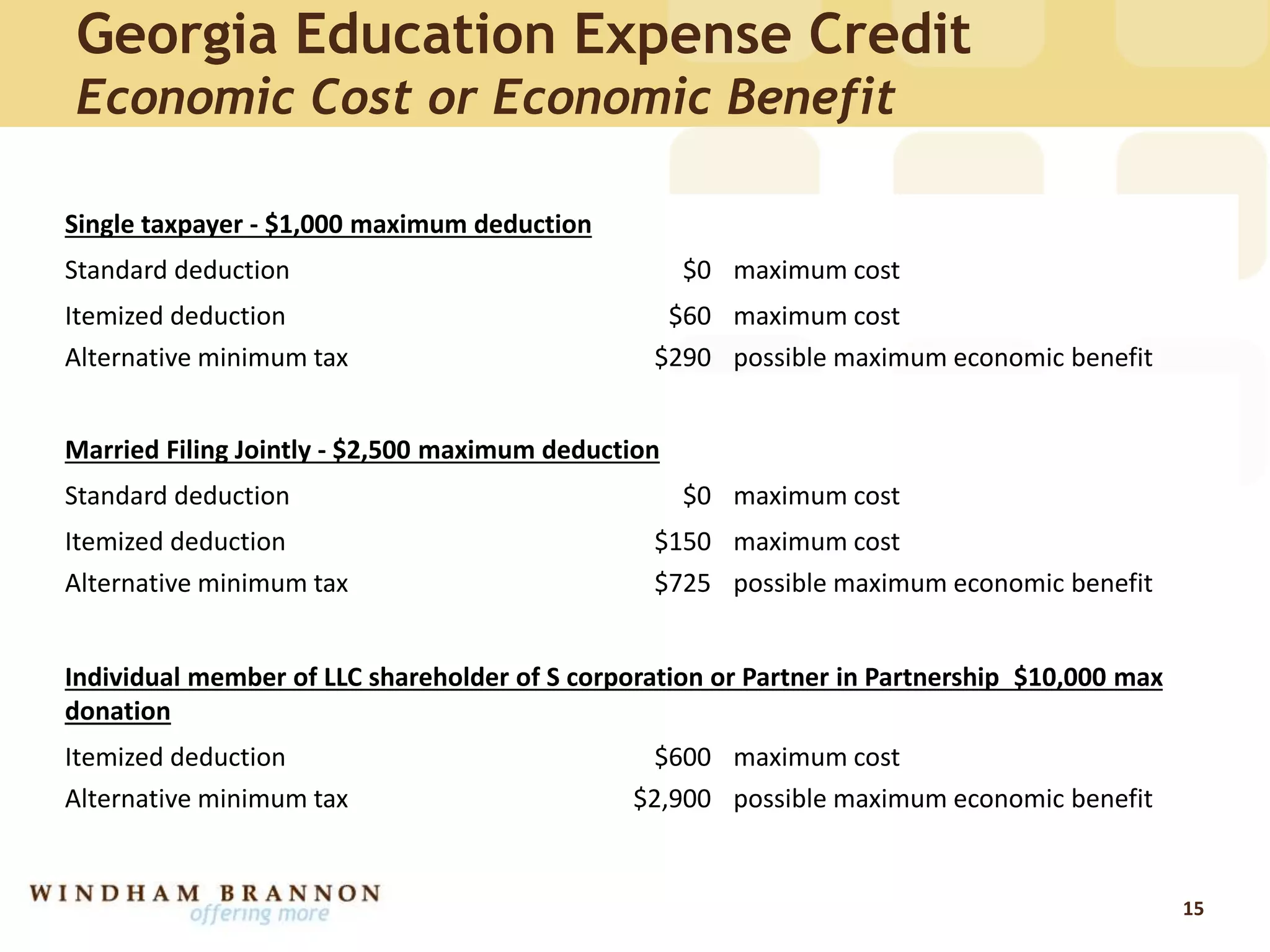

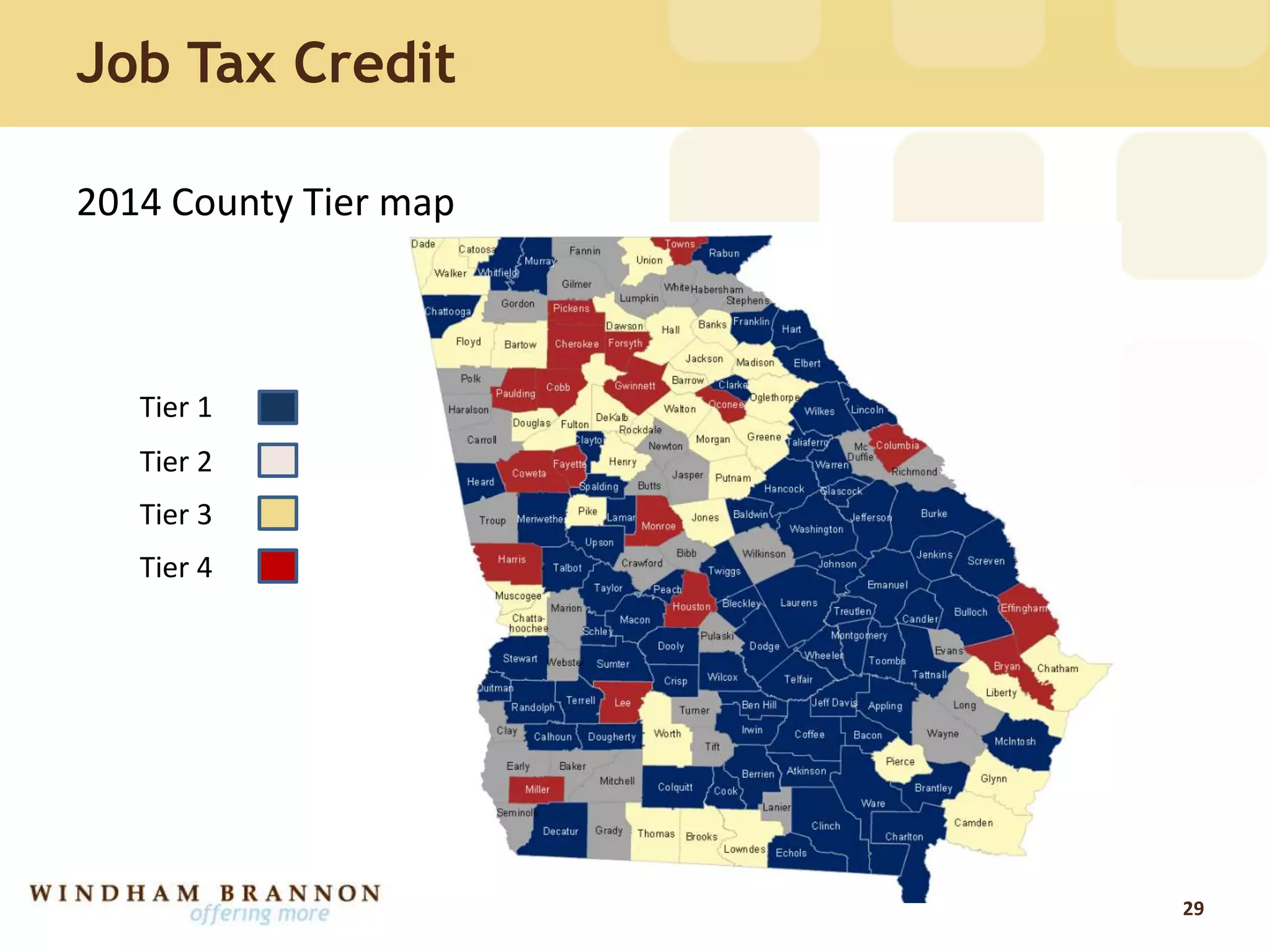

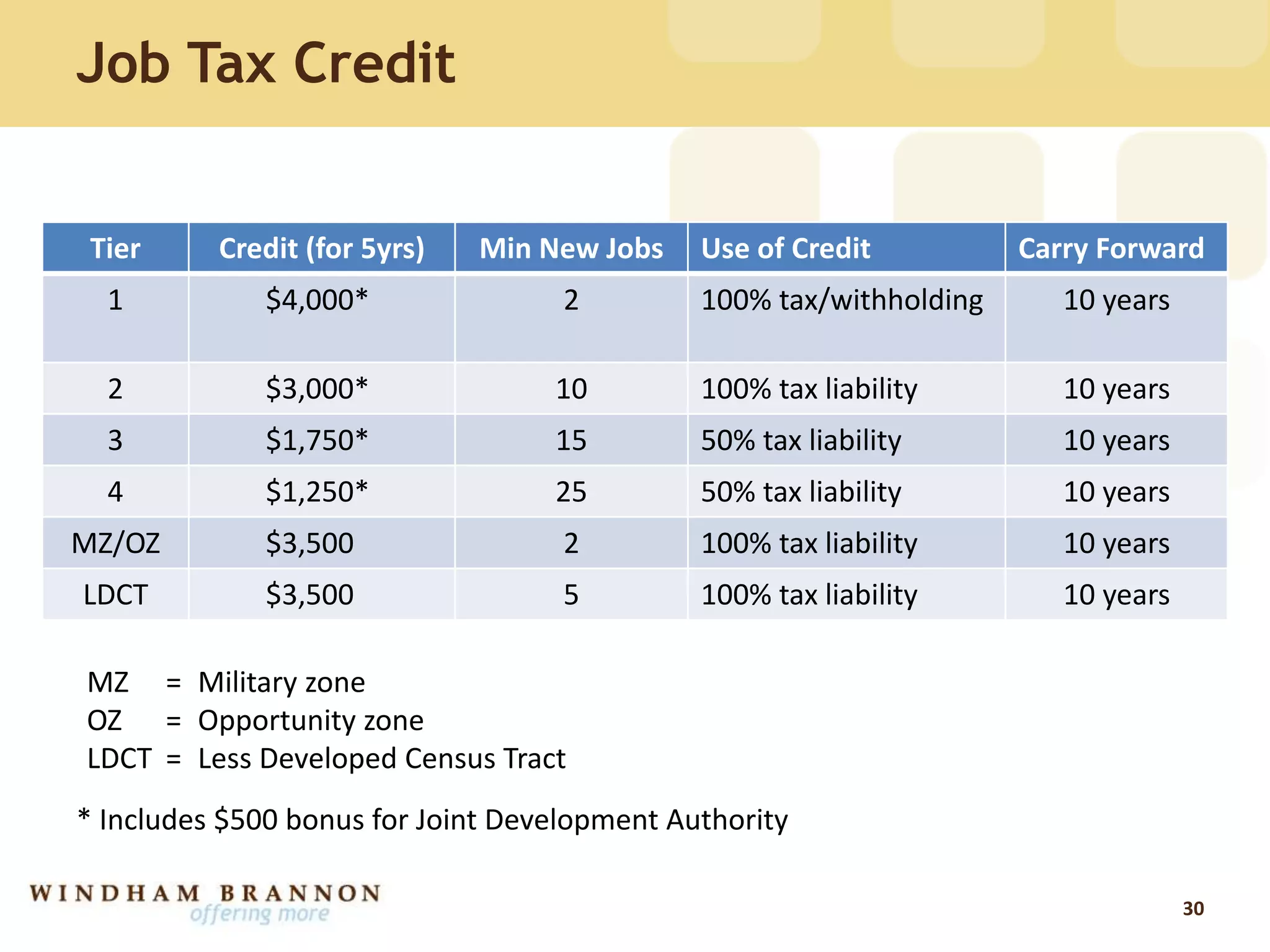

