frog_finmarktrust_the_personalities_of_the_underbanked_final

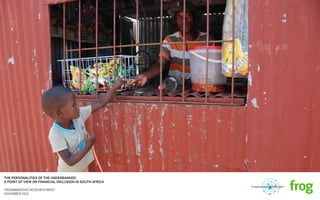

- 1. THE PERSONALITIES OF THE UNDERBANKED: A POINT OF VIEW ON FINANCIAL INCLUSION IN SOUTH AFRICA FROGIMMERSIVE RESEARCH BRIEF NOVEMBER 2012

- 2. 2FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED document contents 01 introduction 02 methodology 03 market context 04 personas 05 recommendations

- 4. 4 INTRODUCTION | FINMARK TRUST AND FROG FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED Created with initial funding from UKaid from the Department for International Development (DFID), FinMark Trust (FMT) is an independent trust. FMT’s purpose is ‘Making financial markets work for the poor, by promoting financial inclusion and regional financial integration’. It does this by conducting research to identify the systemic constraints that prevent financial markets from reaching out to these consumers and by advocating for change on the basis of research findings. Thus, FMT plays a catalytic role, driven by its purpose to start processes of change that ultimately lead to the development of inclusive financial systems that can benefit all consumers. frog is an innovation consultancy with deep roots in product design and realization. frog works across market sectors, geographies, cultures and technologies to help its clients bring meaningful innovations to life. These clients typically face intense pressures to bring more innovative, more business- viable and more consumer-centric solutions to their target markets. frog’s interdisciplinary, end-to-end methodology helps them do so. A key principle of frog’s innovation process is to discover compelling new solutions through inspiration. Quantitative market research is a necessary starting point, but deeper, more immersive, qualitative ethnographic perspectives bring this research to life, injecting the voice of the consumer into the product development cycle. FinMark Trust appointed frog to conduct immersive research within a lower-income community in South Africa to better understand the challenges of deepening financial inclusion in South Africa. FinMark Trust engaged frog for a 2-week frogImmersive study to provide additional insights on consumer behavioral patterns, lifestyles and attitudes on financial services. This document describes frog’s approach, findings and recommendations.

- 5. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 5 INTRODUCTION | ABOUT PERSONAS The challenge of research-led innovation Quantitative research enhances our understanding of people’s lives and their contexts. It is critical to developing a sound, evidence-based approach to policy and regulation, as well to better informing business strategy and planning. For governments, it offers insights into the lives of the entire population, sizes the markets which require specific policy focus and provides guidance on policy initiatives. For businesses, these insights provide important input into business cases and validate strategic roadmaps. To do this well, quantitative research must describe the status quo in rigorous, statistically valid ways. It uses large sample sizes, geographically broad respondent coverage, and fixed questionnaires to create as accurate a picture as possible of consumers in the world today. This perspective is fundamental to the development of viable policy and business strategy, but innovation is concerned with something else – it thinks about tomorrow, not just today.

- 6. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 6 INTRODUCTION | ABOUT PERSONAS Introducing personas, a tool for new thinking and innovation True innovation attempts to create new meaning and value in places where they did not exist before. To do so, it seeks to promote new consumer behaviors, often with little precedent in the market today. How do we create new products and services that will lead to this type of behavioral change that underlies meaningful innovation? Creating new products and services based on an understanding of today’s consumers tends to lead to incremental, evolutionary improvements in those products and services. Instead, we need inspiration for what behaviors could be tomorrow. To be able to project in this way, it is helpful to think about consumers in a deeper way. Behaviors today are a reflection of a more fundamental personality trait, need or aspiration. Behaviors tomorrow may look very different from what we imagine, but they are a manifestation of those same fundamental personality traits, needs or aspirations. Personas are a tool we use to help us think about behaviors in this deeper way, to allow us to design the behaviors of tomorrow.

- 7. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 7 INTRODUCTION | ABOUT PERSONAS Personas as the voice of the consumer Personas are stylized, abstractions of typical consumers seen in a target market. On the surface, personas feel like they describe a unique individual. Personas have names and ages, families and friends, incomes and expenses, daily rituals, less frequent behaviors and personal possessions. But a persona also has needs, deeply felt as they are a reflection of the persona’s priorities and ambitions in life. A persona also has aspirations, dreams of what life could be, and attitudes, a reflection of how interaction with people, places, and things should be. Collectively, all of these characteristics create a vivid personality. The richness of a persona is critical, as it helps inject the voice of the consumer into the innovation process. Too often, as consumer research leads to product design and development over months and even years, something gets lost in translation. Often it is the consumer voice. Personas help us ensure the consumer voice is strongly felt throughout the end-to-end innovation process.

- 8. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 8 INTRODUCTION | ABOUT PERSONAS Personas through qualitative research Creating a vivid consumer voice is better suited to qualitative, not quantitative, consumer research. Qualitative research methods, based on principles of ethnography, psychology, and sociology, seek to probe smaller sample sizes in greater depth. Consumers’ deepest needs, motivations, and aspirations tend not to surface from simple questionnaires. Trust must be developed, relationships must be built, significant face- time must be committed and alternative methods of investigation must be explored to uncover these aspects of consumers’ lives. Qualitative research methods are well suited to this type of study. The combination of deep qualitative research with a solid quantitative foundation is critical to create the richness of a persona that makes it so useful to the innovation process.

- 9. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 9 INTRODUCTION | ABOUT PERSONAS Behavioral and attitudinal significance As personas emerge from qualitative research over small sample sizes, they can not be construed as a complete representation of the target market. They do not attempt to paint a statistically valid picture – this is the job of a formal, quantitative market research or segmentation study. Instead, personas offer a behaviorally and attitudinally significant perspective on the target market. The behaviors and attitudes expressed through personas are based on observations of repeated patterns across diverse consumers in the research sample, telling us that these behaviors and attitudes are not one-off observations, but manifestations of fundamental needs and aspirations. There may always be additional personas that a different qualitative study can uncover, but this is not relevant to the innovator. As long as the personas that were uncovered offer enough range to inspire creation of meaningful products and services, they are serving their purpose.

- 10. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 10 INTRODUCTION | ABOUT PERSONAS Personas as provocative inspiration As the ultimate goal of personas is to inspire continuously through the innovation process, it is helpful to ensure they are structured in a way that is as inspirational as possible. We often find through our research that any given individual participant is inspirational in certain ways, but collectively, research participants are inspirational in many ways. To that end, personas are more useful when they are composites of multiple individuals, as opposed to being based on just one individual. Furthermore, it is helpful to gently exaggerate certain persona characteristics, emphasizing the most fundamental differences in consumer behaviors and attitudes. This act of provocation helps us inject the voice of the consumer into the innovation process in a way that emphasizes the most important consumer differences rather than similarities. This process of emphasis and abstraction tends to be a more useful means of inspiration, as it focuses on our attention on what’s most critical and meaningful.

- 11. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 11 INTRODUCTION | ABOUT PERSONAS Introducing Angela, Lucien, Natalie, Matome, Rolphy, and Patrick & Meiki In this document, we present 6 personas that emerged from a 2-week qualitative research study we conducted in South Africa. These 6 personas describe behaviorally and attitudinally significant consumer differences. We do not intend for these personas to represent a complete picture of the South African consumer. But we hope they are a starting point and motivator that bring a deeper, richer consumer-centric perspective into the innovation process.

