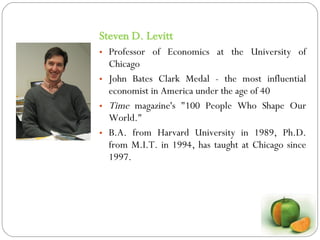

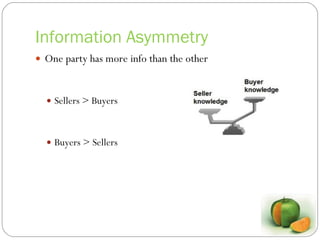

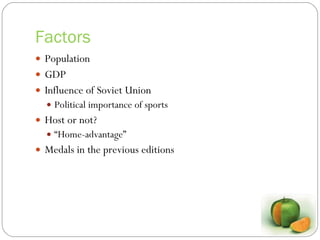

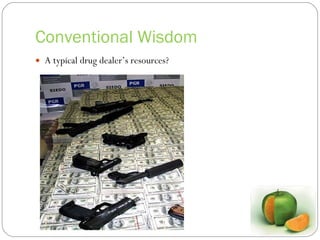

The document discusses the concepts from 'Freakonomics' by Steven D. Levitt, emphasizing the significance of incentives in economic behavior and the pitfalls of conventional wisdom. It explores topics like information asymmetry, social and moral incentives, and the dynamics of winner-take-all markets, providing various examples, including drug dealers and the impact of competition. The discussion highlights how market forces and expert narratives shape understanding and behaviors in economic contexts.