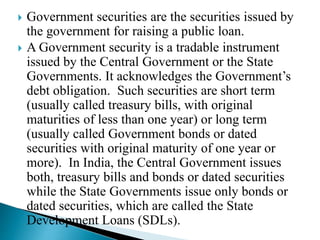

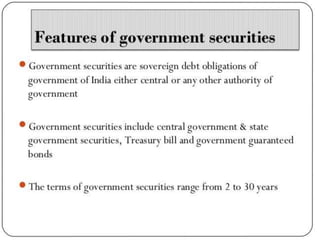

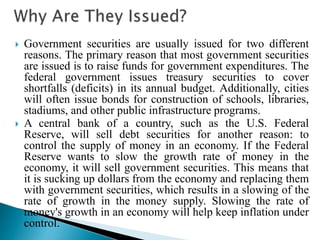

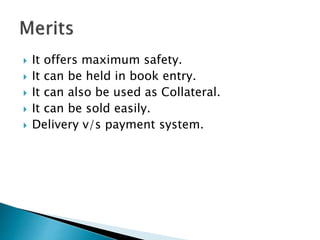

Government securities are debt instruments issued by governments to finance government spending and control money supply. They include treasury bills (short term), notes, and bonds (long term). Government securities are considered low risk investments because they are backed by tax revenue. They offer safety of principal, liquidity, and can be used as collateral for loans. However, they also carry interest rate risk and may not be suitable for long term holding.