Graco Inc. is analyzed with a HOLD recommendation and 12-month price target of $81.50. Graco has a solid but conservative business model in the diversified machinery industry, with impressive market share but lack of significant growth. At its current valuation of 20.71x next-twelve-month EPS of $3.95 based on discounted cash flow analysis, Graco appears fully valued with little upside potential. The company has a strong focus on operational excellence, customer intimacy, and product leadership that provides a strong position, but management's conservative approach could lead to missed growth opportunities.

![CFA

INSTITUTE

RESEARCH

CHALLENGE

12/23/14

Appendix

8.

Discounted

Cash

Flow

Model

and

Calculations

!"#$%&'()$

*+,$%-)./0'1#,2'34%5'6)#47,+,

3+,$#4'8/#"'9)0/0'*/$/:;/"'<=&'>?=<

@+,.%"+$#4 A"%B/$./0

>?=? >?== >?=> >?=< >?=C >?=D >?=E >?=F >?=G H=<'I'H=G'16!J

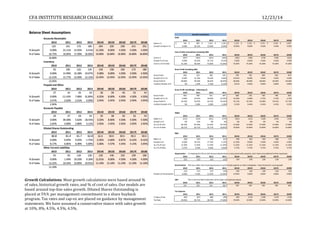

K/.'J/L/)-/ FCCM''''''''''''''''''''''' GNDM''''''''''''''''''''''' =&?=<M''''''''''''''''''' =&=?CM''''''''''''''''''' =&>=CM''''''''''''''''''' =&<=>M''''''''''''''''''' =&<F=M''''''''''''''''''' =&C<>M''''''''''''''''''' =&CNFM''''''''''''''''''' EO<P

!"#$%&'( )*+,! -,+-! .+*! -*+*! /+*! 0+1! 0+1! 0+1!

!"#$%"&%'()*# +,-./%%%%%%%%%%%%%%%%%%%%%%%% +,0,/%%%%%%%%%%%%%%%%%%%%%%%% +12,/%%%%%%%%%%%%%%%%%%%%%%%% +134/%%%%%%%%%%%%%%%%%%%%%%%% +3-3/%%%%%%%%%%%%%%%%%%%%%%%% +310/%%%%%%%%%%%%%%%%%%%%%%%% +3.-/%%%%%%%%%%%%%%%%%%%%%%%% +340/%%%%%%%%%%%%%%%%%%%%%%%% +02,/%%%%%%%%%%%%%%%%%%%%%%%%

!"%,,'A"%Q+. C<G''''''''''''''''''''''''' D<<''''''''''''''''''''''''' DGN''''''''''''''''''''''''' ECD''''''''''''''''''''''''' F?N''''''''''''''''''''''''' FEE''''''''''''''''''''''''' G??''''''''''''''''''''''''' G<E''''''''''''''''''''''''' GFC''''''''''''''''''''''''' EO<P

!"23$456 1/+/! 1.+1! 1/+)! 1/+0! 1/+0! 1/+0! 1/+0! 1/+0! 1/+0!

'567 +28,/%%%%%%%%%%%%%%%%%%%%%%%% +2,4/%%%%%%%%%%%%%%%%%%%%%%%% +208/%%%%%%%%%%%%%%%%%%%%%%%% +2.1/%%%%%%%%%%%%%%%%%%%%%%%% +248/%%%%%%%%%%%%%%%%%%%%%%%% +,83/%%%%%%%%%%%%%%%%%%%%%%%% +,24/%%%%%%%%%%%%%%%%%%%%%%%% +,11/%%%%%%%%%%%%%%%%%%%%%%%% +,34/%%%%%%%%%%%%%%%%%%%%%%%%

96: +,;/%%%%%%%%%%%%%%%%%%%%%%%%%% +12/%%%%%%%%%%%%%%%%%%%%%%%%%% +14/%%%%%%%%%%%%%%%%%%%%%%%%%% +38/%%%%%%%%%%%%%%%%%%%%%%%%%% +3;/%%%%%%%%%%%%%%%%%%%%%%%%%% +02/%%%%%%%%%%%%%%%%%%%%%%%%%% +03/%%%%%%%%%%%%%%%%%%%%%%%%%% +0;/%%%%%%%%%%%%%%%%%%%%%%%%%% +.8/%%%%%%%%%%%%%%%%%%%%%%%%%%

60B-,./0'9R(S*6 =GF''''''''''''''''''''''''' >D>''''''''''''''''''''''''' >FN''''''''''''''''''''''''' <=N''''''''''''''''''''''''' <E?''''''''''''''''''''''''' <GN''''''''''''''''''''''''' C?E''''''''''''''''''''''''' C>D''''''''''''''''''''''''' CCC''''''''''''''''''''''''' EOGP

!"23$456 )1+)! )/+)! )7+8! )/+.! ).+7! ).+7! ).+7! ).+7! ).+7!

