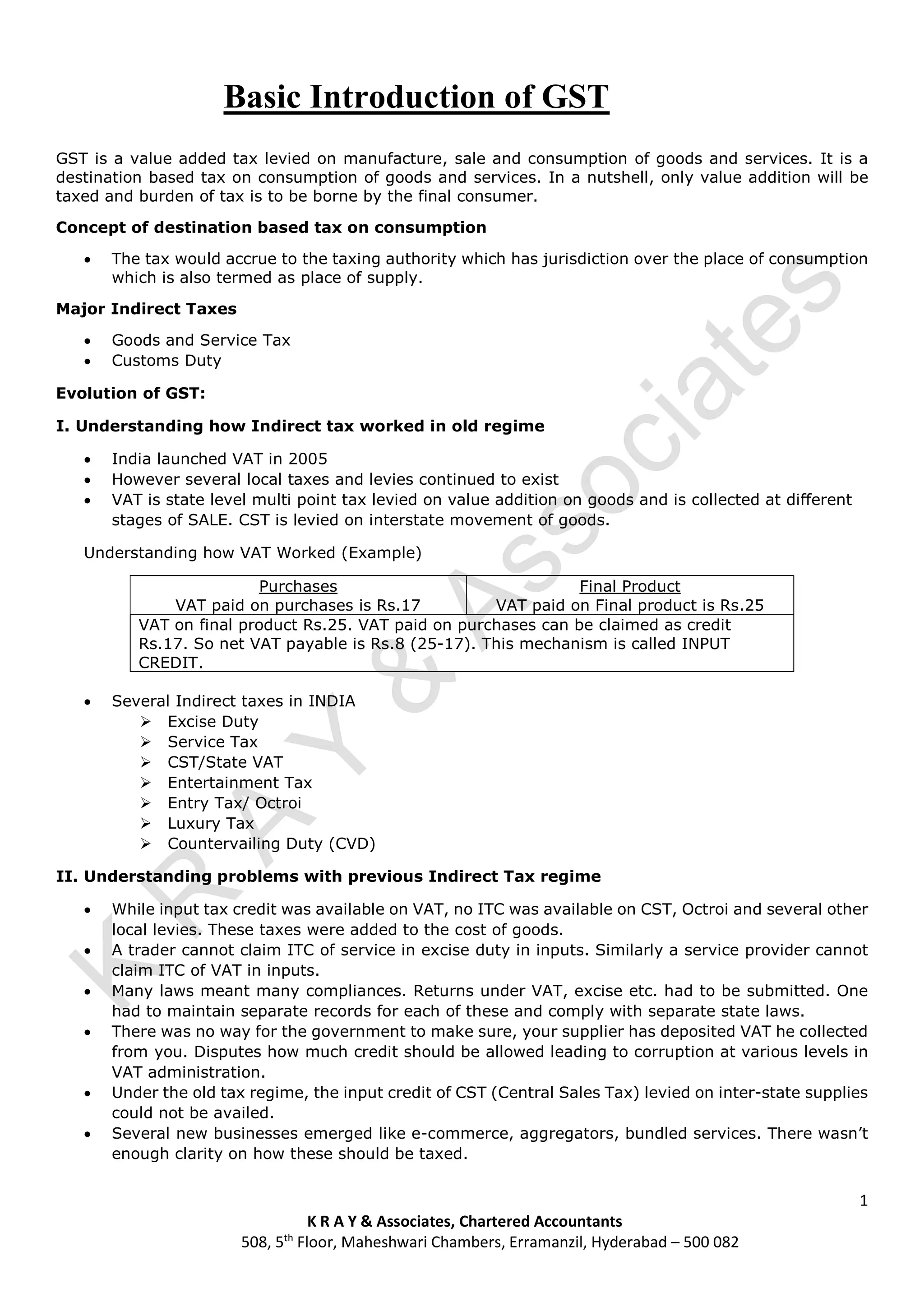

2. The previous indirect tax regime in India had many limitations like cascading of taxes, lack of set-off benefits across tax types and between central and state taxes. GST addresses these issues and aims to make India a common market by subsiding barriers to inter-state trade.

3. By integrating taxes and enabling seamless tax credits, GST is expected to reduce the overall tax burden on goods and services, increase compliance and make Indian exports globally competitive resulting in