- 12. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 12 INTRODUCTION | ABOUT PERSONAS The beginning of an innovation journey Although we will make recommendations on market opportunities that financial service industry players can use as starting points for their consumer-centric innovation initiatives, these recommendations should not be viewed as definitive solutions. Instead, they should be treated as the starting point of an innovation journey. The aim of this journey would be to discover, design, deliver and deploy meaningful products and services to the unbanked and underbanked consumer, achieving sustainable market impact and lasting consumer benefit. To do this, additional research and opportunity identification, ideation and conceptualization, product and service development, and commercialization are necessary steps to truly address the challenges of financial inclusion in South Africa. Discover Analysis Becomes Insights • Design research • Market and business research • Technology assessment • Opportunity evaluation • Roadmapping Design Insights Become Ideas • UX architecture and interaction • ID sketching and modeling • Ecosystem integration • Visual design • Prototyping and usability • Out-of-box-experience Deliver Ideas Become Products • Detailed UX design and documentation • CAD modeling and mechanical engineering • Software architecture and engineering • Testing and QA Deploy Products Become Reality • Certification • Systems integration • Packaging and marketing support • Post-launch revisions and enhancements Focus of this study

- 13. 02 methodology

- 14. INTRODUCTION | FROGIMMERSIVE FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED Introducing frogImmersive Our immersive, ethnographic research methodology (called frogImmersive) aims to gain insight into consumer behaviors, attitudes and aspirations, and unmet and unarticulated needs. Our research is not an activity for its own end; instead, its purpose is to inspire new ideas. Ultimately, our goal is to identify strategic directions for innovation through the synthesis of research findings into insights, insights into opportunities, and opportunities into new product and service concepts. Along the way, we define personas – abstracted representations of target consumers – as a tool to ensure that the voice of the consumer is always present. 14

- 15. INTRODUCTION | FROGIMMERSIVE | IDENTIFYING RESEARCH DIRECTIONS FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED Identifying research directions Before commencing research, it was imperative that frog, Finmark Trust and its syndicate partners be aligned on research directions. Leveraging preliminary results of the FinScope study and existing market understanding, we identified 8 directions to explore in depth in the field: Temporal context: The behaviors around and challenges of irregular income and unpredictable expenses. Financial ecosystems: The portfolio of formal and informal solutions used by consumers to manage their finances. Learning and literacy: The impact of financial, textual, and technological illiteracy on financial service usage. Affinity groups: The impact of communities and groups on financial behaviors. Challenges and hurdles: The pain points of using financial services from the formal sector. Aspirations and goals: The identities of consumers as defined by their personal, family, community, and business goals. Notions of value: The true value of financial services, beyond costs and monetary results. Circles of trust: The approaches used to discover, build, and sustain trust, particularly with respect to formal institutions. 15

- 16. INTRODUCTION | FROGIMMERSIVE | RESEARCH “PLANNING” FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED Research “planning” We plan for breadth but anticipate depth. Our research plan is more of a guideline, not a script. During fieldwork we continually adapt to seek insights from unexpected places, so our “plan” must allow for continuous improvisation. We hire local fixers who are essential to this approach, allowing us to step up to anyone (like an orange farmer with a broken car on the side of a rural road) to start a conversation. From our research directions, we focused on financially underserved consumers in South Africa. These are likely to be from middle- to lower-income brackets with poor access to formal financial services as well as those who are newly formally included. Our initial plan identified 4 starting targets: Heads of household: The key decision-makers in a home, with both traditional and modern attitudes toward finance. Small business owners: These might display special and/ or additional needs due to level of exposure to money and financial transactions. Community leaders: Both financial influencers and decision-makers in their communities. Students: Most likely to adopt and explore new financial products and technologies. 16

- 17. INTRODUCTION | FROGIMMERSIVE | LOCATION PLANNING FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED Location planning We selected the Polokwane area due to its mix of cultures, economies and proximity to formal rural and urban settlements. The various communities in this region have a broad range of income levels (from 45% to 79% with under R9,600 household income), employment (from 9% to 39%) and education levels (from 5% to 27% uneducated, from 4% to 24% with higher education)*. We don’t live in business hotels, preferring to live locally in the communities we study. For this study, our home base was a low-end guesthouse in Seshego township. Our research activities took us across the region in search of strong research participants. Over the course of research, we aimed for the following recruiting mix amongst the underbanked: Age: 18-65 Gender: male and female (evenly split) Income: low to middle income; LSM 3/4/5/6 (split 30%/ 30%/20%/20%) with LSM 1/2 and LSM 7 also evaluated for outlier perspectives Education: primary and secondary levels Family structure: single, family with kids, single parent family, multi-generation households Occupation: student, small business owner, entrepreneur, farmer, vocational worker, mobile agent, trader Location: peri-urban/rural (split 70%/30%) *Source: Census 2001 – Stats SA Polokwane Seshego Mankweng Modjadjiskloof Haenertsburg Tzaneen Chebeng Ga-Madiba Nobody Ga-Mothiba Bloodriver Ga- Mashashane 17

- 18. INTRODUCTION | FROGIMMERSIVE | CONDUCTING RESEARCH FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED Conducting research We learn more from limited, in-depth explorations than from large-scale, passing studies. We spend hours in interviewees’ homes, exploring every aspect of their lives to understand needs, motivations, aspirations, behaviors, hopes and dreams. We continuously look for opportunities to dig even deeper, at times shadowing them for hours, meeting their families, visiting their workplaces and churches, attending private events like funerals, and keeping in touch throughout the course of the research program and sometimes beyond. We find a great source of insight is targeting people when they least expect it. We talk to people on the street, in stores, and in transit, continuously digging for insights. At times we’re rejected or rebuffed, and at times these spontaneous acts turn into hour-long interviews that are richer than we could have ever anticipated. Over a week in the field, we performed 20 in- depth contextual interviews (including expert and group perspectives) and numerous intercept interviews, generating more than 800 data points and taking in excess of 4,000 photographs. 18

- 19. INTRODUCTION | FROGIMMERSIVE | CONDUCTING RESEARCH FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 19 An even mix of LSM 3-6, education levels, family structure and gender, spread across formal rural and urban environs. Occupations: students, street vendor, small business owner, taxi driver, teachers, firewood salesman, orange distributor, tractor driver, poultry farmer, saleslady, tombstone parlor owner, burial society leader, iron monger, pastor, grill man and cleaners.

- 20. INTRODUCTION | FROGIMMERSIVE | SYNTHESIZING INSIGHTS FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED Synthesizing insights A key ingredient of our approach is to turn our home into a project space, continuously filled with observations, insights, and new ideas. At the end of each day, the research team comes together to synthesize findings into insights. This allows us to share and discuss the day’s work, evaluate our progress and alignment with the hypotheses, refine our objectives and plan the activities for the following day. Key insights are captured on Post-its, providing a visual and dynamic reference. The final step in the field is the identification of key themes, supported by the insights gathered from the field. In Polokwane, we derived some 30 themes, allowing us to distill out key insights that would later inform the attitudinal and behavioral framework for the personas that we create during final synthesis and documentation. 20

- 21. INTRODUCTION | FROGIMMERSIVE | SYNTHESIZING PERSONAS FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED Synthesizing personas After fieldwork, we returned to frog Johannesburg to continue the synthesis process. We further refined and molded the themes, expanding some, contracting others, collating insights along the way. Our goal through this exercise is to identify patterns across participants. These patterns form the basis of a persona framework, a set of behavioral and attitudinal axes that differentiate the underbanked consumer. We know an axis is valid if we uncovered behavioral and attitudinal insights from a majority of participants related to the axis and if these participants’ behaviors and attitudes are spread evenly across the axis. By placing all research participants along these axes, we find clusters that suggest strong commonalities in behaviors and attitudes – the foundation of a persona. Typically, clusters of the same 3-5 participants across each axis form valid grounds for a persona. From this process of pattern-seeking and cluster analysis, we identified 6 personas differentiated along 4 behavioral and attitudinal axes. 21

- 22. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED A framework for understanding personas From our research, we identified 4 axes that articulate fundamental behavioral and attitudinal variations amongst consumers. The nature of qualitative research does not allow us to claim that these are the only axes to consider in the market. But we can claim that these are some of the behaviorally and attitudinally significant variations that tell a compelling story about financial inclusion. 1. Risk tolerance 2. Financial discipline 3. Trust in formal institutions 4. Financial horizon 22 financial disciplinefinancial horizon trust in formal institutions risk tolerance low high high low low high long short INTRODUCTION | PERSONAS | FRAMEWORK