:*<=*>?($?"@ +22/%%%%%%%%%%%%%%%%%%%%%%%%%% +22/%%%%%%%%%%%%%%%%%%%%%%%%%% +22/%%%%%%%%%%%%%%%%%%%%%%%%%% +2,/%%%%%%%%%%%%%%%%%%%%%%%%%% +21/%%%%%%%%%%%%%%%%%%%%%%%%%% +21/%%%%%%%%%%%%%%%%%%%%%%%%%% +21/%%%%%%%%%%%%%%%%%%%%%%%%%% +21/%%%%%%%%%%%%%%%%%%%%%%%%%% +21/%%%%%%%%%%%%%%%%%%%%%%%%%%

7A"=$?B($?"@ +82/%%%%%%%%%%%%%%%%%%%%%%%%%% +88/%%%%%%%%%%%%%%%%%%%%%%%%%% +8./%%%%%%%%%%%%%%%%%%%%%%%%%% +81/%%%%%%%%%%%%%%%%%%%%%%%%%% +80/%%%%%%%%%%%%%%%%%%%%%%%%%% +80/%%%%%%%%%%%%%%%%%%%%%%%%%% +80/%%%%%%%%%%%%%%%%%%%%%%%%%% +80/%%%%%%%%%%%%%%%%%%%%%%%%%% +80/%%%%%%%%%%%%%%%%%%%%%%%%%%

9R(S =D<''''''''''''''''''''''''' >>?''''''''''''''''''''''''' >C=''''''''''''''''''''''''' >G>''''''''''''''''''''''''' <>?''''''''''''''''''''''''' <CN''''''''''''''''''''''''' <EE''''''''''''''''''''''''' <GD''''''''''''''''''''''''' C?C''''''''''''''''''''''''' FODP

!"23$456 )*+8! )0+1! ),+/! )1+1! )8+0! )8+8! )8+7! )8+.! )7+*!

C(D*# +10/%%%%%%%%%%%%%%%%%%%%%%%%%% +0./%%%%%%%%%%%%%%%%%%%%%%%%%% +0;/%%%%%%%%%%%%%%%%%%%%%%%%%% +.;/%%%%%%%%%%%%%%%%%%%%%%%%%% +4,/%%%%%%%%%%%%%%%%%%%%%%%%%% +882/%%%%%%%%%%%%%%%%%%%%%%%% +82-/%%%%%%%%%%%%%%%%%%%%%%%% +82./%%%%%%%%%%%%%%%%%%%%%%%% +8,1/%%%%%%%%%%%%%%%%%%%%%%%%

9R(6S =?F''''''''''''''''''''''''' =D>''''''''''''''''''''''''' =F<''''''''''''''''''''''''' >?C''''''''''''''''''''''''' >>F''''''''''''''''''''''''' ><F''''''''''''''''''''''''' >CF''''''''''''''''''''''''' >DG''''''''''''''''''''''''' >F?''''''''''''''''''''''''' DOGP

E)F#G%:67 ,1%%%%%%%%%%%%%%%%%%%%%%%%%%% ,2%%%%%%%%%%%%%%%%%%%%%%%%%%% ,4%%%%%%%%%%%%%%%%%%%%%%%%%%% ,.%%%%%%%%%%%%%%%%%%%%%%%%%%% 1-%%%%%%%%%%%%%%%%%%%%%%%%%%% 1-%%%%%%%%%%%%%%%%%%%%%%%%%%% 1-%%%%%%%%%%%%%%%%%%%%%%%%%%% 1-%%%%%%%%%%%%%%%%%%%%%%%%%%% 1-%%%%%%%%%%%%%%%%%%%%%%%%%%%

H*##G%!(<*D +8;/%%%%%%%%%%%%%%%%%%%%%%%%%% +23/%%%%%%%%%%%%%%%%%%%%%%%%%% +8;/%%%%%%%%%%%%%%%%%%%%%%%%%% +2,/%%%%%%%%%%%%%%%%%%%%%%%%%% +,-/%%%%%%%%%%%%%%%%%%%%%%%%%% +,-/%%%%%%%%%%%%%%%%%%%%%%%%%% +,2/%%%%%%%%%%%%%%%%%%%%%%%%%% +,,/%%%%%%%%%%%%%%%%%%%%%%%%%% +,1/%%%%%%%%%%%%%%%%%%%%%%%%%%