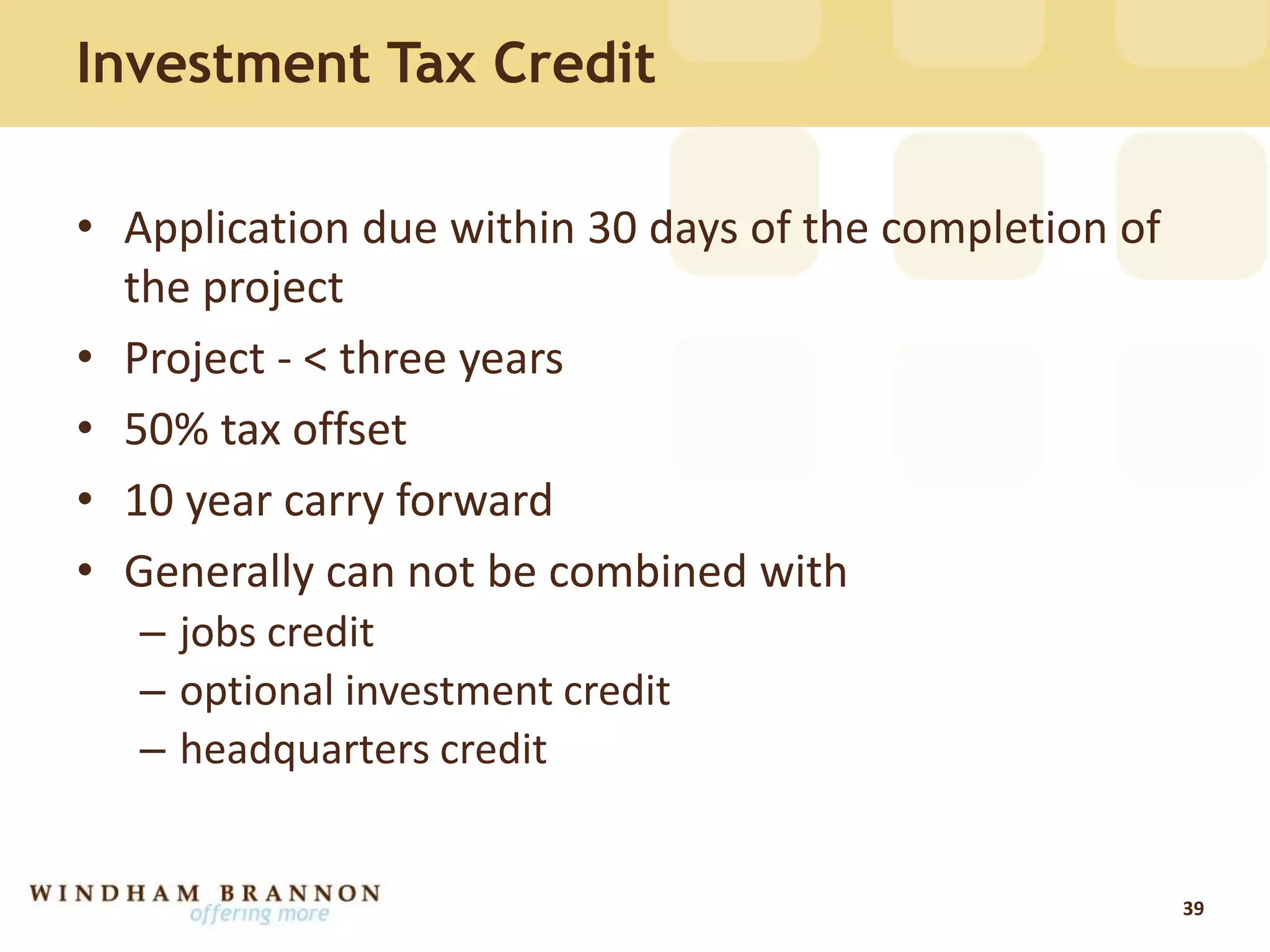

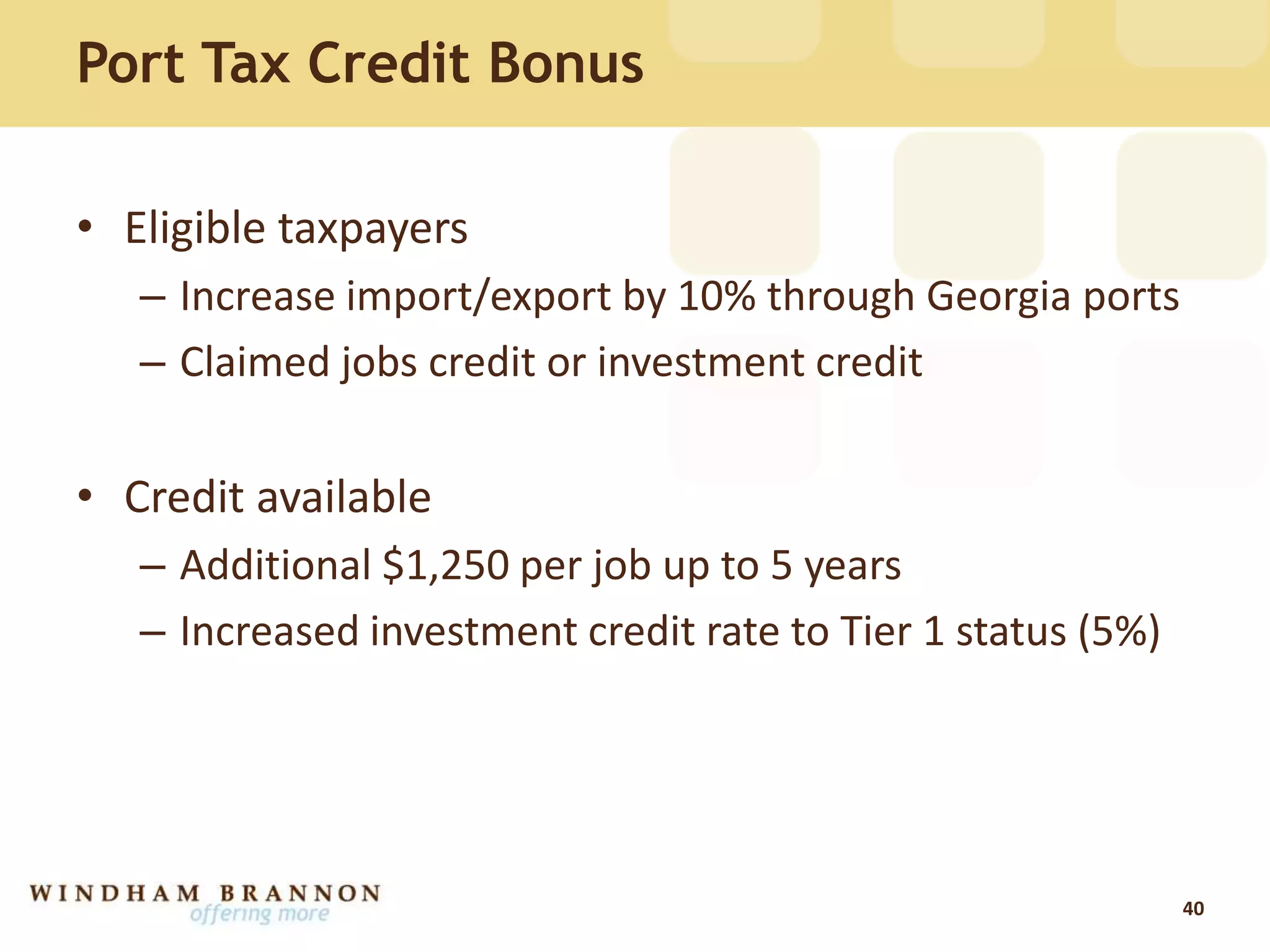

Georgia offers various tax credits to minimize or eliminate income tax for companies and individuals. These include credits for film and entertainment productions, low-income housing development, contributions to private school scholarships, employee retraining programs, job creation, and manufacturing/telecom investments. Credits are also available based on the tier status of communities and some allow transferability or carryforwards for unused amounts. Planning and documentation requirements vary by credit.