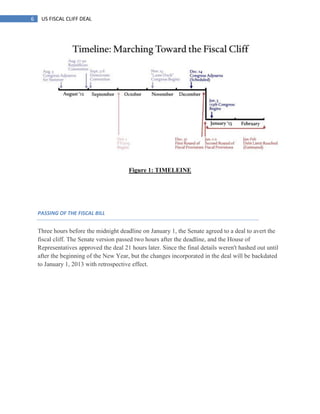

The document discusses the U.S. fiscal cliff that arose at the end of 2012, outlining the implications of tax breaks expiration and spending cuts, and the response from the government through the American Taxpayer Relief Act of 2012. It analyzes the socio-economic impacts of the fiscal deal on various sectors of the economy and debates the effectiveness of the strategies adopted to manage the national debt. The research highlights both benefits and drawbacks of the government's decisions, emphasizing the need for a balance between tax revenue and sustained economic growth.

![1 US FISCAL CLIFF DEAL

US FISCAL CLIFF DEAL:

A SOLUTION OR A PROBLEM

RACHITA BHATTACHARYA [ECONOMICS (H) 3rd

Yr.]

NAMAN RASTOGI [B.COM (H) 2nd

Yr.]

SHRI RAM COLLEGE OF COMMERCE](https://image.slidesharecdn.com/usfiscacliffresearch-171028211914/75/US-Fiscal-Cliff-Deal-2012-1-2048.jpg)