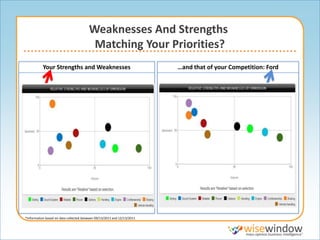

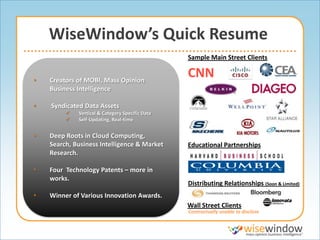

This document provides an overview of a business intelligence snapshot report for Honda by Mass Opinion Business Intelligence (MOBI). The report includes Honda's competitive positioning, market share, strengths/weaknesses, and sentiment ranking compared to other automakers. MOBI believes clients are best equipped to extract strategic value from the intelligence and MOBI provides the data. The report shows Honda's performance on various metrics and opportunities to improve customer engagement. MOBI invites Honda to participate in a "prove it" initiative to experience the benefits of their continuous, real-time business intelligence capabilities.