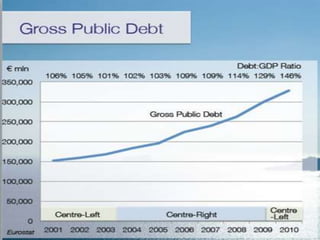

The Greek debt crisis began in 2010 when it was revealed that Greece had been underreporting its deficit figures for years. Greece owed over 350 billion euros to international lenders and investors. While the EU provided over 240 billion euros in bailout loans to Greece, harsh austerity conditions were imposed and the loans primarily paid off Greece's debts rather than helping the economy. The crisis highlighted flaws in the EU system by which individual states control budgets without EU oversight, and threatened the stability of the euro currency.