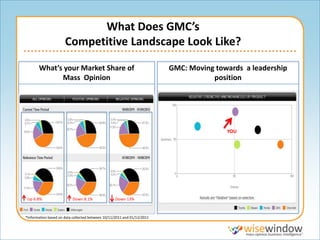

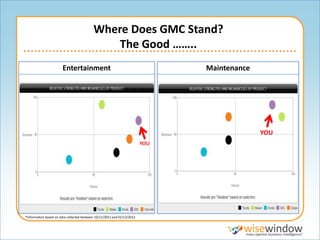

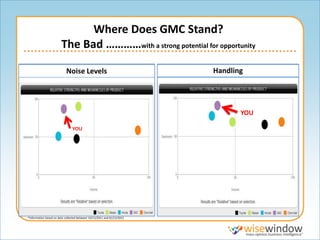

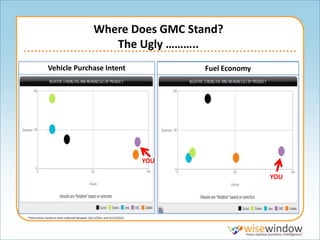

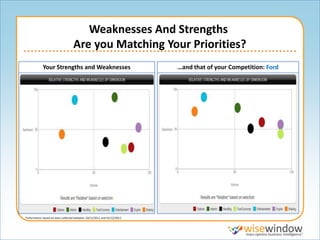

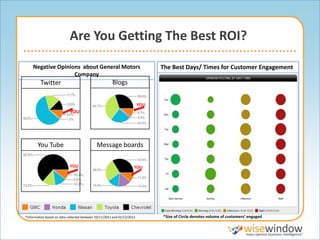

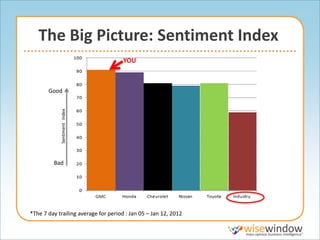

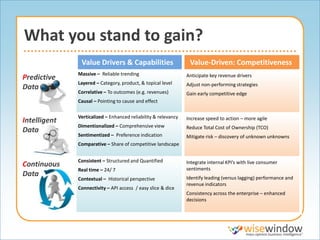

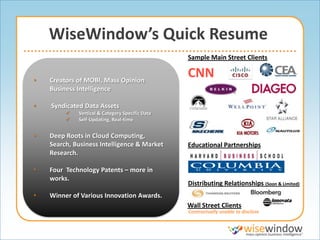

The document discusses a business intelligence snapshot for General Motors Company, emphasizing the importance of understanding competitive landscapes and customer sentiments to drive strategic decisions. It outlines various aspects such as market share, strengths and weaknesses, and consumer engagement channels, while highlighting the value added by Mass Opinion Business Intelligence (MOBI). The call to action invites participation in a limited-time initiative to explore these insights further.