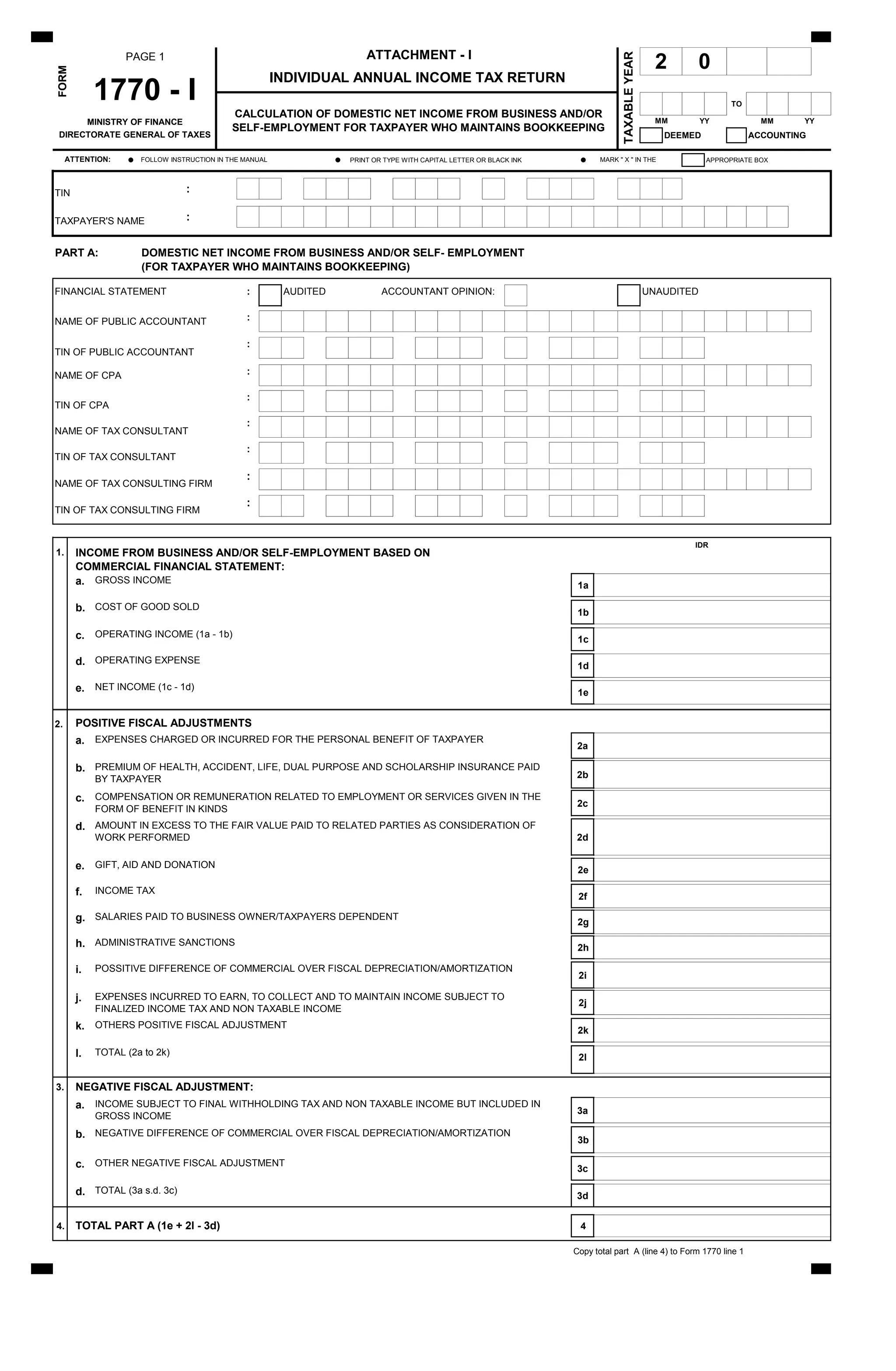

This document is a tax form for calculating domestic net income from business and self-employment for taxpayers who maintain bookkeeping records. It includes sections to provide identification information for the taxpayer and accountant. There are also sections to report gross income, expenses, adjustments to arrive at net operating income, and depreciation/amortization amounts to calculate total net income based on the commercial financial statements and tax rules. The total net income is then copied to another line on the main tax form.