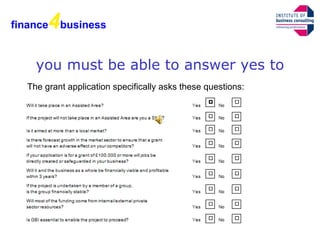

The GBI grant is a major government funding initiative in England aimed at supporting both new and existing manufacturing and service businesses that supply on a national level, with grant amounts starting at £10,000 and varying based on project costs and job creation. Applicants must demonstrate innovation, the potential for job creation, and product marketability without causing job displacement. Excluded sectors include steel, coal, and retail businesses that provide only local services, while successful project examples include manufacturing expansions and safeguarding jobs in the UK.