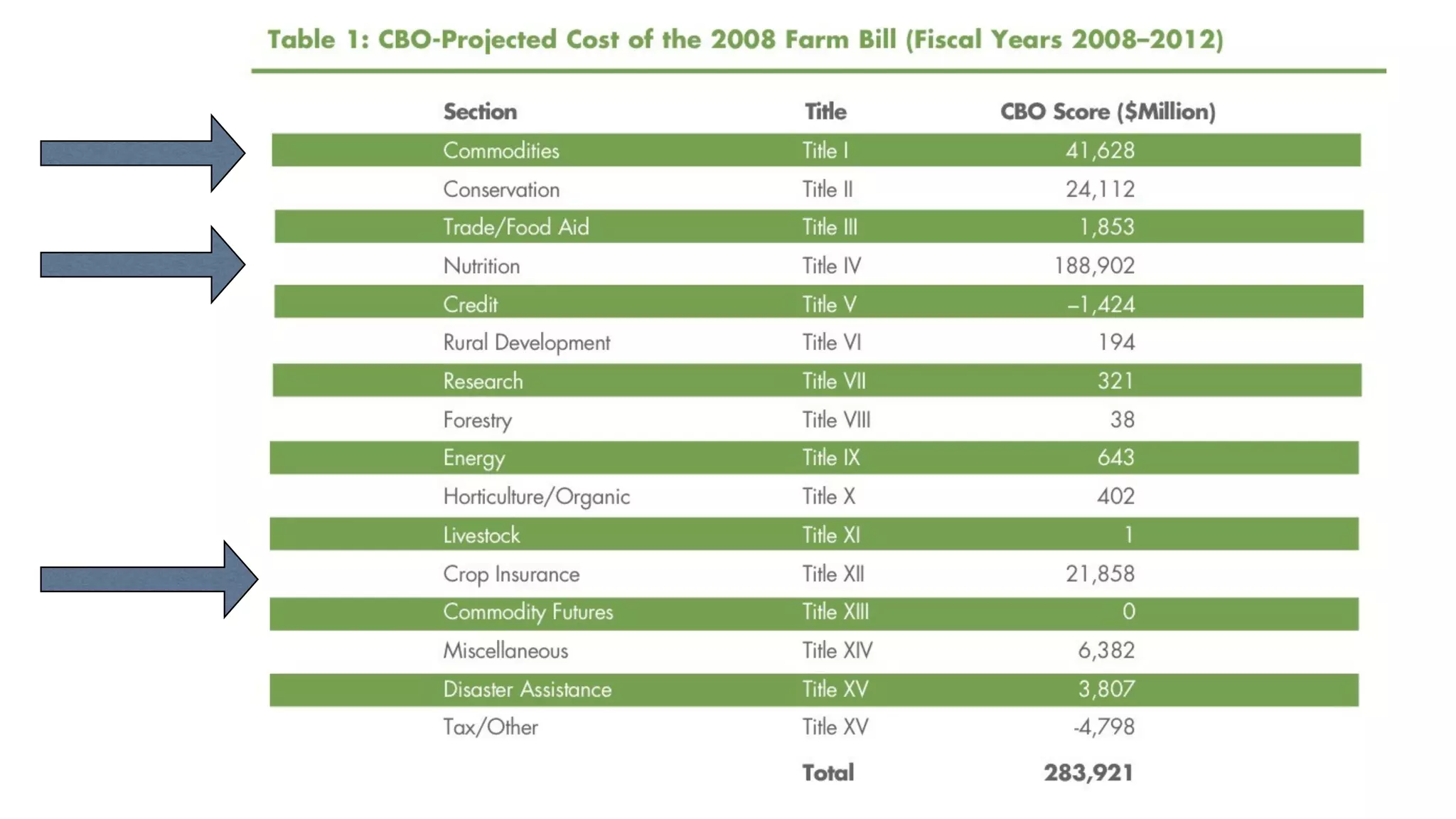

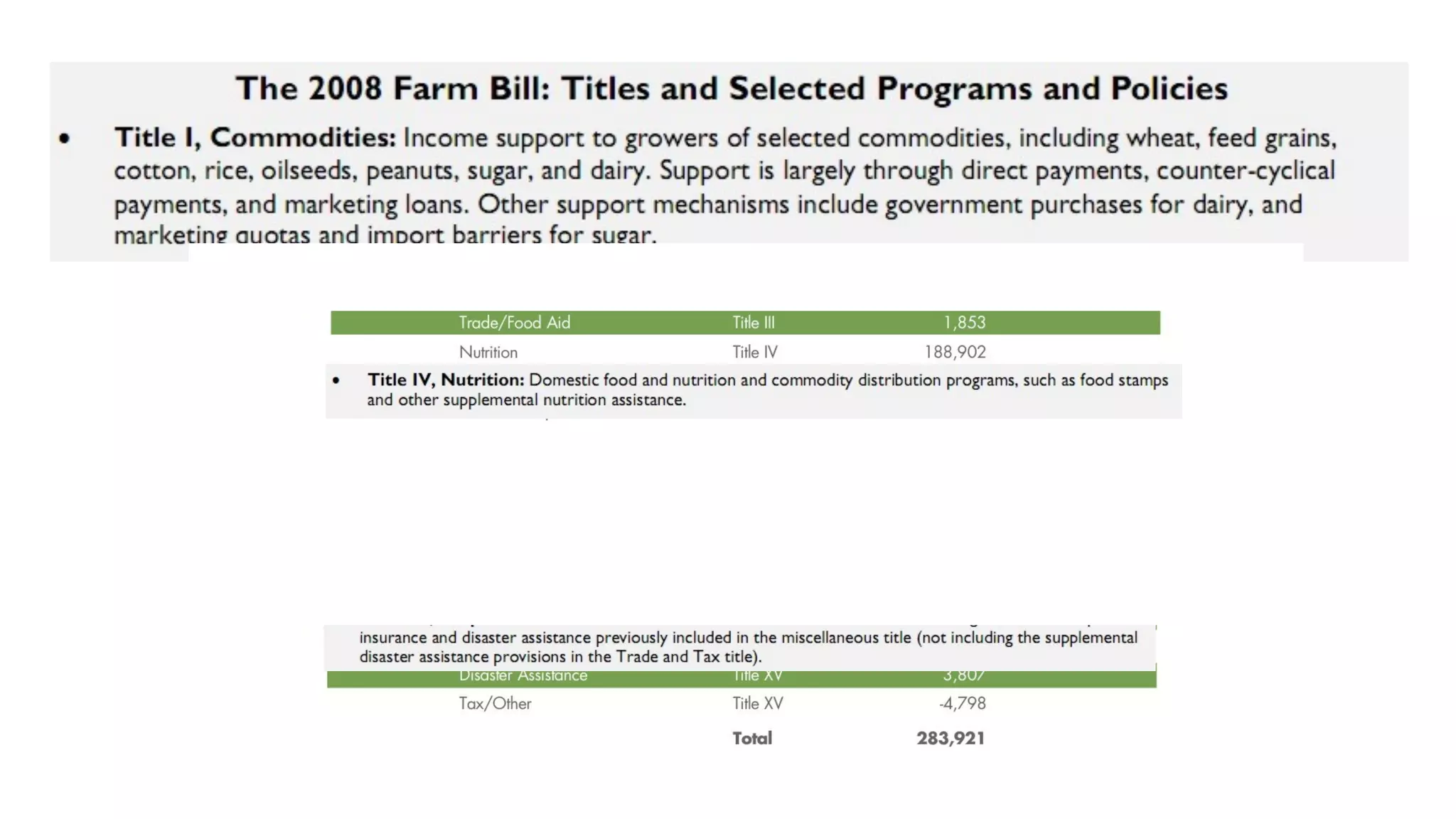

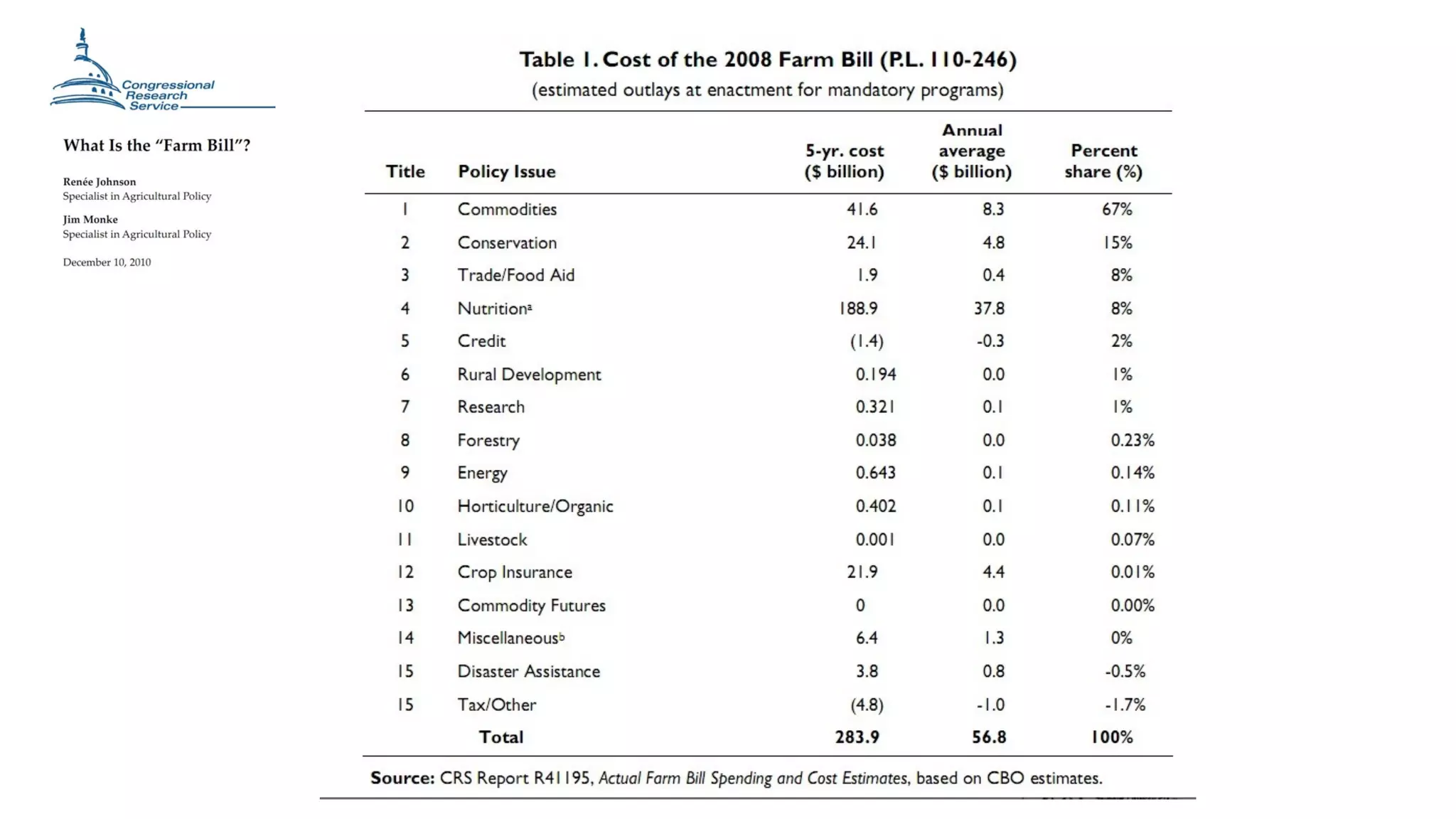

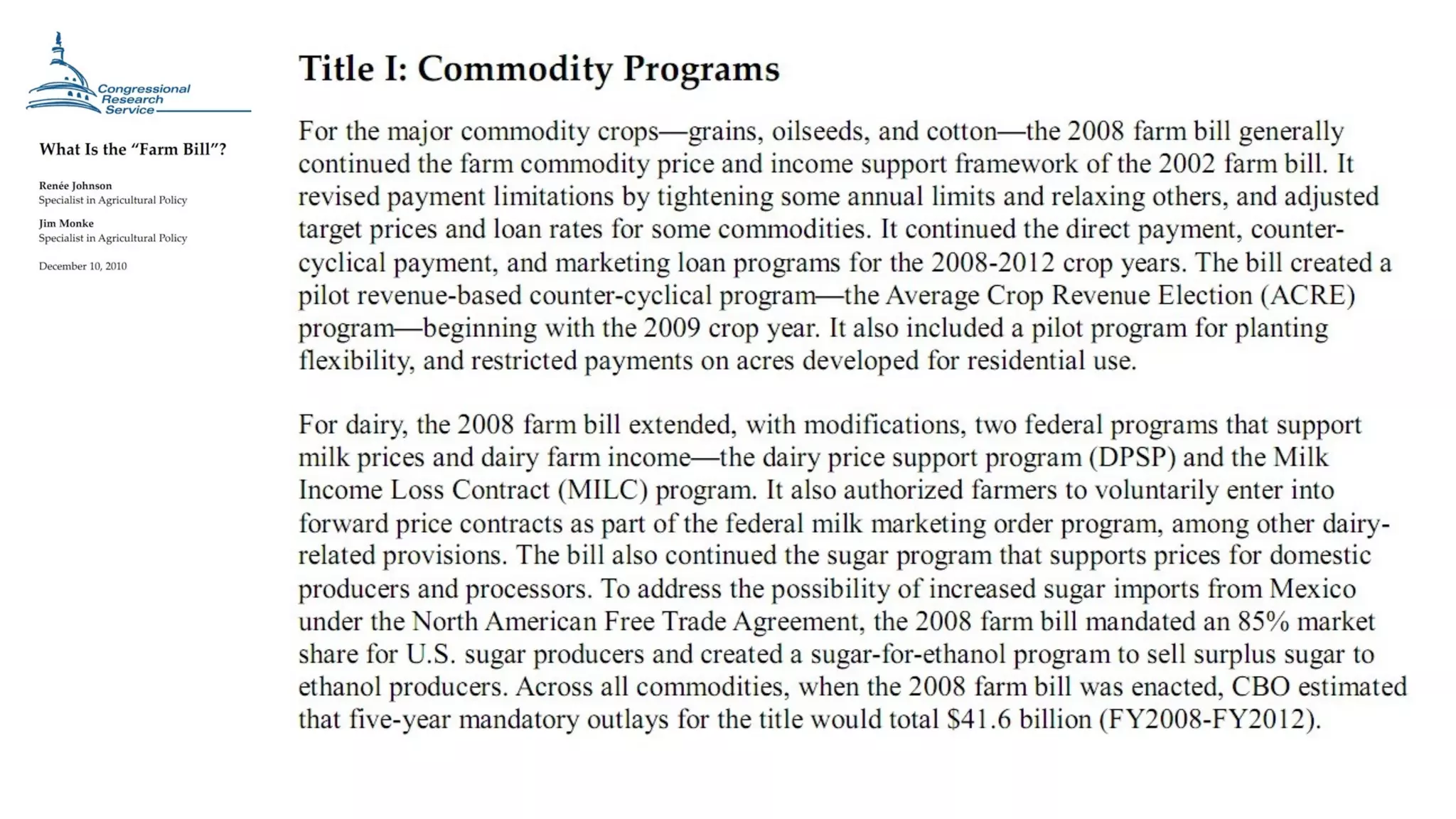

The document discusses various aspects of the 2012 U.S. Farm Bill, highlighting its focus on food and nutrition assistance programs that largely benefit low-income households, rather than solely agricultural subsidies. It debates the separation of nutrition programs from agriculture subsidies to improve policy quality and addresses concerns about the targeting of food assistance to promote healthier diets. Additionally, it covers specific details on direct payments and subsidies for commodities like dairy, alongside the functioning of crop insurance programs.

![Title IV: Crop Insurance

• The Risk Management Agency runs the USDA’s farm insurance programs.

Both “yield” and “revenue” insurance are available to farmers to protect

against adverse weather, pests, and low market prices.

• The RMA describes its mission as helping farmers “manage their business

risks through effective, market-based risk management solutions.” 11 The

RMA has annual outlays of about $4 billion, employs about 550 people, and

its activities are far from “market-based.”

• Federal crop insurance policies are sold and serviced by 16 private

insurance companies, which receive federal subsidies for their

administrative costs and insurance risks. The firms operate like a cartel,

earning excess profits from the high premiums they charge.12

• They get away with that because the government provides [subsidies]](https://image.slidesharecdn.com/fixing2112farmb-111114105317-phpapp01/75/Fixing-the-Farm-Bill-40-2048.jpg)