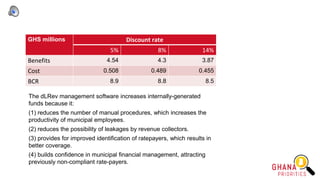

The document discusses the implementation of the DLREV management software for enhancing revenue collection at the local government level in Ghana, aiming to address inefficiencies in municipal revenue mobilization. DLREV is an open-source tool designed to improve property tax and business permit collection, significantly increasing the internally generated funds of municipalities by streamlining processes and improving data management. Financial analysis over four years reveals total costs of GHS 489,000 and expected benefits of GHS 4.3 million, primarily from increased revenue and reduced operational inefficiencies.