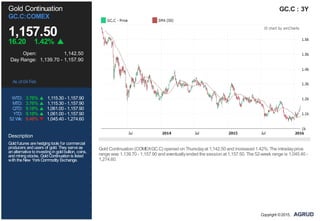

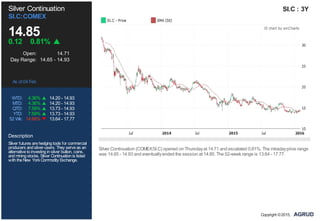

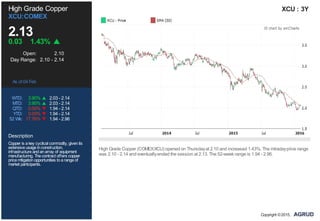

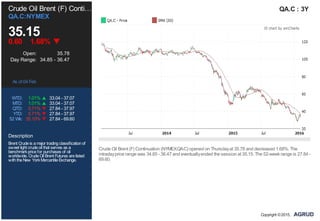

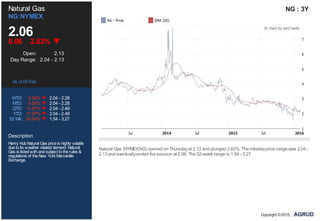

The document provides a summary of commodity price movements on February 4th for several major commodities including the S&P GSCI Total Return Index, gold, silver, copper, crude oil (WTI and Brent), and natural gas. It lists the opening price, daily price range, weekly, monthly, quarterly, and yearly price ranges as well as a brief description for each commodity. All commodities decreased or remained relatively flat on the day except for gold and silver which increased around 1-2%.