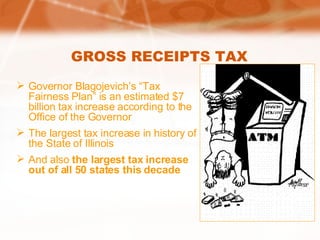

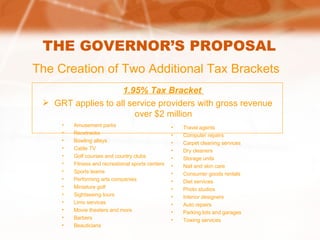

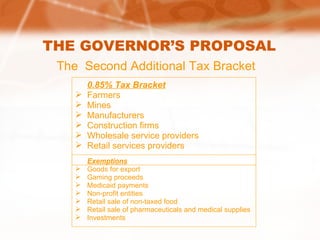

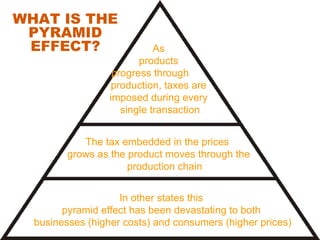

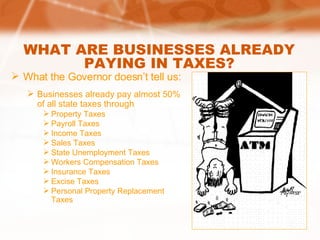

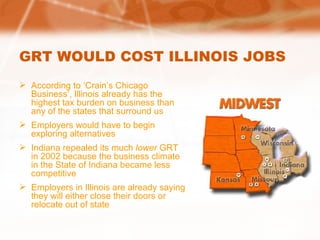

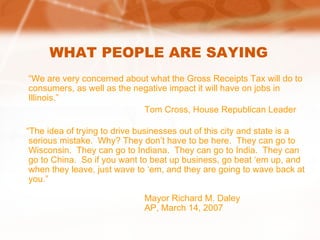

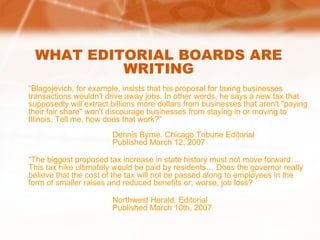

The document discusses Governor Blagojevich's proposed Gross Receipts Tax (GRT) in Illinois, which would be the largest tax increase in the state's history. The GRT is a tax on all business revenues, not just profits, and creates a "pyramid effect" where costs are passed to consumers as goods move through production chains. Opponents argue that the GRT will drive up costs for businesses and consumers, harm Illinois' competitiveness, and potentially cause job losses as businesses relocate to other states with lower taxes.