!I(@J*#%?@%K"=L?@J%!(<?$() M%%%%%%%%%%%%%%%%%%%%%%%%%%%%%% +2;/%%%%%%%%%%%%%%%%%%%%%%%%%% +2-/%%%%%%%%%%%%%%%%%%%%%%%%%% +80/%%%%%%%%%%%%%%%%%%%%%%%%%% +2-/%%%%%%%%%%%%%%%%%%%%%%%%%% +8./%%%%%%%%%%%%%%%%%%%%%%%%%% +8-/%%%%%%%%%%%%%%%%%%%%%%%%%% +88/%%%%%%%%%%%%%%%%%%%%%%%%%% +88/%%%%%%%%%%%%%%%%%%%%%%%%%%

T)4/L/"/0'3"//'1#,2'34%5 =>C''''''''''''''''''''''''' =<>''''''''''''''''''''''''' =F<''''''''''''''''''''''''' >?>''''''''''''''''''''''''' >=F''''''''''''''''''''''''' ><?''''''''''''''''''''''''' >CD''''''''''''''''''''''''' >DC''''''''''''''''''''''''' >EC''''''''''''''''''''''''' DODP

U611 DONCP

:?#>"F@$%E*=?"N 8%%%%%%%%%%%%%%%%%%%%%%%%%%%%% 2%%%%%%%%%%%%%%%%%%%%%%%%%%%%% ,%%%%%%%%%%%%%%%%%%%%%%%%%%%%% 1%%%%%%%%%%%%%%%%%%%%%%%%%%%%% 3%%%%%%%%%%%%%%%%%%%%%%%%%%%%%

:?#>"F@$%O(>$"= -P41%%%%%%%%%%%%%%%%%%%%%%%% -P;4%%%%%%%%%%%%%%%%%%%%%%%% -P;1%%%%%%%%%%%%%%%%%%%%%%%% -P.4%%%%%%%%%%%%%%%%%%%%%%%% -P.3%%%%%%%%%%%%%%%%%%%%%%%%

A"/,/).'V#4-/'%Q'3"//'1#,2'34%5 >?DM''''''''''''''''''''''' >?DM''''''''''''''''''''''' >?EM''''''''''''''''''''''' >?>M''''''''''''''''''''''' =NGM'''''''''''''''''''''''

9W+.'X-4.+Y4/'X/.2%0 (:Y4+/0'9Z-+.7'V#4-/ (:Y4+/0'9V[9R(S*6

1-:-4#.+L/'A"/,/).'V#4-/'%Q'3"//'1#,2'34%5 =&?=DM''''''''''''''''''' 9)./"Y"+,/'V#4-/ D&CGCM''''''''''''''''''' 9)./"Y"+,/'V#4-/ D&CGCM'''''''''''''''''''

H*##G%:*Q$ +18;/%%%%%%%%%%%%%%%%%%%%%%%% HCR%STUC:7

C*=A?@()%7NVF#$*N%STUC:7 111%%%%%%%%%%%%%%%%%%%%%%%%% H*##G%E=*&*==*N%SWF?$X M%%%%%%%%%%%%%%%%%%%%%%%%%%%%%% (:Y4+/0'9V[9R(S*6 ?O??W

SD?$%RF)$?<)* 8,P11D 7NNG%!(#I

S/":+)#4'V#4-/ D&NE<'''''''''''''''''''''' 7NNG%!(#I%&="A%Y<$?"@# (:Y4+/0'A/"Y+.-+.7'!"%5.2'J#./

:?#>"F@$%O(>$"= -P.3%%%%%%%%%%%%%%%%%%%%%%%% (:Y4+/0'9Z-+.7'V#4-/ D&?EE'''''''''''''''''''''' S/":+)#4'8/#"'3"//'1#,2'34%5 201Z%%%%%%%%%%%%%%%%%%%%%%%

A"/,/).'V#4-/'%Q'S/":+)#4'V#4-/ C&CEN'''''''''''''''''''''' K7!! 3P41[

'I(=*#%YF$#$(@N?@J 34P4-%%%%%%%%%%%%%%%%%%%%%% C*=A?@()%()F* 3]40,%%%%%%%%%%%%%%%%%%%%%%

9)./"Y"+,/'V#4-/ D&CGCM''''''''''''''''''' .%$]'A"+$/ GCODF (:Y4+/0'A/"Y+.-+.7'!"%5.2'J#./ 8P11[

34P4-%%%%%%%%%%%%%%%%%%%%%%

C*=A?@()%()F*]%E 3]1;,P.1%%%%%%%%%%%%%%%%

H*##%:*Q$ +18;/%%%%%%%%%%%%%%%%%%%%%%%%

UA<)?*N%SWF?$X%()F* 3]-03P.1%%%%%%%%%%%%%%%%

'$">L%E=?>* ;1P3.%%%%%%%%%%%%%%%%%%%%%%

G=OF=M'''''''''''''''''''

