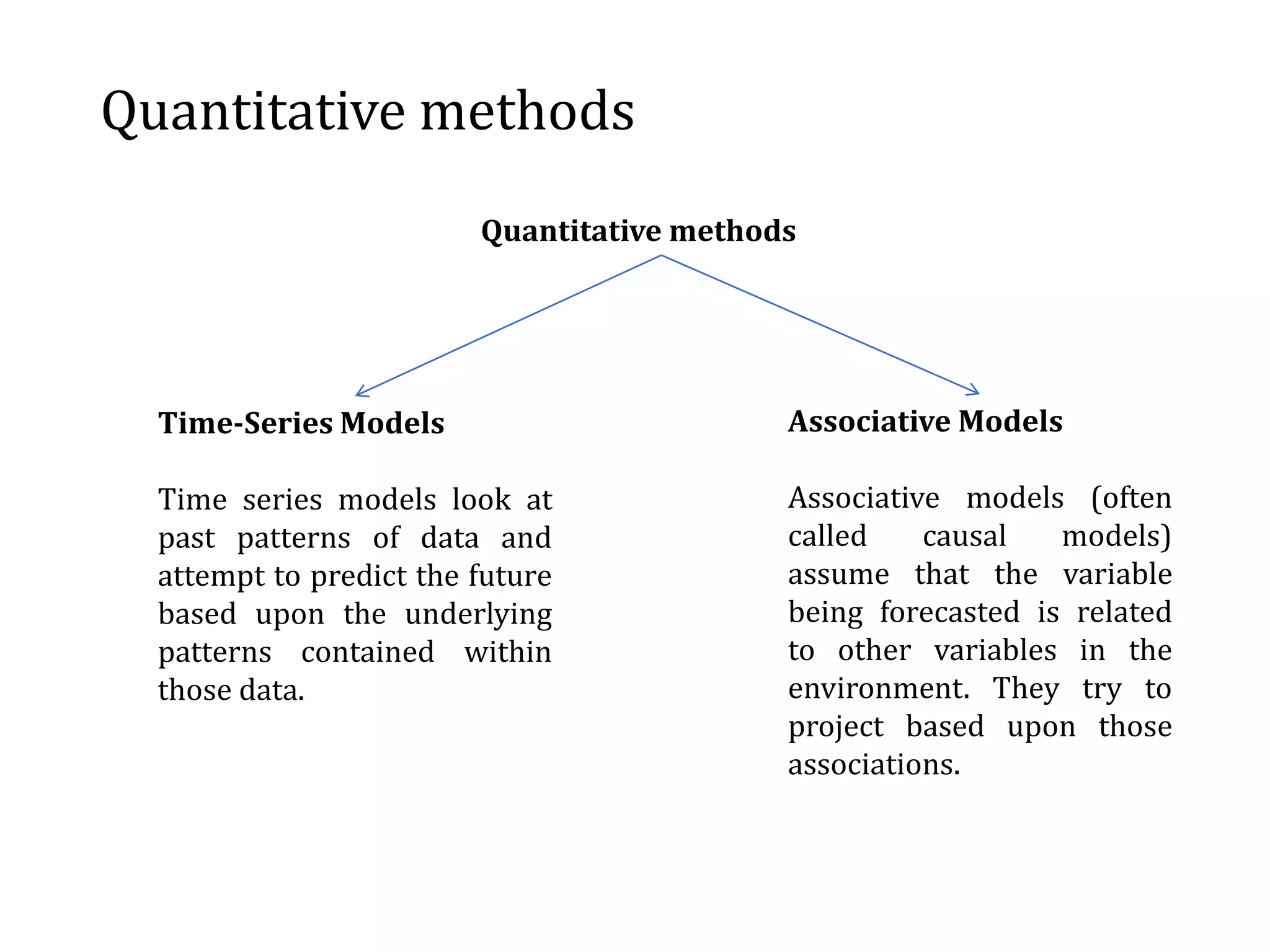

This document discusses forecasting models and techniques. It begins with an introduction to forecasting, then describes two main types of forecasting - business forecasting to predict customer demand, and macroeconomic forecasting to predict economic trends. Next, it outlines qualitative and quantitative forecasting techniques, including executive opinion, market surveys, time-series models, and associative models. It provides examples of forecasting applications in operations, marketing, finance, economics, and demography. It concludes by noting forecasts can be inaccurate when factors are unknown or data is limited.