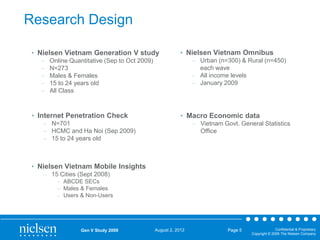

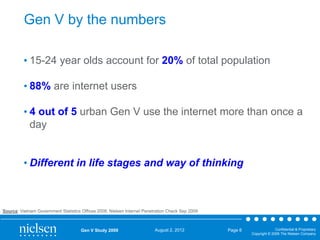

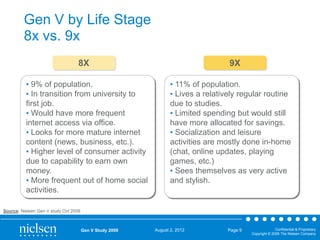

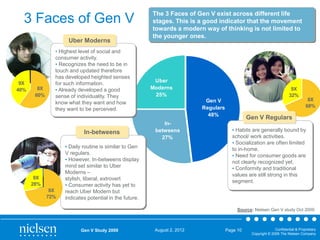

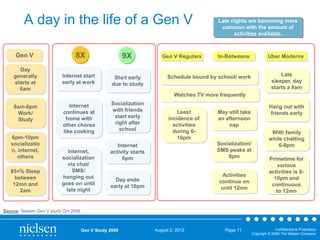

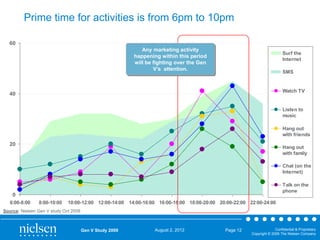

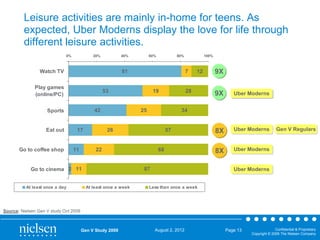

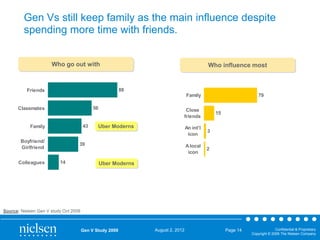

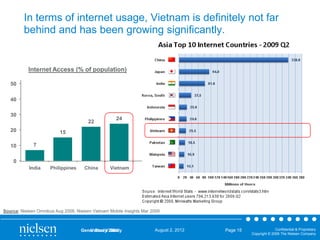

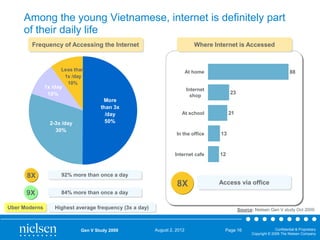

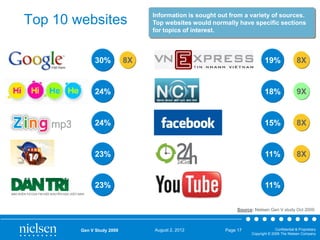

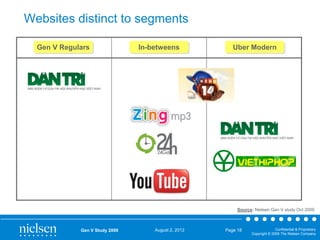

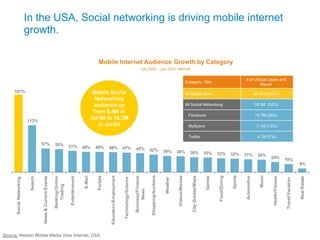

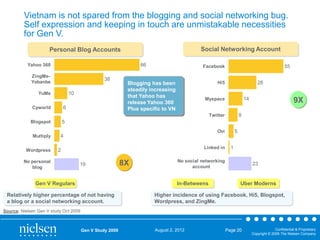

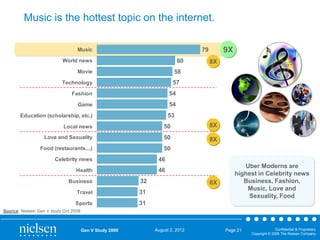

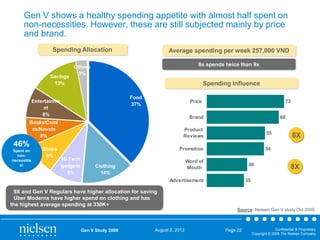

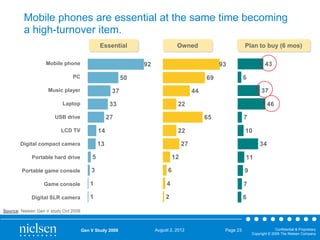

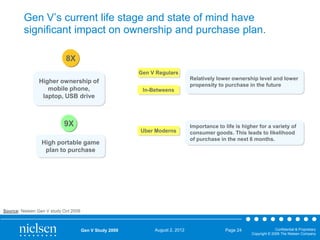

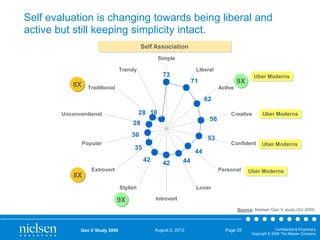

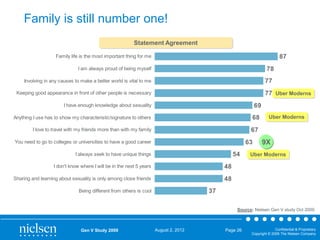

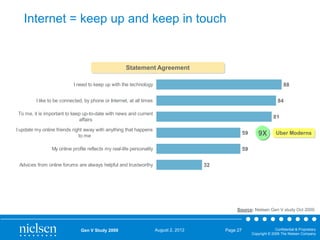

The document presents insights into Generation V, Vietnamese youth aged 15-24, highlighting their internet usage, spending habits, and daily activities. It describes their various life stages, socialization patterns, and consumer behavior, emphasizing the significance of online engagement and brand influence. The study suggests that marketers should strategically target this demographic during peak online activity hours to effectively capture their attention.