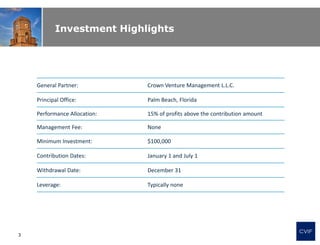

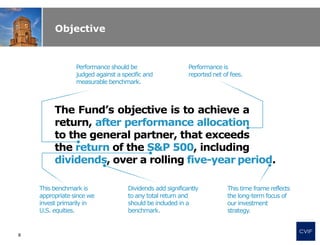

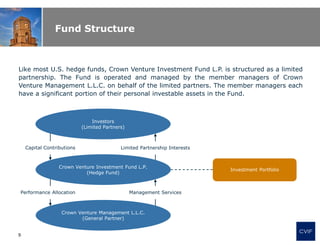

Crown Venture Investment Fund is a private pooled investment vehicle founded in 2008, focusing on value-based investments in U.S. public equities, with a minimum investment requirement of $100,000. The fund is managed by Crown Venture Management LLC, which employs a concentrated investment strategy emphasizing risk management and long-term returns, aiming to outperform the S&P 500 over rolling five-year periods. It operates under a unique fee structure that aligns management compensation with investor performance, without charging a management fee.