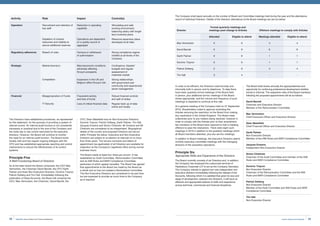

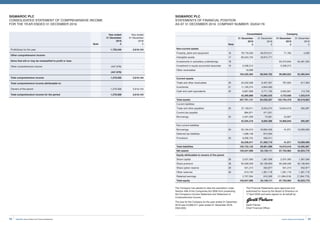

This annual report and financial statements document from SigmaRoc provides:

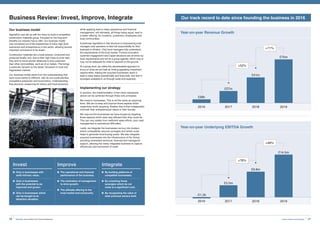

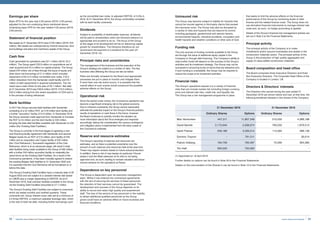

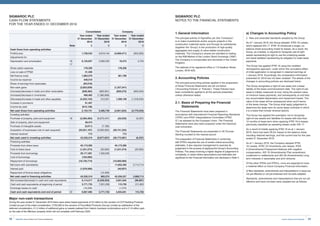

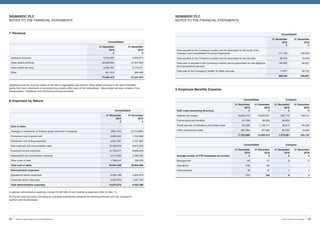

- Financial highlights for 2019 including a 70.6% increase in underlying revenue to £70.4 million and a 47.6% increase in underlying EBITDA to £14.5 million.

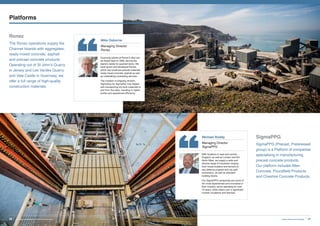

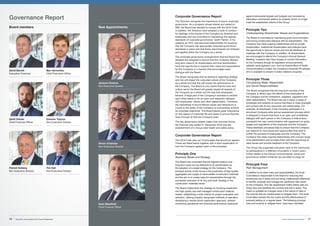

- Operational highlights including four acquisitions that doubled the size of the Group, expansion of production capacity, and rollout of a new Group-wide safety policy.

- An overview of the Chairman and CEO's messages regarding the company's strong financial and operational performance in 2019, focus on safety and governance, and outlook for future growth.