- 23. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 23 Josephine, a salaried saleslady, feels trapped in an irrecoverable debt cycle initiated by the necessity to pay for the burial of her husband and two children. She has no problem taking out multiple leveraged loans. Risime, a 24-year old student, views borrowing as a high- risk expense. He disapproves of the concept of credit and would prefer to achieve his dreams through savings and acquisition of concrete assets. Risk tolerance Through our research, we met people who were highly risk-averse, unwilling to use credit products of any sort and comfortable with products that offer only simple returns, and those who were highly risk-tolerant, comfortable using combinations of leveraged credit products and curious about investments that could reap bigger rewards. LOW HIGH INTRODUCTION | PERSONAS | FRAMEWORK

- 24. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 24 Respect, an informal trader, has very irregular income, so takes great care to manage her expenses. She carefully decides when and how she can treat herself (“I’m going to buy ice-cream tomorrow”, after careful deliberation). John, a self-employed orange distributor, is uneducated and finds it difficult to budget and account for expenses. He and his wife believe savings clubs are the only way to save, as the group enforces discipline. Financial discipline Through our research, we met people who were highly disciplined, adept at managing their limited incomes, ensuring they never went into debt, who save for the future, and those who were undisciplined, often relying on informal group services or other support mechanisms to manage their money. LOW HIGH INTRODUCTION | PERSONAS | FRAMEWORK

- 25. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 25 Michael, a poultry farmer, is happy to ignore the mundane details of keeping a bank account. He claims he does not always check his bank charges as he fully trusts his bank to take care of him. William, a wood-seller, is a successful entrepreneur who has turned to informal support after being rebuffed by formal institutions for loans, even though he’s been a solid customer for multiple decades. Trust in formal institutions Through our research, we met people who had developed significant trust in formal financial providers, secure in the belief that their money would be safe and willing to reach out to banks for advice and support, and those who were highly skeptical of banks’ intentions and actions, often due to prior bad experiences. LOW HIGH INTRODUCTION | PERSONAS | FRAMEWORK

- 26. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 26 Molaiwa is a single mother and a student. She lives with her parents and gets by on a R280 per month SASSA grant. Despite this low income, she is planning on earning, saving and borrowing to uplift her family over time. TD, a tractor driver, doesn’t bother to save because his budget is too tight. He prefers thinking one day at a time, focusing on the now, not worrying about the bigger picture until his fortunes change. Financial horizon Through our research, we met people who had grand plans for their future and some indications of how they could realize their dreams through steps they could take in the short-term, and those whose entire focus was on the day-to-day, ignoring the means by which financial services could lead to a better future. SHORT LONG INTRODUCTION | PERSONAS | FRAMEWORK

- 28. MARKET CONTEXT | THE SOUTH AFRICAN FINANCIAL LANDSCAPE FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED The South African financial landscape Through our research, we learned about a broad array of financial services used by South African underbanked consumers. As in most markets across the world, people manage their finances through a portfolio of services that attempts to meet their needs related to having money to achieve individual goals (savings), acquiring funds when money isn’t available (credit), transferring money to people and institutions (payments), and hedging against risk (insurance). People employ a range of formal and informal financial solutions across these categories of needs. The particular solutions used are a reflection of South Africa’s unique position and history, one that combines the banking infrastructure and financial sophistication typically associated with developed markets with the lack of access and traditionalism typically associated with emerging markets. By means of introduction, we’ll first review the most common financial services we encountered through our research. We did not come across the full range of financial services available in South Africa, so this introduction should not be considered comprehensive. 28

- 29. MARKET CONTEXT | THE SOUTH AFRICAN FINANCIAL LANDSCAPE FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 29 A bank transfer is the most common instrument used to transfer money over distance, whether to individuals, businesses, or for services. Most participants were comfortable with the notion of transferring money within the same bank or to other bank accounts via an intra-bank transfer, performed in-person at a retail branch. In several cases, participants would withdraw cash from a savings account at one bank, then travel to another bank’s retail branch to deposit money into another person’s account. The purpose of this activity is to minimize bank transfer fees. A common behavior we witnessed amongst multiple participants was the use of multiple bank accounts for different purposes. Savings accounts were often separated from accounts used primarily for payments. Participants maintained multiple bank cards to use these accounts. Many participants made electricity payments through bank transfers or through retail channels. Shoprite, for example, allows for purchase of prepaid electricity through their retail stores. A few participants used debit orders and stop orders for the purposes of making loan payments on a car or other bigger-ticket items. In general, these were viewed as more sophisticated payment mechanisms, not understood by most consumers, and perceived as not relevant to the regular needs of the underbanked. Mobile money was not popular amongst our participants. Several knew it existed, but didn’t see a burning reason to use it, claiming bank transfers accomplished the same task. One exception was an immigrant family that used a specialized mobile money service to transfer money to relatives in Zimbabwe. PAYMENTS Risima, a student, on payments: Risima uses internet banking to buy airtime and electricity and to transfer money to siblings. He also uses an eWallet money transfer solution through PEP stores to send money to siblings. He keeps 3 bank accounts for different purposes – including one dedicated to receiving money from his parents.

- 30. MARKET CONTEXT | THE SOUTH AFRICAN FINANCIAL LANDSCAPE FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 30 A bank account is the primary savings instrument used by most. All of our research participants had an account with a major financial institution ostensibly intended for savings, although the realities of low income and high expenses meant that in many cases these accounts did not hold much. In several cases, these accounts were opened out of necessity (e.g., as a job requirement or for a grant, a visa, or a loan). Several used multiple bank accounts to promote savings discipline. Some create obstacles to cash withdrawal (e.g., giving an ATM card to a relative) to help save. A few participants also used specialty savings accounts, like 32-day stop orders and auto-direct debit orders to help save. Participants trusted banks as secure places to safeguard the money they have, despite a handful of examples of fraud or other inexplicable account leakages. Many prefer accessing their account at a physical branch for safety reasons, while others were comfortable using ATMs. Keeping cash on hand as an alternative was seen as particularly unsafe. Most were not aware of specific account fees or interest rates, although a few had a general sense. Although more sophisticated savings instruments like unit trusts and money market accounts exist across South Africa, we did not encounter any usage through our research. On the informal side, stokvels (savings clubs) are commonly used in many communities. Stokvels are associations of typically less than 20 individuals from one community. All members contribute a fixed amount periodically (weekly, biweekly, or monthly) that is placed into a common pool stored in a bank account. Each period, the total pool is paid out to one member, giving that individual the opportunity to take advantage of a large lump-sum burst of cash. Many stokvels intend payouts to be used for a specific purpose. In our research, we encountered grocery stokvels (intended for bulk grocery purchases) and event stokvels (intended for wedding, Christmas, and party purchases). Stokvels vary in their structure – some have formal leadership (presidents, treasurers) with strict rules (e.g., penalty fees for missed contributions), while others are loosely structured and quite flexible. Some offer loans as well, keeping a percentage of the total pool to the side for low-interest (or no-interest) loans to members. Many value the social aspect of getting together periodically the most. Many male interviewees believe stokvel participation is a female activity, preferring not to get involved, even if they ultimately benefit from the payouts. Saving through accumulation of tangible assets is another behavior we observed. For those who could afford to, purchasing a home or car was seen as a responsible way to save. Some in rural locations preferred purchasing cows or other livestock. SAVINGS Zacharia, a teacher, on savings: Zacharia has a mix of informal and formal saving mechanisms in his portfolio. Cash is far too liquid to save for the short-term, so a 32-day notice account provides the requisite discipline to save for big-ticket items such as building a house for his mother and fraternal family. Medium-term savings requirements are fulfilled by investing in livestock. An education policy for his children is an additional long-term saving option, but only when his short- term needs are fulfilled.

