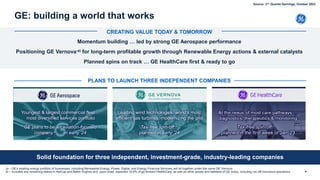

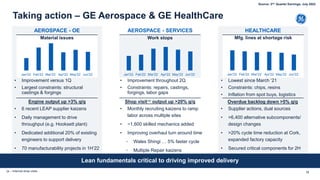

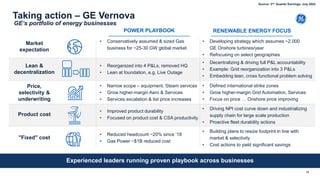

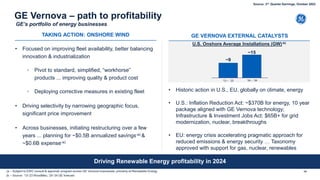

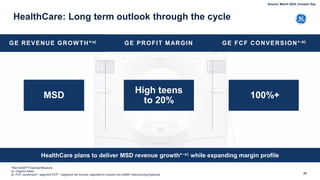

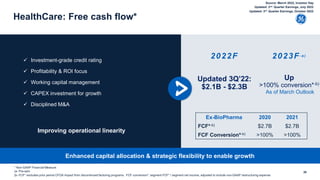

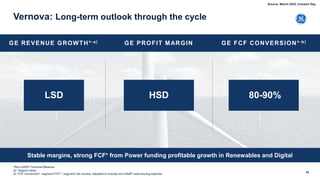

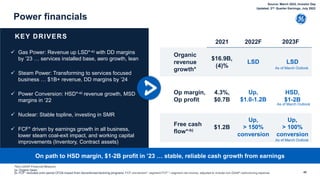

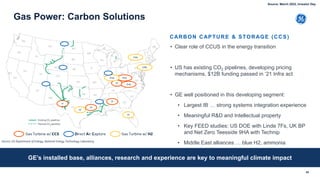

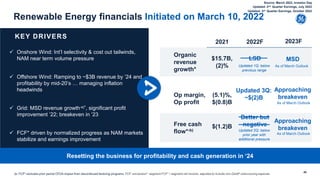

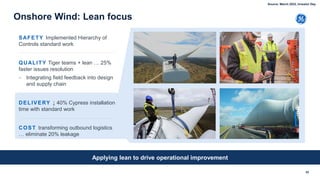

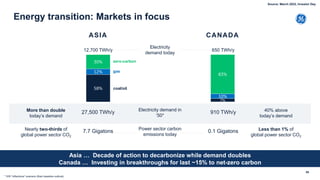

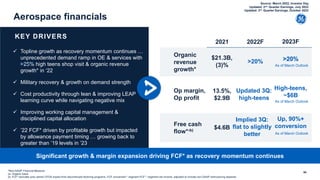

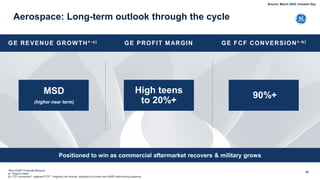

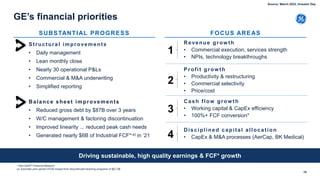

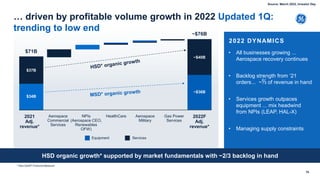

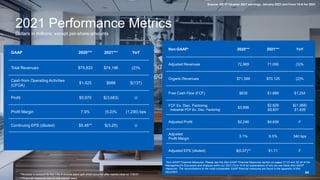

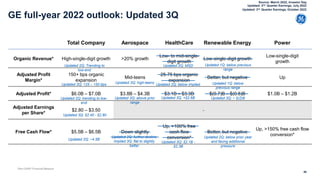

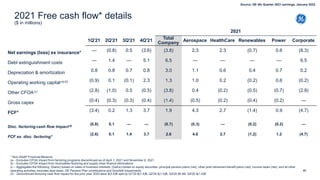

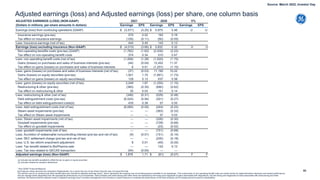

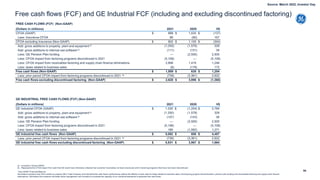

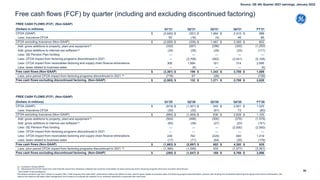

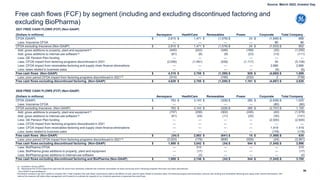

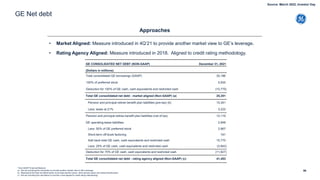

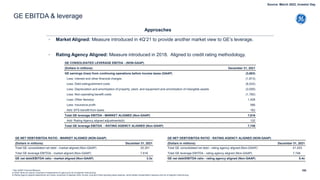

The document provides an overview of GE's strategic initiatives, focusing on the planned spin-off into three independent companies and the transition towards renewable energy and healthcare innovations. It discusses financial performance, including the use of non-GAAP measures, and outlines GE's commitment to sustainability, diversity, and operational excellence. The report emphasizes GE's goals for profitable growth, innovation in precision care, and contributing to energy transitions while addressing uncertainties in forward-looking statements.