O!O 84;%%%%%%%%%%%%%%%%%%%%%%%%%

J 2P.8[

K7!! 3P41[

C*=A?@()%()F* 0],-2%%%%%%%%%%%%%%%%%%%%%%

:?#>"F@$%O(>$"= -P.3%%%%%%%%%%%%%%%%%%%%%%%%

E%"&%C*=A?@()%()F* 1].2,%%%%%%%%%%%%%%%%%%%%%%

'$">L%E=?>* .;P;3%%%%%%%%%%%%%%%%%%%%%%

9W+.'X-4.+Y4/'X/.2%0

'I(=*#%YF$#$(@N?@J

A/"Y/.-+.7'!"%5.2'X/.2%0.%$]'A"+$/^

7^*=(J*%"&%$I*%SD?$%RF)$?<)*%R*$I"N%(@N%E*=<*$F?$X%

5="_$I%R*$I"N](https://image.slidesharecdn.com/23146272-a028-461f-9a3a-eae981db4d16-151005162916-lva1-app6892/85/GGG-19-320.jpg)

![CFA

INSTITUTE

RESEARCH

CHALLENGE

12/23/14

!"#$%&'()$

*+,-./+0'12+"#-+'3%4/'%5'3#6,/#7

8,4$#7'9+#"':)0+0';+$+<=+"'>?&'@A?>

3%4/'%5';+=/ 3%<6#"#=7+'3%<6#),+4'B)7+2+"+0'C+/#

D+),%"'E+"<'1 F"+0,$/+0 G#"H+/ G#"H+/ ;+=/I G#"-,)#7 B)7+2+"+0

!"#$!#!$%&'()*(+,-%.,-,)*/ !012%%%%%%%%%%%%%%%%%%%%%%% 3%<6#)J K+2+"+0'C+/# L#7M+'%5';+=/ L#7M+'%5':NM,/J :NM,/J E#O'P#/+ C+/#

3)4/'/54%6,4/ 071!8 9:-;,< !71= !>?1@%%%%%%%%%%%%%%%%%%%%%% ">A!?%%%%%%%%%%%%%%%%%%%%%% AB7!A8 $"7008 !7$$

3CDE !7!1 @@?%%%%%%%%%%%%%%%%%%%%%%%%% !>A@$%%%%%%%%%%%%%%%%%%%%%% ?B7"08 $"7008 0711

D+),%"'E+"<'C F:'G5:) !7"1 ==1%%%%%%%%%%%%%%%%%%%%%%%%% 111%%%%%%%%%%%%%%%%%%%%%%%%% @A7"=8 $"7008 071A

!"#$!#!$%&'()*(+,-%.,-,)*/ $002%%%%%%%%%%%%%%%%%%%%%%%

3)4/'/54%6,4/ ?71!8 G+#) ?QA@

100,/,%)#7'D+),%" 3%4/'%5':NM,/J P+7+2+"+0'C+/#

!"#$!#!$%&'()*(+,-%.,-,)*/ !"#$!#!$%&'/;/''/G%DHI(4J K2%%%%%%%%%%%%%%%%%%%%%%%%%%%% L/,)%M)-/N/'/G%./4, !70"