- 31. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 31 Bank loans are a well understood credit mechanism, although attitudes vary widely toward the very notion of credit. Participants complain that the bank loan process is particularly complex and time-consuming, requiring extensive documentation that may be difficult to obtain and requiring weeks or months for loans to be approved, often with minimal visibility into the status of an open loan application. Most participants thought bank loans were best for big-ticket purchases – business expansion, homes, and cars. Banks vary in their flexibility in loan payment. We heard examples of stricter banks that come down hard when payments are missed or late, imposing penalties and threatening to change terms. On the other hand, we heard of more forgiving banks that allow loan terms to be revised and payments to be missed in times of need – only a token payment need be made to keep the loan alive. Another common formal loan product is the official student loan (NSFAS), offered by the government to cover the costs of tuition and textbooks. This loan does not require repayment until after graduation, when the graduate has secured a full-time job. These loans have penalties for poor academic performance – failing a year results in the loan being rescinded. Almost all loans we discussed with participants were unsecured loans. The sole exceptions were those who had secured automotive loans used to purchase new (or almost new) cars. A few participants used credit cards (issued by the major banks), but these were typically viewed as emergency- only solutions. Retail credit products were also quite popular. Several participants purchased bigger-ticket items like vehicles or regular bulk purchases like annual clothing using retail credit, paying back in installments over time. Interest rates are typically around 20% per month for major retailers. We did not encounter extensive use of informal credit mechanisms. A few participants had experience with stokvel loans, used for community-related purchases (e.g., weddings and parties). More often, people turn to friends and family for casual, smaller loans, but the social stigma associated with being indebted to those who are close means that this mechanism is not a regular course of action. People see this as gifting (as there’s no interest or repayment scheduled) rather than credit. A last resort is the loan shark, but exorbitant interest rates (above 40%) and the fear of forced removal of assets by the loan shark’s “sheriff” (i.e., muscle) make this a hardly desirable alternative. However, we did hear a story about one individual using a loan shark as a consistent, monthly source of loans to cover the final tough week before payday. The lack of an application process and speed of loan approval made it the most useful option available. CREDIT MARKET CONTEXT | THE SOUTH AFRICAN FINANCIAL LANDSCAPE Josephine, a retail saleswoman, on credit: Despite her experience of the dangers of heavy borrowing from both the formal and informal sectors, Josephine does both. Long-term needs are fulfilled by the formal sector, where money is easily spent and repayments become a long-term burden. A credit card helps for smaller payments, providing access to revolving credit without regard for interest rates. When times are tough, the immediacy of short-term loans from loan sharks puts food on the table for her children and orphaned grandchildren.

- 32. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 32 The most common insurance product seen amongst South Africans is funeral insurance, intended to cover the extremely high costs of funerals (R60,000-80,000). On average, funerals occur over a period of 2-3 years, with the first 7-11 days being the most cost-intensive. Funeral insurance is typically provided via a burial society of 20-25 members, although sizes vary. This society is an informal mechanism that functions as a group savings club (R25-50/month payments) with a long-term horizon, paying out significant funds at the time of death of the insured. Many participants were part of multiple burial societies to ensure coverage of all family members – some societies just cover the husband and wife, just the kids, just certain age ranges, etc. Similarly, membership in multiple societies ensures all funeral costs are covered – some societies just focus on coffins, tombstones, food, funeral function supplies, etc. Some societies also have geographic or community requirements, only permitting membership if the applicants are living in a specific location (sometimes a single block). See the next page for more details on burial society mechanics. Funeral insurance is also available through formal institutions, but these are less popular at the moment. They are more attractive to consumers with geographically dispersed families. Other forms of insurance – health, life, and property insurance – are available in South Africa, but our research participants were not particularly interested in these. The value they offer was perceived as too long-term, too abstract, and only for those with higher disposable income. Ironically, owning life insurance was seen as being particularly risky as it could put one’s life at risk, as others would know the specific value placed on a life. MARKET CONTEXT | THE SOUTH AFRICAN FINANCIAL LANDSCAPE INSURANCE Patrick, a teacher, on insurance: Patrick ‘s insurance needs are fulfilled from both the informal and formal sector. Within his portfolio are two long term insurance products – a self-initiated endowment /life insurance product and a group life insurance scheme provided through his SADTU (trade union) affiliation. A burial society affiliation completes his long-term insurance portfolio requirements.

- 33. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 33 Funeral insurance: much more than insurance Consider the significant prevalence of funeral insurance and the burial societies that provide it. The traditional view of this phenomenon is that it is a unique insurance scheme. But its actual mechanics include more than just insurance – it has savings, credit, payment, and insurance facets, particularly when assessed from a consumer’s, as opposed to from a bank’s, point of view. When asked about savings, many respondents describe their burial society contributions as a savings scheme, often while simultaneously describing it as a form of insurance. They further characterize the practice of making regular contributions as representative of strong financial discipline, something they believe should be valued in credit contexts (e.g., in loan applications). Some burial societies allow emergency loans from the funeral pool, effectively serving as credit institutions. And the mechanics of contribution and of payout touch on many of the core principles of payment solutions – payment over time, over distance, and over social networks. From a consumer perspective then, the funeral insurance and burial society phenomenon can be viewed as the ultimate composite financial product, bringing together a variety of diverse financial behaviors that are traditionally viewed (in the formal sector) as siloed. This example highlights a fundamental principle of consumer-centric innovation: behaviors don’t always fall nicely into corporate product structures, nor should providers try to force customers into using products based on these structures. 0R 5,000R 10,000R 15,000R 20,000R 25,000R 0! 2! 4! 6! 8! 10! 12! 14! 16!D0 D1 D2 D3 D4 D5 D6 D7 D8 D9 D10 D11 Y1 Y2-3 typical funeral inflows and expenses over 3 years postmortem food, transport (cash) food (cash) food (cash) food (cash) food (cash) food (cash) food (cash), grave-digging (cash) food (cash) food (cash), cow (cash or bank transfer) body storage fee (cash), coffin (cash or bank transfer) transport (cash) tombstone (cash or bank transfer) food (cash), cow (cash or bank transfer) uncovered funeral expense (payment mechanism) covered funeral expense (payment mechanism) • cash inflow from formal and informal funeral insurance (payment mechanism) • R5,000 food (cash) • R15,000 coffin (cash or bank transfer) • R25,000 insurance payout (bank transfer) • R5,000 condolences (cash) MARKET CONTEXT | THE SOUTH AFRICAN FINANCIAL LANDSCAPE time (days to years) Note: some societies make in-kind payments instead of cash.

- 34. 04 personas

- 35. PERSONAS | FRAMEWORK FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 35 Through cluster analysis of participants placed along the 4 axes of the persona framework, we identified 6 personas, representing 6 unique personalities with different financial behaviors and attitudes. Collectively, these 6 personas span the full range of behaviors and attitudes defined by the 4 axes. The 6 personas are: 1. Angela, the aspiring student 2. Lucien, the family man 3. Natalie, the survivor 4. Matome, the driven businessman 5. Rolphy, the struggling entrepreneur 6. Patrick & Meiki, comfortable elders financial disciplinefinancial horizon trust in formal institutions risk tolerance Patrick & Meiki, comfortable elders Angela, the aspiring student Lucien, the family man Natalie, the survivor Matome, the driven businessman Rolphy, the struggling entrepreneur

- 36. PERSONAS | ANGELA, THE ASPIRING STUDENT FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 36 PERSONA 1: Angela, the aspiring student 22 years old FET student Seshego, living with her family Single (in a relationship) Aspiring students are keen to contribute to their family once they graduate. Many are hoping that their certificate will secure them a full-time job with a stable salary. Savings is a challenge for many as they find ways to discipline themselves from over-spending on clothes, food and entertainment.

