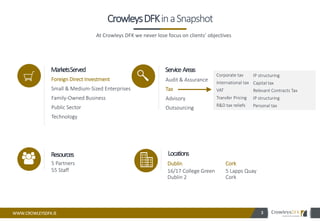

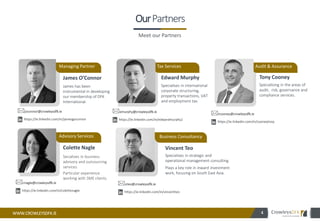

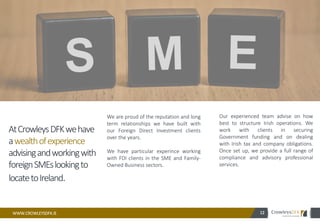

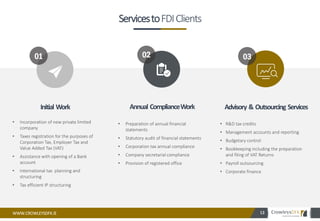

This document provides information about Crowleys DFK, an Irish accounting firm that is a member of DFK International. It summarizes Crowleys DFK's services, experience, and case studies working with foreign direct investment clients. Some key points include that Crowleys DFK assists international clients with tax planning, corporate structuring when investing in Ireland, and ongoing compliance and outsourcing services once set up. It highlights Ireland's competitive tax regime and skilled workforce as benefits for foreign investment. Case studies show the firm's work with clients from sectors like software, data centers, manufacturing, and media.