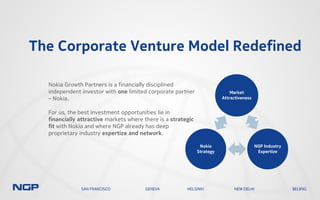

Nokia Growth Partners (NGP), established in 2005, is a growth-stage venture fund with $700 million under management and investments focused on the mobile sector. The fund invests $5 million to $15 million in companies with established revenue and products, emphasizing markets that align with Nokia's strategic interests. NGP has a global team of 11 investment professionals and a successful track record, including significant exits and partnerships in the connected car industry.