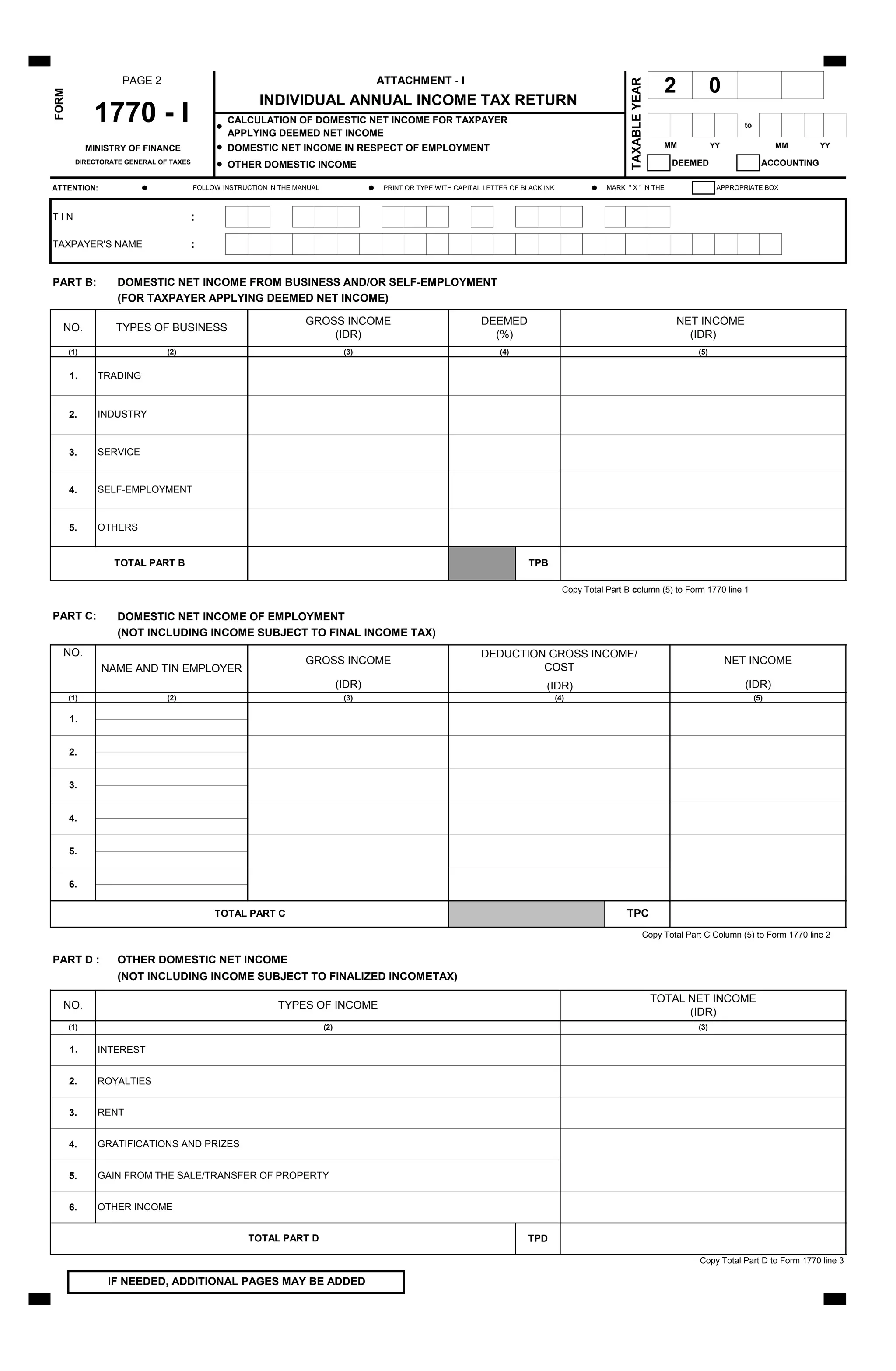

This document appears to be part of an individual annual income tax return form for a taxpayer applying deemed accounting in Indonesia.

It includes sections to report:

1. Domestic net income from business and/or self-employment using deemed percentages of gross income. This is to be copied to line 1 of Form 1770.

2. Domestic net income in respect of employment and other domestic income, with totals to be copied to lines 2 and 3 of Form 1770 respectively.

3. Other domestic net income such as rent, gratuities and prizes, gains from property sales, and royalties, with a total for this section.

The taxpayer's name, tax ID number and