GP example.pptx

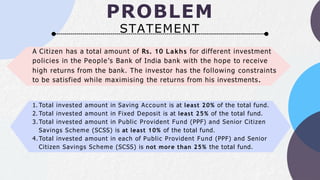

- 1. PROBLEM STATEMENT A Citizen has a total amount of Rs. 10 Lakhs for different investment policies in the People’s Bank of India bank with the hope to receive high returns from the bank. The investor has the following constraints to be satisfied while maximising the returns from his investments. 1. Total invested amount in Saving Account is at least 20% of the total fund. 2. Total invested amount in Fixed Deposit is at least 25% of the total fund. 3.Total invested amount in Public Provident Fund (PPF) and Senior Citizen Savings Scheme (SCSS) is at least 10% of the total fund. 4.Total invested amount in each of Public Provident Fund (PPF) and Senior Citizen Savings Scheme (SCSS) is not more than 25% the total fund.

- 2. For bank to maximize its returns on the total funds of Rs. 150 crores from RBI and from the investments which it receives from 100 similar citizens of 10 lakhs they provide loans such as: Home Loan Personal Loan Business Loan Car Loan Two Wheelers Loans 24x7 Loan against Securities Education Loan Loan Against Property Gold Loan Loan Against FD Commercial Vehicle Construction Equipment Loan

- 3. CONSTRAINTS The total amount allocated to Home Loan, Personal Loan and Education Loan should be at least 25% of the total fund. The total amount allocated to Loan against property, Gold Loan, 24x7 loan against securities, Loan against FD should not be more than 20% of the total fund. The total amount allocated to Car Loan, Two wheelers Loans should not be more than 15% of the total fund. The total amount allocated to Business Loan, Commercial Vehicle Construction Equipment Loan should be at least 20% of the total fund. The total amount allocated to Business loan is not more than 10%. The total amount allocated to education loan is at least 10% The total amount allocated to Home loan is at least 5%

- 4. CONSTRAINTS The total amount allocated to Personal loan is at least 5% The total amount allocated to Loan against property, Gold loan, Loan Against FD is at least 3.5% The total amount allocated to each of Car loan, Two wheelers Loans is at least 7.5% The total amount allocated to each of 24x7 loan against securities, Construction vehicle Construction Equipment loan, Gold Loan, Loan against property, Loan against FD is at least 2.5%.

- 6. GO A LS Goal 1: The total amount invested by each investor is at most 10 Lakhs Goal 2: The returns of the investors should be at least 20% of the amount all the investors have invested Goal 3: The total amount available for the bank to lend as various types of loans should not exceed the total amount of 10 crores received from 100 investors and the fund of 150 crores from the RBI Goal 4: The returns of the bank should be at least 25% of the amount they have lent in the form of loans to the customers

- 7. DECISION VARIABLES y1 =The amount to be invested by investor in Savings account y2 =The amount to be invested by investor in Fixed Deposit y3 =The amount to be invested by investor in PPF y4 =The amount to be invested by investor in SCSS x1 =The amount to be lent by the bank to customers as Home Loan x2 = The amount to be lent by the bank to customers as Personal Loan x3 = The amount to be lent by the bank to customers as Business Loan x4 =The amount to be lent by the bank to customers as Car Loan x5= The amount to be lent by the bank to customers as Two Wheelers Loan x6 =The amount to be lent by the bank to customers as 24x7 Loan against securities x7 =The amount to be lent by the bank to customers as Commercial Vehicle Construction Equipment Loan x8 =The amount to be lent by the bank to customers as Education Loan x9 =The amount to be lent by the bank to customers as Loan Against Property x10 =The amount to be lent by the bank to customers as Gold Loan x11 =The amount to be lent by the bank to customers as Loan against FD

- 8. D EV IA TIO N V A RIA B LES diN = Amount the right-hand side of goal i is deficient diP = Amount the right-hand side of goal i is exceeded Each bank investor invested at most 10 Lakhs There are 100 similar investors in and around that region who are investing at most 10 Lakhs similarly. Therefore, total amount invested by 100 investors = 100 * 10 Lakhs = 10 Crores Total amount available with Bank to lend as loans = Amount received from investors + Amount received from RBI = 10 crores + 150 crores = 160 crores

- 9. FUNC TIO NA L C O NSTRA INTS Amount invested in savings account: y1>= 2 Amount invested in Fixed Deposit: y2>= 2.5 Amount invested in PPF and SCSS (Minimum Limit): y3+y4>= 1 Amount invested in PPF (Maximum Limit): y3<= 2.5 Amount invested in SCSS (Maximum Limit): y4<= 2.5 Amount allocated to Home Loan, Personal Loan and Education Loan: x1+x2+x8>=40 Amount allocated to Loan against property, Gold Loan, 24x7 loan against securities, Loan against FD: x9+x10+x6<=32 Amount allocated to Car Loan, two-wheelers Loans: x4+x5<=24 Amount allocated to Business Loan, Commercial Vehicle Construction Equipment Loan: x3+x7>=32 Amount allocated to Business loan: x3<=16 Amount allocated to Education loan: x8>=16 Amount allocated to Home Loan: x1>= 8 Amount allocated to Personal Loan: x2>= 8 Amount allocated to Loan against property, Gold loan, Loan Against FD: x9+x10+x11>= 5.6 Amount allocated to each Car loan, Two-wheelers Loans: x4>=12, x5>=12 Amount allocated to each of 24x7 loan against securities, Construction vehicle Construction Equipment Loan, Gold Loan, Loan against property, Loan against FD: x6>=4, x7>=4, x9>=4, x10>=4, x11>=4 Non-negativity constraints: yi, xi, di >=0, for all i

