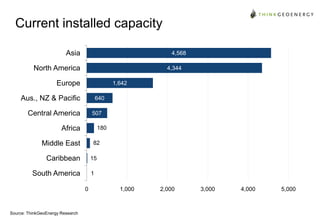

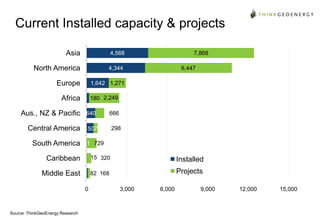

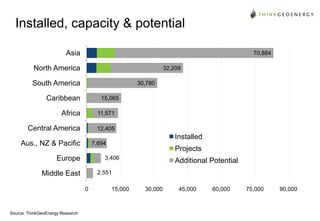

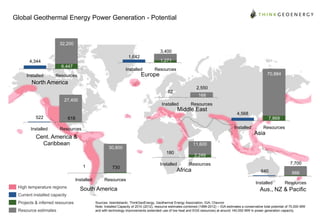

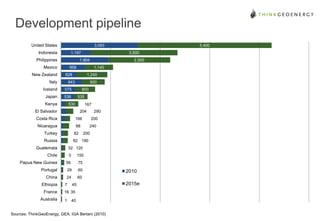

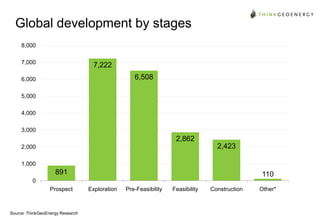

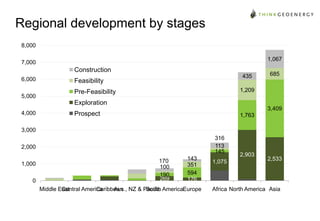

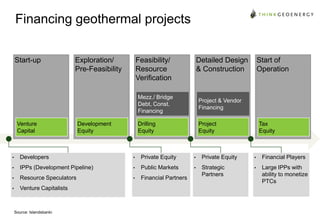

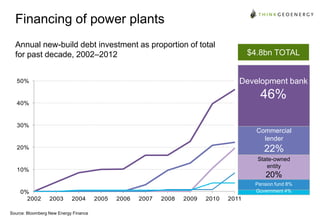

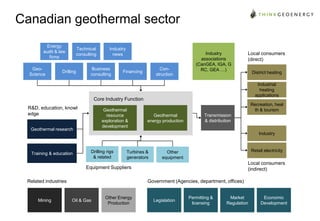

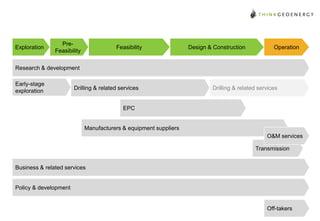

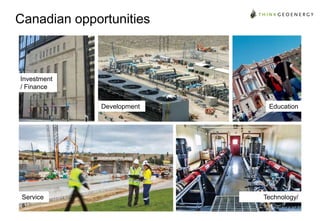

The document summarizes the current status of global geothermal development. It shows that Asia has the largest installed geothermal capacity at 4,568 MW, followed by North America at 4,344 MW. The development pipeline is largest in the United States, Indonesia, and the Philippines. Financing remains a challenge, with development banks playing a key role. The document also outlines opportunities for Canadian companies to participate in geothermal supply chain areas like drilling, engineering, manufacturing, and services.