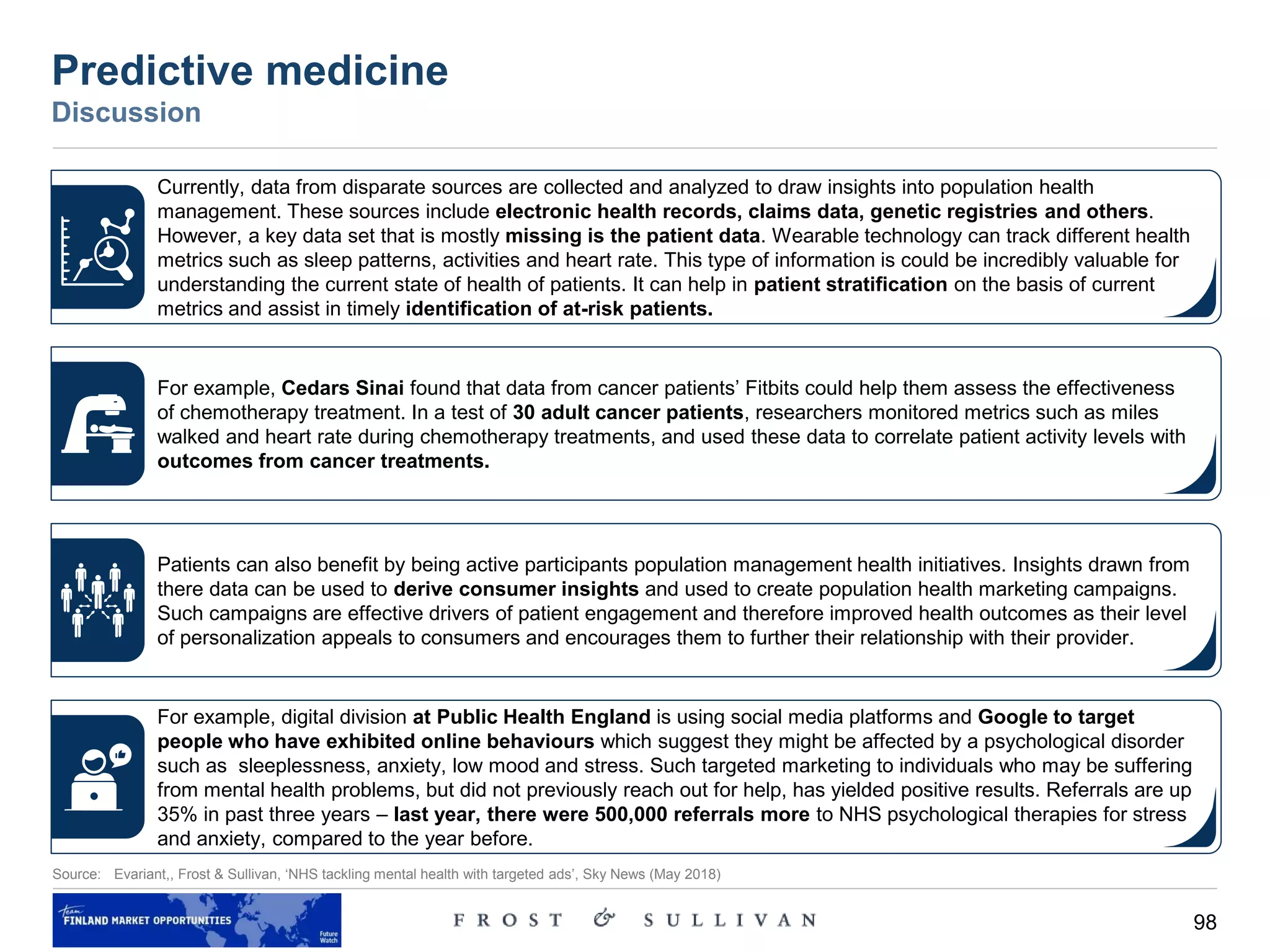

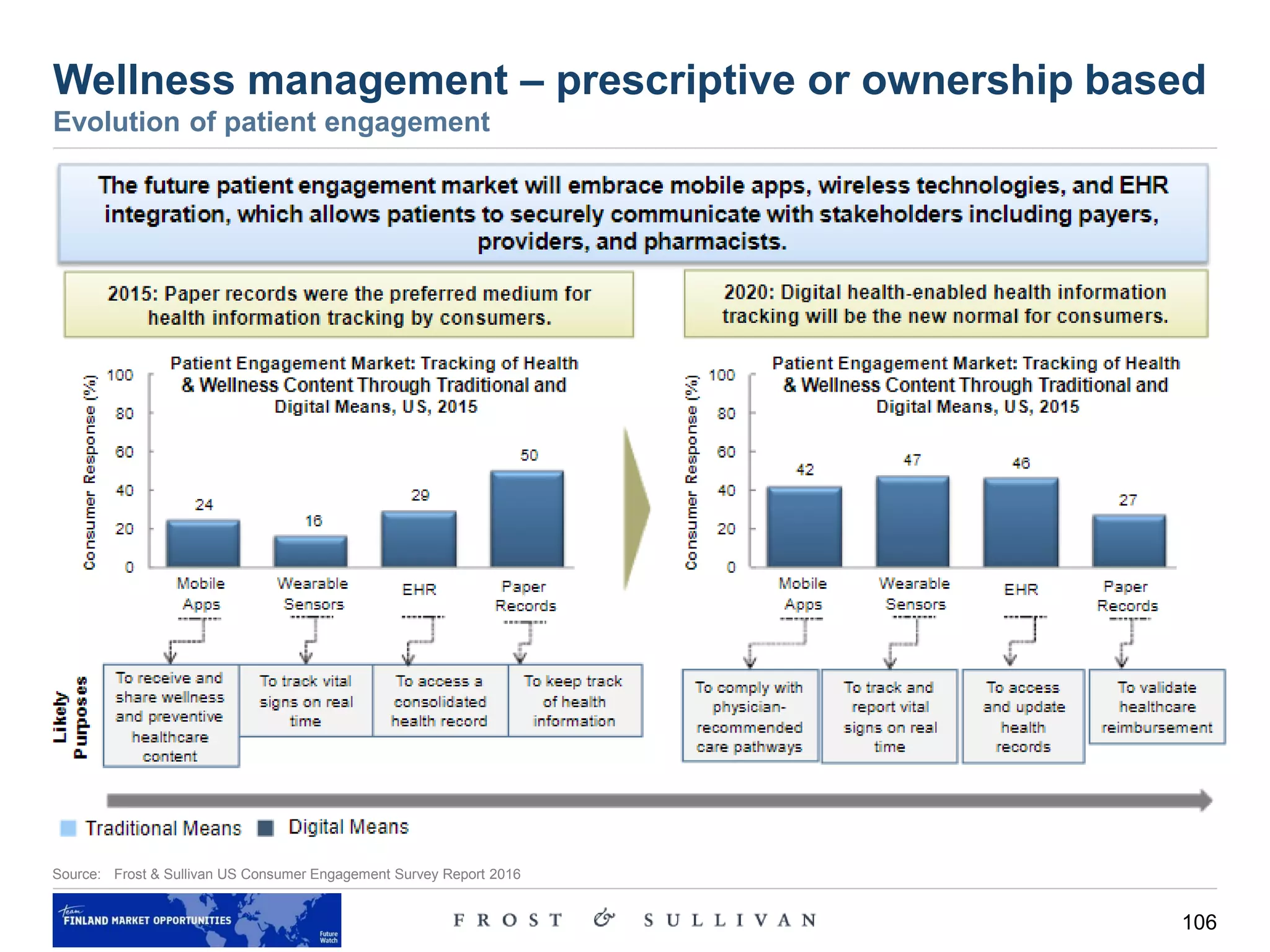

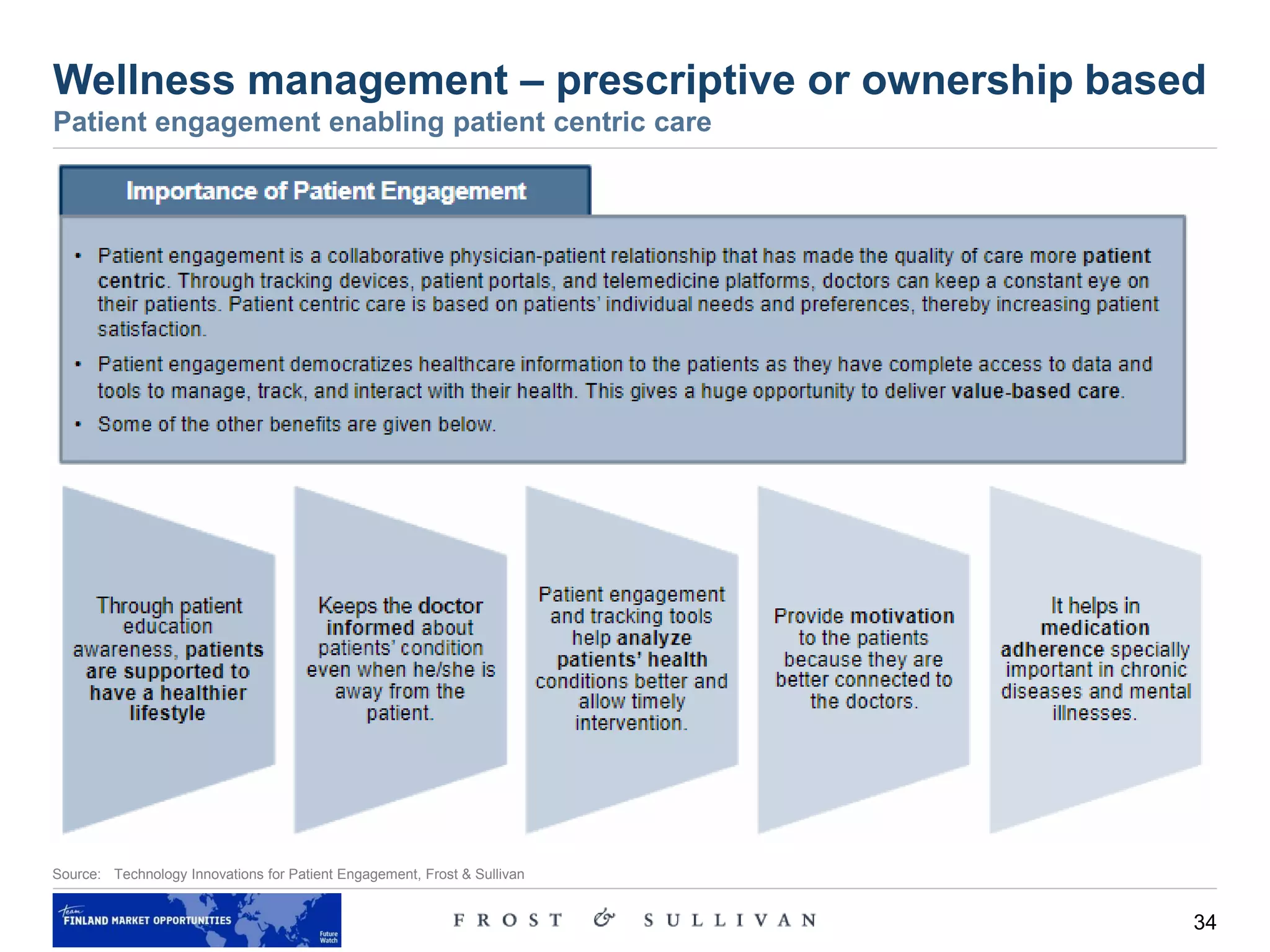

1) Developed countries aim to increase patient accountability and focus on education and awareness programs to promote healthier lifestyles.

2) Developing countries struggle to meet basic healthcare demands of large populations due to limited funding and infrastructure.

3) Examples provided of successful programs in Finland and the US that use incentives and competitions to encourage physical activity and reduce chronic diseases.