- 37. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 37 “Getting a certificate is important. By all means, I’m going to graduate.” A level 6 student in Education and Development, Angela is looking forward to her graduation. As the youngest daughter of a single parent family, Angela relies on her NSFAS loan to cover half of her R6,500/year tuition. She understands that she will need to repay the loan but is not exactly sure about the interest rate and repayment schedule involved, nor does she think she really needs to worry about it at the moment. “Saving money alone is hard. I need someone that is trustworthy and understands me.” Angela gets most her pocket money from her eldest brother working in Pretoria. Money is usually deposited into her student account at the end of the week. She has specifically asked her brother to deposit on a weekly basis so she will refrain from spending all of her monthly allowance in a week. Angela leaves for school at 8 am everyday. She eats lunch and dinner at home to save money. On weekends, Angela enjoys spending time with her friends in town. Her largest spend apart from groceries is on clothes. She has a credit account with Ackermans – she currently owes R300 and must pay back R105/month (20% monthly interest included). Angela bought a BlackBerry last year for her school assignments. She spends up to R60 on prepaid airtime per month (R40 on calls and R20 on 20MB of data). She also uses Whatsapp and Mixit to connect with her friends. “In the meantime (before graduation), I am planning to set up a perfume business to earn money.” With a strong entrepreneurial spirit, Angela is also an active member in the Youth Enterprises Group (YEG). With over 500 members, YEG is one of the largest societies in her college, and she loves bonding with other like-minded students. PERSONAS | ANGELA, THE ASPIRING STUDENT

- 38. 200# 100# 60# 50# 30# 30# 30# FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 38 MONTHLY PERSONAL INCOME Trans- port Others R500 family-supported Clothing Food and drinks Airtime Entertain- ment Savings MONTHLY EXPENSES SPENDING PATTERNS R470 KEY ASSETS 0 7 14 21 28 DAILY SPEND MONTHLY SPEND Nokia E63 Used PC Television Spending bursts after weekly allowances PERSONAS | ANGELA, THE ASPIRING STUDENT

- 39. financial disciplinefinancial horizon trust in formal institutions risk tolerance FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 39 Angela is an active member of the Youth Enterprises Group in her college and has a broad social circle of financial influencers. However, when it comes to finance, she still prefers flexibility and tends to rely more on herself to ensure she meets her goals. At age 22, Angela is already thinking way beyond her graduation. In reality, however, Angela does not really have a savings plan, and her monthly allowance from her family barely covers her expenses. When it comes to finance, Angela has a strong preference toward formal institutions, as she believes their policies and products better suit the lifestyles of young people. Although an NSFAS loan is generally considered a safe bet, Angela signed up without understanding the actual terms involved. Aside from her education loan, Angela also has some light, manageable retail credit, despite not having an income. PERSONAS | ANGELA, THE ASPIRING STUDENT

- 40. While most people of her age tends to dream big, Angela’s aspiration is more grounded in reality. She is looking forward to her graduation, as having a certificate will increase her chance of finding a full-time job, allowing her to start contributing to her family. With a stable income, the very first thing she would want to do is renovate the house her parents are living in. Angela also hopes her children will have a better life than the one she currently has. She would want all her kids to go to universities (not vocational schools) and is already planning to get education policies once she has her first child and a stable income. “I hope my degree will help me get a job. If not, I’ll start my own business. With the money, I can fence my parent’s house.” FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 40 PERSONAS | ANGELA, THE ASPIRING STUDENT

- 41. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 41 KEY INSURANCE NEED Lower barriers to entry for formal funeral insurance Angela wishes to pursue a formal funeral policy, which she thinks is a more modern approach than her parents’ burial societies, but cannot without payslips and other formal documentation that she doesn’t have. She is keen to use a formal solution as she plans to move to a larger city away from home and will no longer be entitled to her parents’ burial coverage after she gets married. KEY PAYMENTS NEED Greater control and ownership of the money receipt process There have been a number of times when her brother is busy, forgetting to send her money on time. Angela will then have to borrow from her friends for the weekend. She is frustrated that her income is so dependent on the behaviors of others. Angela is currently covered under an informal burial plan, paid for by her parents (R50/month). Angela receives money from her elder brother every week. She withdraws around R100 every week from an ATM located inside a Shoprite 30 minutes from where she lives. Like 70% of other students studying at FET, Angela currently finances her R6,500/year tuition fee with a loan from NSFAS. KEY CREDIT NEED More approachable loan information and education to inform long-term planning Although Angela will only start repaying her student loan after she graduates and lands a full-time job, she is still concerned that the loan burden may be quite severe. She doesn’t truly understand how her life will be impacted by loan repayments, nor does she have the time or energy to figure it out given the distractions of school life. KEY SAVINGS NEED Greater self-discipline to promote savings and discourage careless spending Preventing herself from spending her entire allowance within a week is a real challenge given the temptations of student life. Angela doesn’t feel she has enough self-discipline, so she asks her brother to deposit her allowance on a weekly – not monthly – basis, to resist the urge to spend. Angela opened a student account 2 years ago. She receives her weekly allowance (R125) from her brother in this account, and also uses it to pay for school fees. PERSONAS | ANGELA, THE ASPIRING STUDENT

- 42. PERSONAS | LUCIEN, THE FAMILY MAN FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 42 PERSONA 2: Lucien, the self-made family man 44 years old Poultry farmer Chebeng, living with his family Married with children Being the heads of a household and the only breadwinners, self-made family men have the challenging role of ensuring a stable flow of income for their family, both now and in the future. Growing their present income and savings while juggling the needs of their multiple dependents are their biggest concerns.

- 43. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 43 “I head out to the farm at 4:30 am everyday to make sure everything is alright. Sometimes, I sleep there.” A father of five and the owner of a chicken farm, Lucien has a very busy life. Monday through Saturday, he wakes up at 4:00 am and attends to his farm business. Managing a poultry business is not easy – income is uncertain and volatile as revenues are highly dependent on the market price of chickens and fertility rate of the eggs. Lucien on average earns R4,500/month and might earn an additional R3,000-7,000 at the end of the year depending on how many chickens are bred. “I never borrow money from the bank because I believe I will end up paying more.” Despite his income uncertainty and wish to expand his business, Lucien has never considered taking a bank loan. When it comes to his family however, Lucien will always try to go the extra mile. Upon his kids’ request, Lucien bought a home stereo system from OK House and Home last year. The stereo was bought using hire purchase (installments) and Lucien is now paying R852/month for 30 months (he’s not exactly sure about the interest rates). The family is also planning to get a DSTV service which will cost R599 for the dish and R265/month for subscription. “The bank will lose the money of an individual, but not when we are in a group.” For savings, Lucien is relying on the burial society that he inherited from his father. He currently contributes R70 each month to cover his entire family. Being around for so long and recognized as the financially savvy one, Lucien was chosen as one of the society’s 3 leaders a few years ago. The society usually gathers during the first week of each month to discuss matters and collect money. To make better use of the money, Lucien has been shopping around for banks that give better interest rates. He was also the one who proposed using part of the society’s money to stock up on funeral necessities such as pots, plates and tents to cut down on the operating costs of funerals. PERSONAS | LUCIEN, THE FAMILY MAN

- 44. 1500$ 1000$ 850$ 250$ 200$120$100$ 480$ FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 44 MONTHLY PERSONAL INCOME Clothes Airtime R4,500 self-made Groceries Farm operations Installment Electricity Savings MONTHLY EXPENSES SPENDING PATTERNS R4,020 KEY ASSETS 0 7 14 21 28 MONTHLY SPEND PERSONAS | LUCIEN, THE FAMILY MAN Societies TelevisionNokia feature phone Flatscreen TV (1 per bedroom) Stereo Microwave Mini-fridge Washing machine DAILY SPEND Grocery bulk purchase

