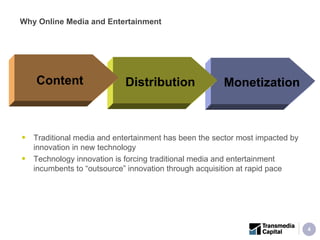

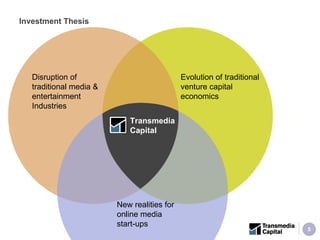

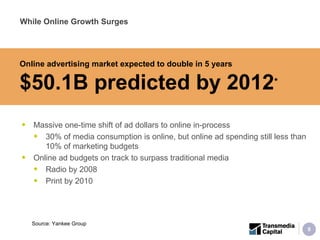

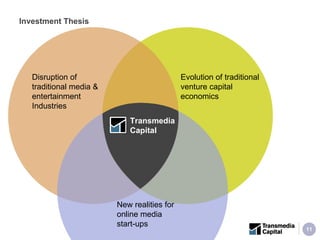

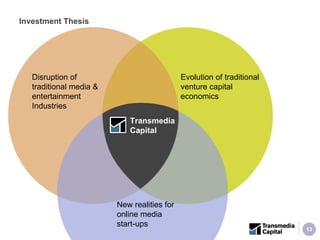

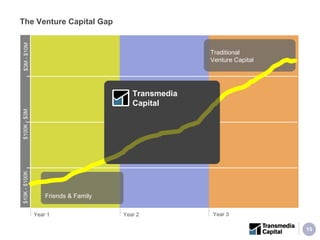

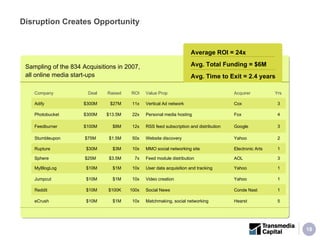

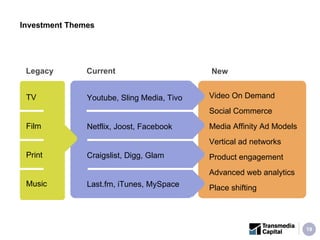

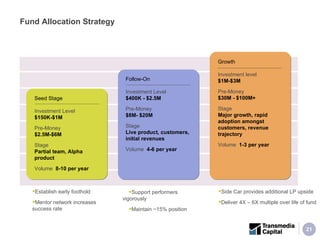

Transmedia Capital is a $25 million seed stage venture fund investing in new technologies that impact traditional media and entertainment industries. It will focus on opportunities created by disruption of these industries from technological innovation. The fund will provide small initial investments of $150k-$3m and mentor support to 8-15 portfolio companies per year. It believes this approach is better suited to current venture capital realities and opportunities compared to larger traditional VC funds.