![39

Source: Vision 2025 – Healthcare in the Smart Home, Frost & Sullivan, HealthCatalyst

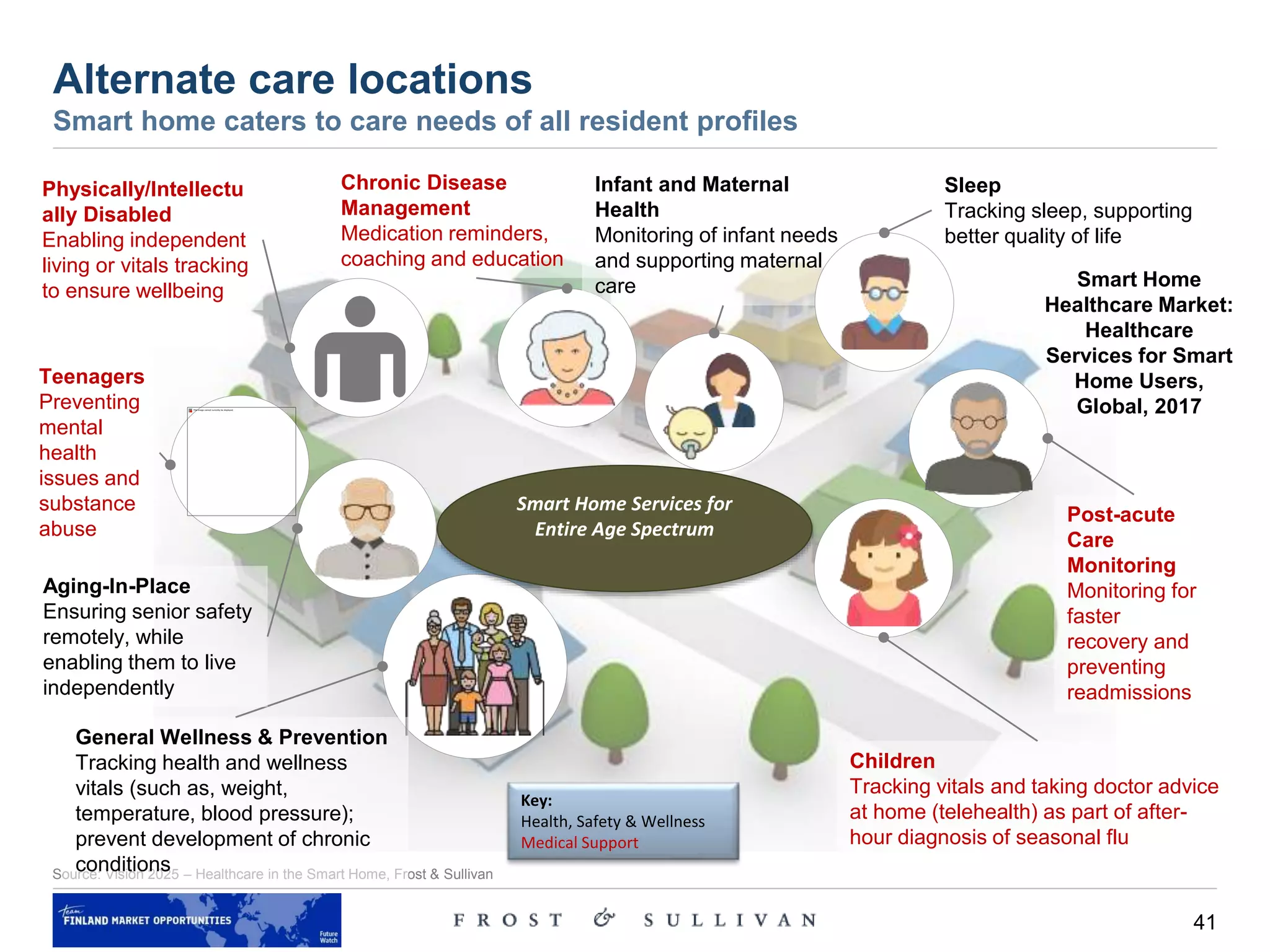

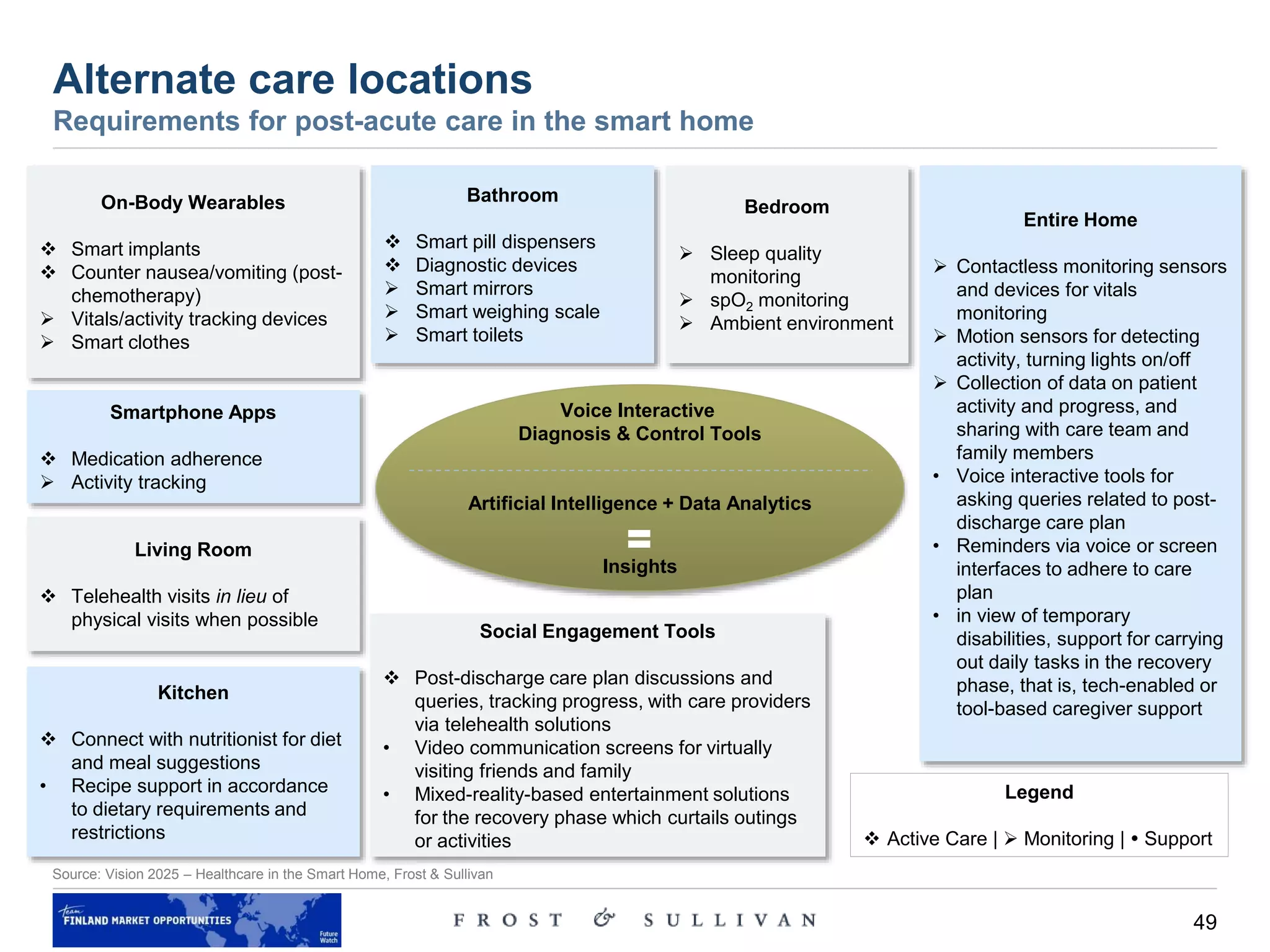

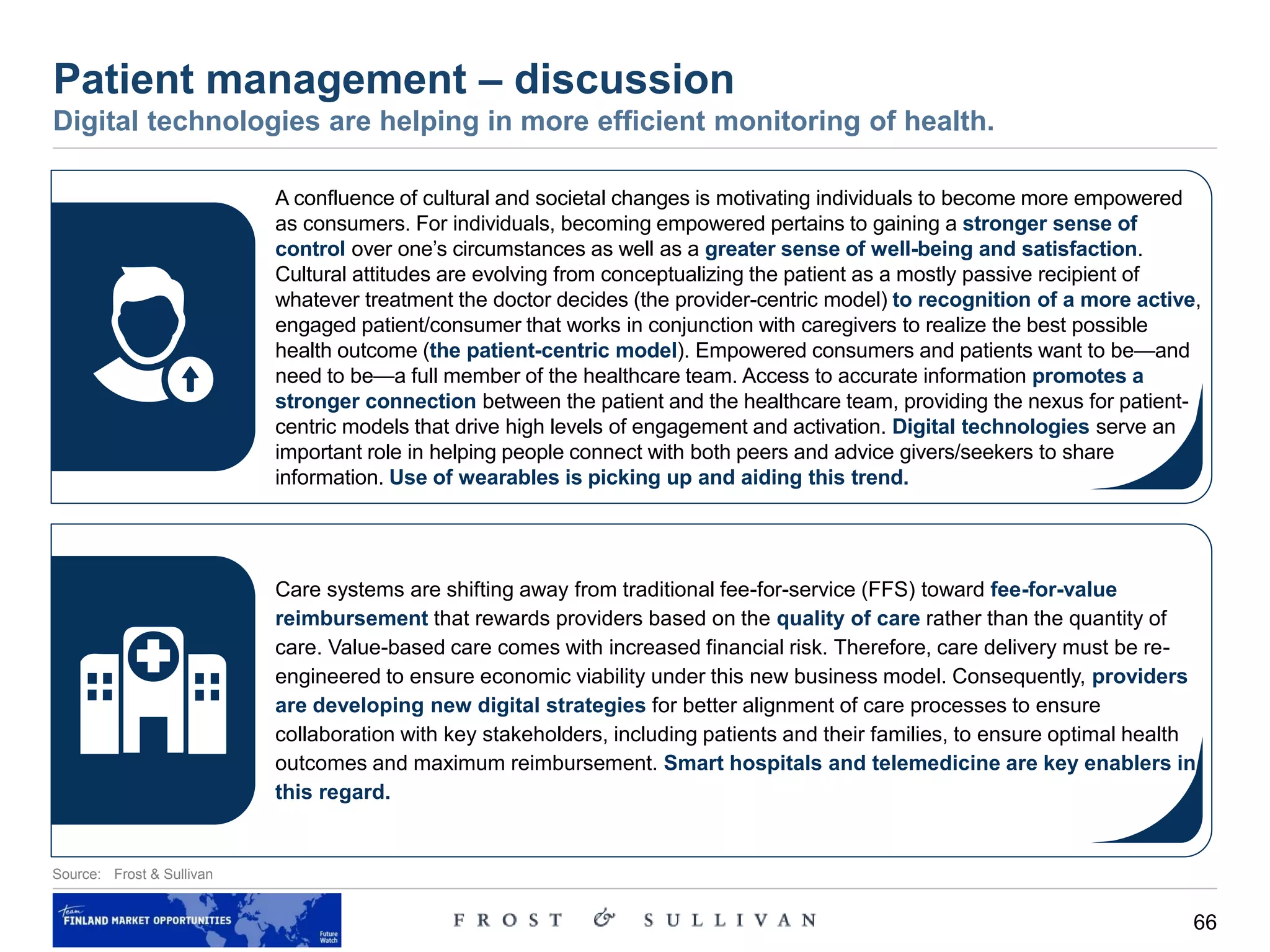

Alternate care locations – discussion

Care delivery moving to the home environment

• The industry is gradually evolving to acknowledge the ‘anytime, anywhere care’ model, and the result is the remodeling

of healthcare services to suit this trend. Technological developments and the Internet of Things (IoT) enable a home to

evolve into a connected home. We believe that the convergence of these trends—focus on prevention and

wellness, care delivery moving in to the home and endless home automation possibilities—is imminent.