- 45. financial disciplinefinancial horizon trust in formal institutions risk tolerance FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 45 Lucien is one of the 3 leaders of a burial society he inherited from his father. He strongly believes in the notion of community as a means to influence positive financial behaviors and has been actively finding ways to improve the operation of the society. Despite his desire to save, he has an unstable income, so he finds it hard to plan financially beyond the next season (2-3 months). The family relies mostly on payouts from their saving societies for any major unexpected expenditures, e.g., funerals and weddings. While trusting banks to be the safest place to keep his money, Lucien has always had doubts on whether banks do act in customers’ best interests. He strongly believes that communities should manage their own finances. When it comes to insurance however, Lucien does see the value of having an education policy. He wants to make sure that none of his family members will suffer even when he is not around. Despite his wish to expand his business, Lucien never considers applying for a loan for fear that he will not be able to pay it back. Instead he prefers saving up. He is comfortable with taking purchase installments due to the smaller amounts involved. PERSONAS | LUCIEN, THE FAMILY MAN

- 46. Working hard and providing for his family for more than two decades, Lucien has consistently made family the central part of his life. By expanding his chicken farm, Lucien hopes to increase his income so that he can send all the rest of his three children to university. Cognizant of his present challenges in operating a business, he does not expect any of his children to take over the farm, but rather wants them to get a good job in town and earn a stable income. He also hopes to find ways to manage the funding of the burial society more effectively so that they can contribute more at times of any member’s funeral. “My biggest achievement will be seeing all my children go to university, getting a good job and not having to worry about money.” FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 46 PERSONAS | LUCIEN, THE FAMILY MAN

- 47. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 47 KEY INSURANCE NEED Clear value proposition on how formal and informal solutions can co-exist Lucien is quite comfortable with his portfolio of informal group savings and insurance schemes. He has recently been receiving calls from a few insurance companies, but is not sure which ones he can trust, nor does he see a truly compelling reason for why he should switch. KEY PAYMENTS NEED Easier and cheaper inter-bank transfer mechanisms As not all the hatcheries he deals with use the same bank as he, Lucien often has to pay additional fees for money transfers. He tried opening multiple accounts to reduce fees, but decided the hassle of managing multiple accounts was too inconvenient. In addition to a burial society, Lucien contributes to an informal food stokvel (R50/month). He is also considering buying an education policy for his children. Lucien receives money (R3,000-7,000) from various hatcheries in Pretoria toward year-end via bank transfers. Despite wishing to expand his business, Lucien has not considered taking a loan for fear of not being able to pay back. He thinks hire installments are best because of the small payments involved. KEY CREDIT NEED More flexible and more approachable loan terms Lucien could benefit from loans to grow his business, but has a deep- seated fear of credit. He believes all bank loans are inflexible in their terms, so he would rather borrow from family or friends if needed. However, he feels uncomfortable using personal relationships for large loans, so defaults to not borrowing at all. KEY SAVINGS NEED Better tracking and management of family and community finances Managing the finances of a family of 7 and a 26-member burial society is not easy. Lucien tries to diligently log all transactions, often referring back to SMS notifications, and keeps all receipts in a plastic bag. He finds this process cumbersome and tedious, but doesn’t feel he has any other options. Lucien has 2 bank accounts: one for the burial society and one for personal finance. He likes one for its SMS notifications, the other for the simplicity of its flat transaction fees. PERSONAS | LUCIEN, THE FAMILY MAN

- 48. PERSONAS | NATALIE, THE SURVIVOR FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 48 PERSONA 3: Natalie, the survivor 41 years old Part-time cleaner Ga-Mashashane, living with her family Single mother/grandmother Often living with small incomes and SASSA social grants, survivors struggle with their finances on a daily basis. A lack of transparency into financial products and the pressure to make ends meet forces many of them into repeated cycles of debt.

- 49. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 49 “I have had 7 kids and 3 of them died so I’m left with 6 orphans. My husband passed away 2 years ago.” At age 41, Natalie is already the grandmother of 11. She has a part-time cleaning job which pays her R1,500/month and is also entitled to foster care grants of R1,500/month. Life has not been easy on Natalie – both her husband and 3 kids passed away a few years ago and now she is left with 6 orphans, the youngest one aged 4. “I have a R400 loan from a loan shark. The interest rate is 40% which I think is high but I still agreed as it was convenient. I cannot let the kids go hungry.” With a monthly household expenditure of around R3,500, Natalie’s income hardly covers living costs. She started borrowing from banks 2 years ago and has since been borrowing from different institutions. One of the largest loans (R14,000) was used to buy a water tank and to put electricity in the house. Another recent loan was used for a burial. Recently, she is looking for smaller banks as they are the ones least concerned about her credit history. Although Natalie has been trying to pay off parts of her loans, she estimates that the amount owed to banks still exceeds R27,000. Natalie is currently paying R1,200/month to cover minimum payments and interest. Lately, faced with the pressure to feed her family, Natalie has resorted to borrowing R400 from a loan shark that lives in her village. Natalie is fully aware of the outrageous interest rate (40%), but has little choice. “I get my SASSA money on my card once a month but as soon as the money is deposited, I take it all out at Shoprite.” Though she has 3 bank accounts, Natalie hardly has money left in any of her bank or SASSA accounts at one time. Like many other single mothers, she withdraws all the money from a Shoprite near her home almost immediately after money is deposited. She will normally spend the money right afterwards on bulk food and groceries that she hopes will last the family the entire month. PERSONAS | NATALIE, THE SURVIVOR

- 50. 1200$ 1200$ 400$ 200$ 150$ 100$60$ FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 50 MONTHLY PERSONAL INCOME Clothes Others R3,000 self-made and grants Loan repayment Groceries Transport Airtime MONTHLY EXPENSES SPENDING PATTERNS R3,500 KEY ASSETS 0 7 14 21 28 MONTHLY SPEND TelevisionNokia feature phone Stereo Microwave PERSONAS | NATALIE, THE SURVIVOR Refrigerator DAILY SPEND Grocery bulk purchase Grocery bulk purchase and loan repayment ElectricityLoan shark repayment

- 51. financial disciplinefinancial horizon trust in formal institutions risk tolerance FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 51 As much as she wants to be part of savings communities, Natalie is not as she cannot afford the monthly payments. She often feels helpless in the face of crushing debt and doesn’t have the discipline to truly find viable ways out. With hardly any money left in her bank account at any given time, Natalie’s financial horizon does not stretch beyond even the current month. Natalie considers banks as the safest place to borrow money and will only turn to informal institutions such as loan sharks as a last resort. However, in times of desperation, the convenience factor still precedes all – she will take out loans from whichever institutions are willing to lend to her. The pressure to sustain herself and her grandchildren means that Natalie is willing to take as much financial risk as she can to cover basic expenditures. Trapped in a debt cycle, she regularly takes out loans from both formal institutions and loan sharks to cover the minimum repayment and interest expenses. PERSONAS | NATALIE, THE SURVIVOR

- 52. As simple as it might sound for people not living on a tight budget like Natalie, making it through the day appears to be the most sensible thing she can hope for in her life. Fully understanding the risks and dangers involved, Natalie wishes to get out of her increasingly vicious debt cycle. Getting a full-time job with better pay is what she sees as the best solution. “I wish I can have a full-time job that will earn me more money. All I want is to feed the children. I cannot let them go hungry.” FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 52 PERSONAS | NATALIE, THE SURVIVOR