- 10. GO A LS Goal 1: The total amount invested by each investor is at most 10 Lakhs: y1+y2+y3+y4<=10 y1+y2+y3+y4+d1N-d1P = 10 Goal 2: The returns of the investors should be at least 20% of the amount all the investors have invested: 0.035y1 +0.0715y2 +0.08y3 +0.086y4>=2 0.035y1 + 0.0715y2 + 0.08y3 + 0.086y4 +d2N -d2P = 2 Goal 3:The total amount available for the bank to lend as various types of loans should not exceed the total amount of 10 crores received from 100 investors and the fund of 150 crores from the RBI: x1+x2+x3+x4+x5+x6+x7+x8+x9+x10+x11<=160 X1+x2+x3+x4+x5+x6+x7+x8+x9+x10+x11 + d3N- d3P=160 Goal 4: The returns of the bank should be at least 25% of the amount they have lent in the form of loans to the customers: 0.1025x1+0.1260x2+0.15x3+0.0865x4+0.07x5+0.065x6+0.0915x7+0.08x8+0.1x9+0.1150x10 +0.078x11>= 40 0.1025x1+0.1260x2+0.15x3+0.0865x4+0.07x5+0.065x6+0.0915x7+0.08x8+0.1x9+0.11 50x10+0.078x11 + d4N- d4P

- 11. OBJECTIVE FUNCTION Minimize d1P + d2N + d3P +d4N

- 13. LINGO SOLUTION

- 14. LINGO SOLUTION

- 15. LINGO SOLUTION

- 16. INTERPRETATION

- 17. VARIABLE VALUE INTERPRETATION x1 8 8 cr should be lent by bank to customers as a Home Loan x2 64 64 cr should be lent by bank to customers as a Personal Loan x3 16 16 cr should be lent by bank to customers as a Business Loan x4 12 12cr should be lent by bank to customers as a Car Loan x5 12 12cr should be lent by bank to customers as a Two Wheeler Loan x6 4 4 cr should be lent by bank to customers as a Loan Against Security x7 16 16 cr should be lent by bank to customers as a Commercial Vehicle Construction Equipment x8 16 16 cr should be lent by bank to customers as a Educational Loan x9 4 4 cr should be lent by bank to customers as a Loan Against Property x10 4 4 cr should be lent by bank to customers as a Gold Loan INTERPRETATION

- 18. INTERPRETATION y1+y2+y3+y4<=10 y1+y2+y3+y4+d1N-d1P = 10 D1P = 0 D1N = 0 Goal 1 Hence, we can conclude that Goal 1 is completely met and total amount invested by each investor is 10 Lakhs Goal 2 0.035y1 + 0.0715y2 + 0.08y3 + 0.086y4>=2 0.035y1 +0.0715y2 + 0.08y3 + 0.086y4 +d2N -d2P = 2 Values in Lingo solution D2P =0 and D2N =1.30050 R.H.S. = 2 - D2N + D2P = 2 - 1.30050 = 0.6995 Hence, we can conclude that Goal 2 is underachieved by 1.30050 crores i.e; each investor will gain a profit of (2- 1.30050) crores/100 = 0.6995 crores/ 100 = Rs. 69,950

- 19. INTERPRETATION Goal 3 x1+x2+x3+x4+x5+x6+x7+x8+x9+x10+x11<=160 X1+x2+x3+x4+x5+x6+x7+x8+x9+x10+x11 +d3N- d3P=160 Values in Lingo solution D3P =0 D3N = 0 Hence, we can conclude that the total amount available for the bank to lend as various types of loans is exactly equal to 160 crores

- 20. INTERPRETATION Goal 4 0.1025x1+0.1260x2+0.15x3+0.0865x4+0.07x5+0.065x6+0.0915x7+0.08x8+0 .1x9+0.1150 x10+0.078 x11>= 40 0.1025x1+0.1260x2+0.15x3+0.0865x4+0.07x5+0.065x6+0.0915x7+0.08x8+0 .1x9+0.1150x10+0.078x11 +d4N- d4P = 40 Values in Lingo solution D4P =0 D4N = 22.6620 Hence, we can conclude that the Goal 4 is underachieved by 22.6620 crores i.e; the bank will gain a profit of 40- 22.6620 = 17.338 crores.