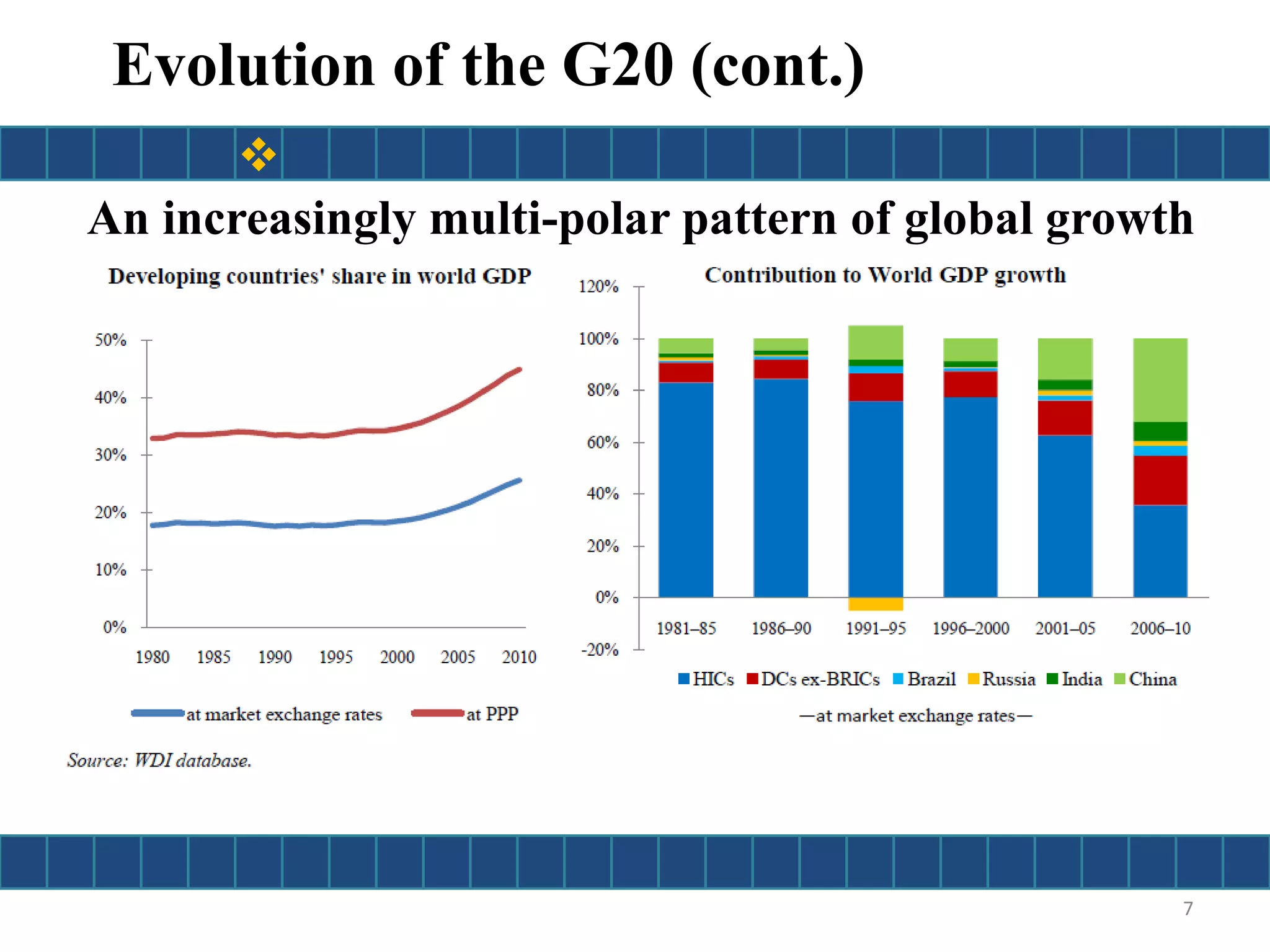

The document presents a comprehensive overview of the G20, detailing its origins, membership, and evolving roles in global economic governance since its inception in 1999, notably following the Asian financial crisis. Key focus areas include financial stability, sustainable development, and responses to global challenges such as the 2008 financial crisis, with the World Bank actively engaging in initiatives connected to financial inclusion, food security, and infrastructure. The G20 aims to foster consensus and cooperative policy-making to address the complex dynamics of a multi-polar world economy.

![A growing concern about jobs

“If you were to ask me, from all the world polling Gallup has

done for more than 75 years, what would fix the world -- what

would suddenly create worldwide peace, global wellbeing,

and the next extraordinary advancements in human

development, I would say the immediate appearance of 1.8

billion jobs -- formal jobs. […] We can’t see that quest for

good jobs as an internal skirmish between warring political

ideologies. It’s an international war” (Jim Clifton, Chairman

and CEO of Gallup, author of The Coming Jobs War.

19

Focus on Jobs

](https://image.slidesharecdn.com/g20inretrospectandinprospect-190820181640/75/G20-in-retrospect-and-in-prospect-19-2048.jpg)