3)4/'/54%6,4/ 3)4/'/54%6,4/ O',*:>%3)*%C/P4#DHI(4J !00708

O',*:>%3)*%Q,<%6,4/ $"708

DM=';+=/'R'S/.+" !"#$!#!$%9:RR:)%DHI(4J =$?%%%%%%%%%%%%%%%%%%%%%%%%% P+7+2+"+0'C+/# @QTA

!"#$!#!$%&'()*(+,-%.,-,)*/

3)4/'/54%6,4/ 6(5SKT'//%6,4/ !7AB8 *133

L,'S/4%6(5S%&'/R(IR "7@A8 C/P4 !7"A8

S/.+"';+=/ U/N/'/G%./4, "7@0 &'/;/''/G%DHI(4J 07008

!"#$!#!$%&'()*(+,-%.,-,)*/ !02%%%%%%%%%%%%%%%%%%%%%%%%% V(W/%&'/R(IR 07008 9:RR:)%DHI(4J ?7=B8

3)4/'/54%6,4/ 3%4/'%5'3%<<%)':NM,/J B70!8 *133 UQVWX

E%/#7';+=/ W?YZ''''''''''''''''''''''' 3#6,/#7'D/"M$/M"+

C/P4%8 A07008 B7$B8

9:54%:;%C/P4 $7==8 &'/;/''/G%DHI(4J%8 07008 !7AB8

Q,<%6,4/ $"7008 9:RR:)%DHI(4J%8 A07008 A71B8

15/+"'E#O'3%4/'%5';+=/ "7?B8 Q:4,-%DHI(4J%8 A07008 "7@0

070

"7?B8

6(5S%T'//%6,4/ 31FG'G%0+7 $"7008

A%X/,'%QK.:)G !7AB8 A0%G/P4>%A0%/HI(4J

M+G,4/G%,5%:; !"#"#!? 6T !"#$% #"$&%

$0%X/,'%QK.:)G $7008 U/N/'/G%./4, '"()

L6& #"*$% 3%4/'%5':NM,/J

V& )"))% B7$B8

T(),-%YZ99

6(5S%T'//%6,4/

L,'S/4%6(5S%&'/R(IR

U/N/'/G%./4,

V(W/%&'/R(IR

3%4/'%5':NM,/J'R'C+/.+7'B),2+"4,/J

6T%[%U/N/'/G%./4,%<%L6&%K%6T]%[%V&

*133'3%<6%)+)/4

9:54%:;%9:RR:)%DHI(4J

Z;4/'%Q,<%9:54%:;%C/P4

Z55IR/G%Q,<%6,4/

9,+(4,-%V4'I*4I'/

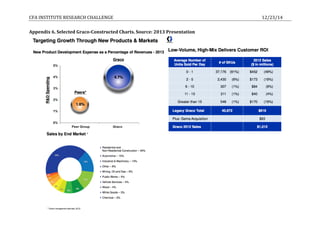

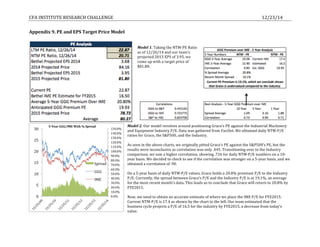

MRP.

Market

Risk

Premium,

as

depicted

in

the

chart

to

the

left,

is

a

blend

of

the

average

Quarter

over

Quarter

returns

of

Graco

(and

competitors)

over

the

S&P500

and

DJIA.

Our

final

number,

5.89%,

is

very

comparable

to

Aswath

Damodaran

and

KPMG’s

numbers

of

5.21%

and

6%,

but

our

calculation

provides

a

more

accurate

representation

of

the

industrial

machinery

industry.](https://image.slidesharecdn.com/23146272-a028-461f-9a3a-eae981db4d16-151005162916-lva1-app6892/85/GGG-20-320.jpg)

![Disclosures:

Ownership

and

material

conflicts

of

interest:

The

author(s),

or

a

member

of

their

household,

of

this

report

[does

not

hold]

a

financial

interest

in

the

securities

of

this

company.

The

author(s),

or

a

member

of

their

household,

of

this

report

[does

not

know]

of

the

existence

of

any

conflicts

of

interest

that

might

bias

the

content

or

publication

of

this

report.

Receipt

of

compensation:

Compensation

of

the

author(s)

of

this

report

is

not

based

on

investment

banking

revenue.

Position

as

a

officer

or

director:

The

author(s),

or

a

member

of

their

household,

does

not

serve

as

an

officer,

director

or

advisory

board

member

of

the

subject

company.

Market

making:

The

author(s)

does

not

act

as

a

market

maker

in

the

subject

company’s

securities.

Disclaimer:

The

information

set

forth

herein

has

been

obtained

or

derived

from

sources

generally

available

to

the

public

and

believed

by

the

author(s)

to

be

reliable,

but

the

author(s)

does

not

make

any

representation

or

warranty,

express

or

implied,

as

to

its

accuracy

or

completeness.

The

information

is

not

intended

to

be

used

as

the

basis

of

any

investment

decisions

by

any

person

or

entity.

This

information

does

not

constitute

investment

advice,

nor

is

it

an

offer

or

a

solicitation

of

an

offer

to

buy

or

sell

any

security.

This

report

should

not

be

considered

to

be

a

recommendation

by

any

individual

affiliated

with

[Bethel

University],

CFA

Institute

or

the

CFA

Institute

Research

Challenge

with

regard

to

this

company’s

stock.](https://image.slidesharecdn.com/23146272-a028-461f-9a3a-eae981db4d16-151005162916-lva1-app6892/85/GGG-29-320.jpg)