Embed presentation

Download to read offline

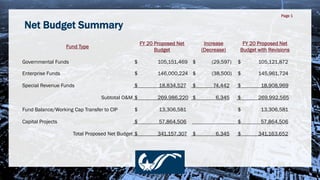

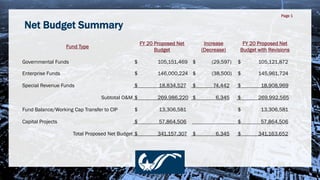

The document presents a net budget summary for fiscal year 2020 that shows proposed budgets and increases or decreases for various city funds, including governmental funds, enterprise funds, and special revenue funds. It also lists capital projects funding and notes that adopting the budget requires passing a budget ordinance and ratifying a proposed property tax rate of $0.534618 to support the budget.