- 53. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 53 KEY INSURANCE NEED Lower costs of entry for funeral coverage All burial societies in her neighborhood demand a minimum contribution of R50/month which Natalie cannot afford. She would not mind if fewer items are covered for a lower contribution. She feels even light, partial coverage is better than nothing. KEY PAYMENTS NEED None She wants to enroll in a local burial society, but can’t afford the monthly payment. She contributes R10 towards funerals happening in her community in the hope that people will do the same for her. Natalie is not using any payment or remittance services. She currently has 3 loans from 3 institutions – for R14,000, R7,000, and R5,000. She is also borrowing R400 from a loan shark at 40% interest. She will borrow R300 from her friend too regularly, with no interest. KEY CREDIT NEED Greater confidence and better planning to assist in escaping from the debt cycle Poor financial planning and the daily pressure to make ends meet has forced Natalie into a painful repeated debt cycle – using one loan to cover others. She feels so trapped in this cycle that she has no idea how to start trying to escape. KEY SAVINGS NEED Better mechanisms to force short- term savings through income troughs Despite having three accounts, Natalie can barely maintain savings in any of them. She will withdraw and spend it all as long as there is money, even if she knows that saving a little would be more beneficial to bulk purchasing for her family. Natalie has 3 bank accounts – one for her payroll account and two for loans. She also has a SASSA card through which she receives R1,500 monthly. PERSONAS | NATALIE, THE SURVIVOR

- 54. PERSONAS | MATOME, THE DRIVEN BUSINESSMAN FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 54 PERSONA 4: Matome, the driven businessman 36 years old Teacher Mankweng, living with his family Divorced with children Educated and with high income, driven businessmen are financially savvy and open to new ways of managing their finances. They are keen to find ways to increase income, but not at the cost of security.

- 55. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 55 “I learned from my father that the most important thing in life is to grow to be a responsible man.” As the only kid out of 5 with a college degree and a teaching diploma, Matome is the star of his family. Being a teacher at a rural high school gives Matome a reasonably good, stable income (R9,000). Inspired by his father, Matome sees responsibility – for his business, his family, and his health – as the most important priority in life. He works hard to be able to support three households – his mother, his current wife with a child, and his divorced wife and child (R1,000/month support) who are living in Magoebaskloof. “Money is easy to spend. I find it more interesting to put it into the house and in livestock.” Despite the easy income of a teaching job, Matome is never tired of finding ways to grow his income. Lately, he started to run a small farm in his backyard where he grows chicken and fruits. Matome also started a project to extend his family house three months ago. The extension is expected to cost R40,000 in total, but Matome has never considered taking a loan. He actually had R30,000 savings in his bank account prior to starting. To Matome, taking out a loan is only necessary if you cannot meet your basic living needs. Matome has nonetheless agreed to purchase a pickup truck, even though he doesn’t need it all the time as he’s part of a lift club with 4 of his colleagues. He has also bought car insurance (R900) based on recommendations from his garage. “I do not believe in a burial society. I only trust myself to be the best person to save money.” Matome does not believe in the informal way of savings. When his father passed away, the burial society only managed to provide R3,000 for the coffin. Matome ended up having to put in an extra R7,000 to get his father a ‘decent coffin’. Instead, Matome relies on placing a 32-day stop order every month for R3,000. Despite trusting the bank as a safe place to keep his money, Matome has become skeptical about other services offered by banks. He recently suffered a direct debit fraud where R200 was taken away from his account for 3 months. PERSONAS | MATOME, THE DRIVEN BUSINESSMAN

- 56. 3500$ 1000$ 800$ 250$ 3290$ FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 56 MONTHLY PERSONAL INCOME R9,000 self-made Vehicle installment Child support Electricity Savings MONTHLY EXPENSES SPENDING PATTERNS R5,710 KEY ASSETS 0 7 14 21 28 MONTHLY SPEND Nokia feature phone Flatscreen TV (1 per bedroom) Microwave Washing machine DAILY SPEND Grocery bulk purchase and vehicle installment Bakkie (pickup truck) Refrigerator PC PERSONAS | MATOME, THE DRIVEN BUSINESSMAN Groceries Petrol (100) Airtime (60)

- 57. financial disciplinefinancial horizon trust in formal institutions risk tolerance FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 57 Matome is confident about managing his own finances and does not want the inflexibility imposed by savings societies. He believes that community- oriented finances are not for successful businessmen like him. Matome has a financial roadmap of at least 4-5 years. He is saving a large portion of his salary to expand his family house. He is also developing a small farming business in his backyard where he plans to create additional income for himself and his family by selling chickens and fruits. Matome believes that banks are the only safe place to keep his money, although his confidence in formal institutions has been taunted by his recent experience with a fraudulent debit order. Though willing to take cautious investment risks to build and extend his family house, Matome will only use his savings to fund the extensions. He would rather do it over 2-3 years instead of completing it with a bank loan in 6 months. PERSONAS | MATOME, THE DRIVEN BUSINESSMAN

- 58. Inspired by his father to be responsible and provide, Matome’s latest expenditure is on extending the family house where his mother still lives. Matome believes the house extension is a symbol of achievement as well as an expression of gratitude. He takes great pride in using his income to bring stability to others. For him, this is the ultimate sign of responsibility. He intends to instill this belief in his children as well, urging hard work to make the future better for all.“My dad struggled a lot to get me to where I’m today. Back in those times, it was not easy. Now I’m the breadwinner, so I need to handle my responsibilities first and foremost.” FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 58 PERSONAS | MATOME, THE DRIVEN BUSINESSMAN

- 59. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 59 KEY INSURANCE NEED Greater tangibility around insurance mechanics, contributions, and payouts Matome struggles with the mechanisms of insurance payout. He has had bad experiences with informal solutions, and doesn’t trust formal solutions either due to his prior fraud experience. He defaults to cattle, considering it great insurance as it’s a liquid asset, readily convertible to cash in case any of his family members pass away. KEY PAYMENTS NEED Greater confidence and security in inter-bank money transfers Matome wishes there were an easier and cheaper option for transferring money to his ex-wife. He does not fully trust inter-bank transfers, preferring the tedious process of visiting another retail branch as he knows the payment will be confirmed. Matome considers investment in cattle as a better and more direct insurance option than buying a life or funeral insurance policy. Matome transfers money to his ex-wife by withdrawing money from one of his bank accounts and depositing it into another bank account every month. Only this second bank is available where his wife lives. Matome bought a pickup truck using a vehicle loan. He also has a credit card for emergencies. KEY CREDIT NEED Tailored loan products based on individual risk profile Matome does not like the idea of taking a loan for his house extension because of the large total amount due. He’s happy with a vehicle loan, as the risk of taking out such a loan is much lower due to the smaller total amount due. KEY SAVINGS NEED Secure wealth management mechanisms that inspire confidence Rather than keep money in a bank account, Matome is looking for better ways to grow his income. Currently, he is investing money in his house and livestock because he feels these are the safest approaches. He was once burned by a fraudulent debit order, so now approaches money-making schemes very conservatively. Matome has 3 bank accounts – one for payroll, one for his vehicle loan, and one for remittances only. PERSONAS | MATOME, THE DRIVEN BUSINESSMAN

- 60. PERSONAS | ROLPHY, THE STRUGGLING ENTREPRENEUR FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 60 PERSONA 5: Rolphy, the struggling entrepreneur 31 years old Entrepreneur Blood River, living with his family Single with 2 young kids High unemployment and little education mean that many are left with few choices but to start their own business. Struggling entrepreneurs look for financial solutions that help them sustain their often ailing business. They seek safe ways to borrow money and better ways to manage their unstable income.