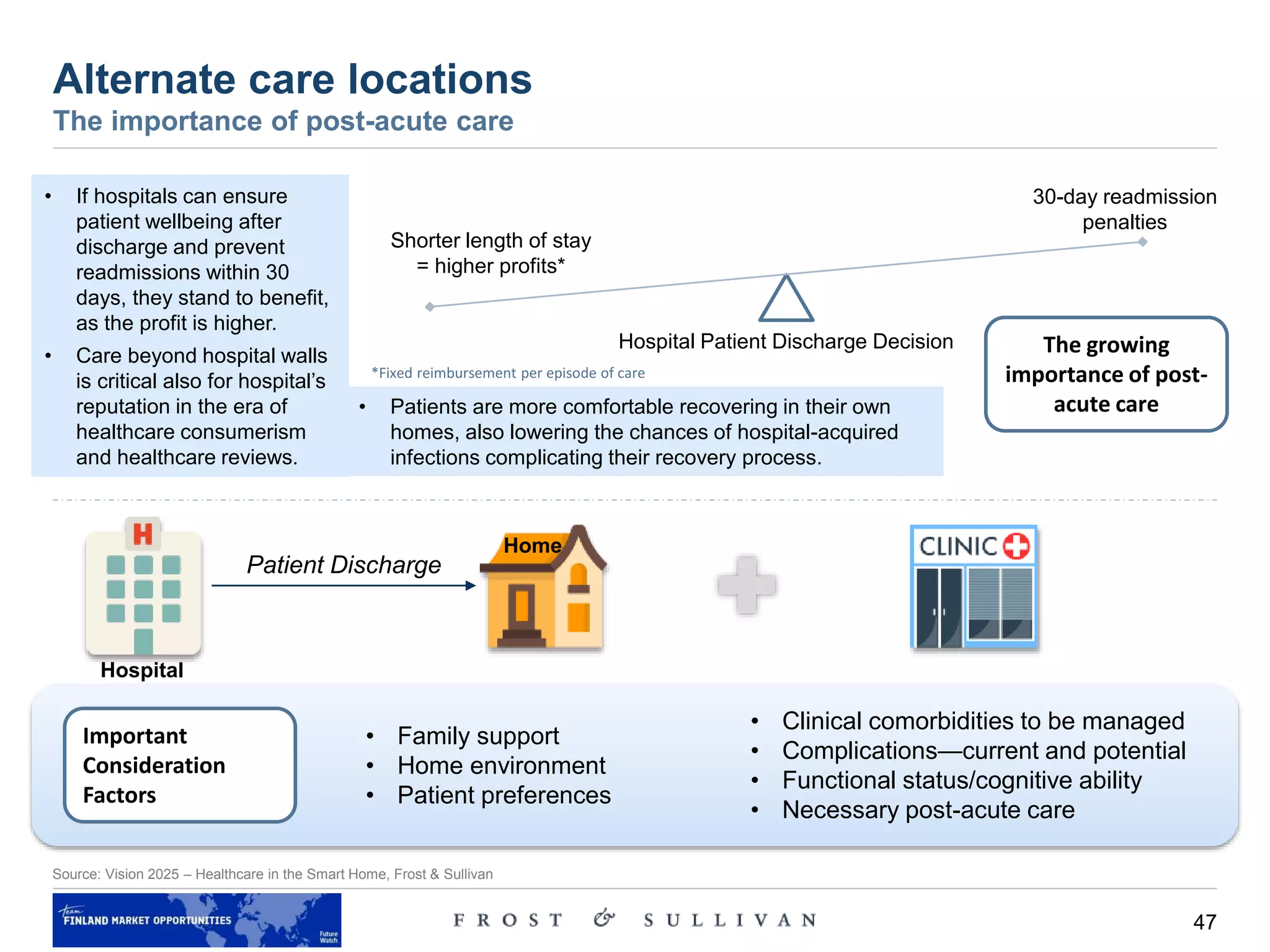

• According to a report on the Clinically Appropriate & Cost-Effective Placement Project (CACEP) from the Alliance for

Home Health Care Quality and Innovation, Medicare could reduce its spending by $34.7 billion over a 10-year period

by shifting patient care settings from facility-based care to home and community-based care. Additional $100 billion

could be saved if care delivery were restructured to be less wasteful and more effective.

Pharmacy

Patient

Visits

Path lab

Clinic

Health &

wellness

stores

Telemedicine

Home testing/collection

Online stores

[nutrition, wellness, medical devices]

House call

Products

and

Services

Visit

Patient.

ePharmacy/third-party delivery

Past Present

Healthcare Market: State of Care Delivery, Global, Past, Present & Future

In future, integration of

digital solutions will be

more concrete and visible](https://image.slidesharecdn.com/futurewatchhealthwellbeinginadigitalage-vision2025-190524094543/75/Future-Watch-Health-and-wellbeing-in-a-digital-age-vision-2025-39-2048.jpg)