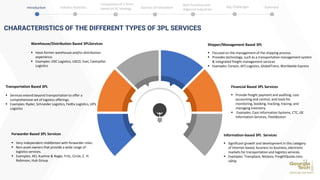

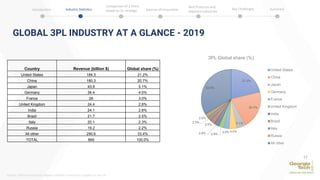

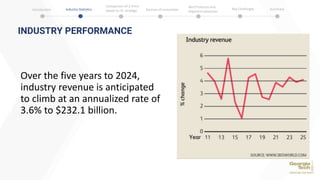

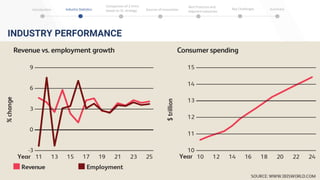

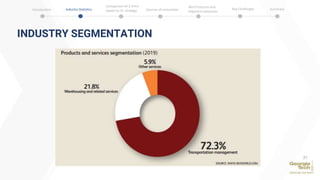

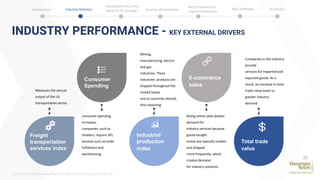

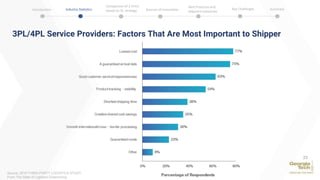

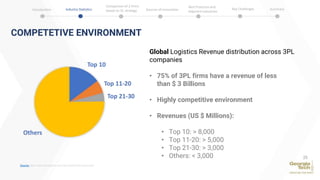

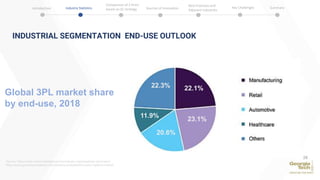

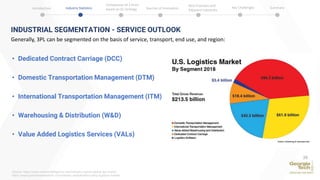

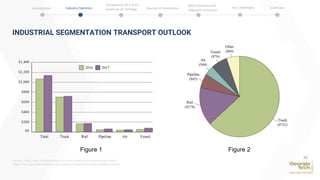

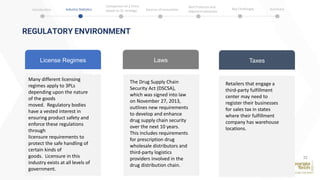

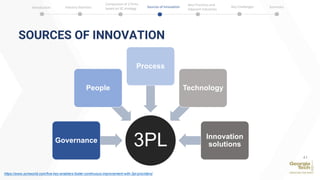

The document discusses the 3PL industry, providing statistics on the size and segmentation of the global and US 3PL market, with the US and China representing the largest country markets. It also outlines the types of services 3PL providers offer, including transportation, warehousing, and contract carriage, as well as how the 3PL industry is segmented by region, end use, and service line.