- 61. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 61 “I started the tombstone business because there is no other better way to make money. It’s very hard to find a job.” Rolphy is in the fifth year of his tombstone business. Eyeing the large potential revenues involved, he decided to start the business with a group of friends. He sells tombstones mainly to customers living in his neighborhood. Sustaining the business has not been easy – the funeral business has become extremely competitive with many new players in recent years. Also, his customer base is shrinking – most of his customers are older. The younger ones are just not that interested anymore. “Payments from my customers are unstable. I feel a lot of stress running my business.” Most of Rolphy’s income comes from a monthly contribution (R30-60) of 25 customers. However, income tends to be fairly unstable as many of his customers are on social grants and there are times when his customers cannot pay. Special arrangements will be made with these customers –they are usually given up to three months to make the repayment. Rolphy keeps a record of all the income and expenses in a notebook which he hides at home. When income is received, he pays for all the expenses and banks the remaining. He has one bank account in town. His largest spend, apart from buying stones and paying for electricity, is on his 2 young kids who are staying with his mother. Rolphy sends money to them via a payment service called Money Market at Shoprite at the end of every month. He cuts costs by sharing the R60/week electricity payment with 4 other friends. “I want to borrow from banks but I don’t think they’ll lend to me.” Faced with ailing financials, Rolphy is really worried that one day he will not be able to continue his business. He believes the only way to get out of this predicament is by expanding into other funeral parlor services and obtaining new customers. He has considered borrowing from banks, but thinks banks will not lend to him due to his current financial condition. He is also worried that he will not be able to pay back. Currently he is relying on friends who are lending him money, but is not sure how long this can last. PERSONAS | ROLPHY, THE STRUGGLING ENTREPRENEUR

- 62. Television FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 62 MONTHLY PERSONAL INCOME R1,200 self-made MONTHLY EXPENSES SPENDING PATTERNS R1,200 KEY ASSETS DAILY SPEND MONTHLY SPEND PERSONAS | ROLPHY, THE STRUGGLING ENTREPRENEUR Motorola feature phone Used PC 0 7 14 21 28 Tombstone and money remittance 600# 260# 200# 80# 60# Landline & airtimeTombstone Groceries Money to kids Electricity

- 63. financial disciplinefinancial horizon trust in formal institutions risk tolerance FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 63 Trying hard not to get into a debt, Rolphy is highly disciplined in terms of his personal expenditures. However, he still struggles to manage the realities of unstable income and unexpected business-related expenditures. Despite having a strong financial horizon in mind – with plans to expand into other funeral services, Rolphy is faced with the day-to-day challenges of sustaining his business. He is constantly exploring the possibilities of expanding his business, but lacks the capability to do so. Rolphy places strong trust in banks as the safest place to keep his money. However, he does not see banks as truly helpful to lower-income customers like himself. He does not believe they can help with loans of business advice. While being open to taking up bank loans to expand his business, Rolphy is unsure banks would help him given the inconsistency of his business. He is currently relying on friends for loans instead. PERSONAS | ROLPHY, THE STRUGGLING ENTREPRENEUR

- 64. Struggling to generate a stable flow of income and keep an adequate number of customers, Rolphy’s current biggest concern is to keep his business going. He believes the only solution is to expand his business into other funeral parlor services. His biggest hope is to see his business grow and not having to worry about its financials all the time. “I want to expand into the funeral parlor business and get more customers.” FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 64 PERSONAS | ROLPHY, THE STRUGGLING ENTREPRENEUR

- 65. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 65 KEY INSURANCE NEED Greater flexibility in payment terms Running a funeral business himself, Rolphy does see the value of having an insurance policy, but doesn’t think that the formal sector understands his needs and the needs of those in similar situations. Many like himself who live on tight, irregular incomes find it difficult to make the regular payments required by the formal service providers. KEY PAYMENTS NEED Accelerated and more efficient money transfers Rolphy transfers R200 regularly to his mother and children but has to do it manually at Shoprite, which can be a tedious process at month-end. He is looking for more hassle-free, secure solutions to conduct this regular transaction. Rolphy is not contributing to any formal or informal insurance products. Rolphy uses the Money Market transfer service at Shoprite every month to transfer money to his family. Rolphy relies mostly on his friends to fund his business activities, but the amount of money lent is generally very small. KEY CREDIT NEED Access to small business loans and advice for small business growth Rolphy would like to obtain capital from banks but does not believe banks will lend to small, struggling businesses like his. He is also worried about not being to pay back. In addition to desiring access to loans for his business, Rolphy also thinks financial advice to help him expand his business could be very helpful. KEY SAVINGS NEED Better ways to stabilize erratic income Unstable payments by his customers mean that Rolphy finds it hard to keep track of his finances. There are also moments when his business requires sudden, large cash outflows (e.g., when his customer requests a tombstone). Rolphy struggles to find solutions that help him stabilize income while meeting all unexpected capital needs. Rolphy has one bank account for all personal and business needs. He tries to save the little that’s left after paying off all his expenses at month-end. PERSONAS | ROLPHY, THE STRUGGLING ENTREPRENEUR

- 66. PERSONAS | PATRICK & MEIKI, COMFORTABLE ELDERS FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 66 PERSONA 6: Patrick & Meiki, comfortable elders 62 (Patrick) and 60 (Meiki) years old Welding store owner and teacher Ga-Mothiba, living with their family Married with children With well-established business histories and accumulated wealth over the years, comfortable elders are looking for financial solutions that will help them manage their wealth and navigate through retirement.

- 67. FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 67 “I do not think of growing my business anymore due to my age.” At age 62, Patrick is looking forward to his retirement. Being a father of five and the owner of a welding workshop for more than four decades, Patrick has had a very busy life. Still running his business today, Patrick has hired 3 men to help him out. Competition has intensified lately but Patrick has no plans to retire due to age. He is happy with the R2,000-3,000 monthly profit that his business still makes for him. His wife Meiki is also making R3,000 from her teaching job. “I am most proud of the fact that my house and TV are fully paid. I am a free man.” All but one of Patrick’s children have graduated from school. Patrick is very proud that all of his sons have managed to find a decent job and are all contributing to the expenses of the family. Patrick is also proud of the fact that he has never taken out a loan. He does not like the idea of owing others. A great accomplishment of his has been raising all of his kids on his own. “My wife is the one who makes all the purchasing decisions. She knows best what the family needs.” With all his focus on the business, Meiki is the one who makes all the major purchasing decisions. She will normally visit Shoprite once or twice a month to stock up on groceries. Patrick is currently part of 2 burial societies, to which he contributes R70 each month to cover his entire family. Meiki is part of 2 food stokvels. Patrick is also the MD of the Stonebreakers football club. The society has created a stokvel with 21 members who contribute R50 monthly. Their original thought was to use the money toward rebuilding the football club, but now the goal is more about savings. Club funds are stored at a bank – he’s had to move the accounts around a few times due to changing requirements around society constitutions. PERSONAS | PATRICK & MEIKI, COMFORTABLE ELDERS

- 68. 1500$ 1000$ 300$ 250$ 50$ FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 68 MONTHLY PERSONAL INCOME R6,000 self-made Groceries Airtime Savings MONTHLY EXPENSES SPENDING PATTERNS R3,430 KEY ASSETS 0 7 14 21 28 MONTHLY SPEND Nokia feature phone Microwave Washing machine DAILY SPEND Grocery bulk purchase and farm operations Refrigerator Petrol PERSONAS | PATRICK & MEIKI, COMFORTABLE ELDERS Second-hand car Television Flatscreen TV (1 per bedroom) Plant operations Societies Electricity 200# Dogs 2570#

- 69. financial disciplinefinancial horizon trust in formal institutions risk tolerance FINMARK TRUST + FROG | THE PERSONALITIES OF THE UNDERBANKED 69 Patrick and Meiki strongly believe in the notion of community and the value community brings to financial discipline. Multiple burial societies and stokvels have helped them save for decades. At age 62, Patrick is really looking forward to his retirement. Even though he understands that his business is at risk from competition, he has no plans to alter his business model in response. While Patrick believes that banks are the safest place to keep money, he does not trust them to be acting in his best interest all the time. He is especially disappointed by some of the newer technology developments (e.g., SMS notifications instead of paper statements), which he finds hard to keep up with. Patrick and Meiki have never and would never consider taking a bank loan. They do not like the idea of owing others anything. PERSONAS | PATRICK & MEIKI, COMFORTABLE ELDERS