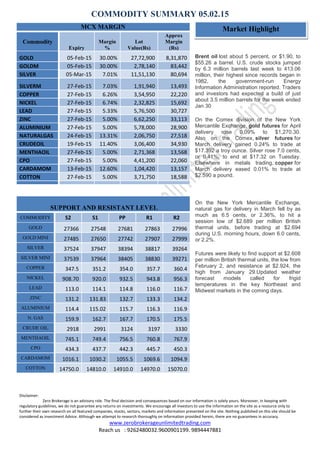

The document provides a commodity market summary dated February 5, 2015, highlighting significant movements in various commodities, including a 5% drop in Brent oil and an increase in U.S. crude stocks to record levels. Gold and silver prices showed slight gains, while natural gas experienced a decline amid forecasts of colder temperatures. The document also includes margins for various commodities set to expire, advising that the information should not be considered as investment advice and is meant for research purposes only.