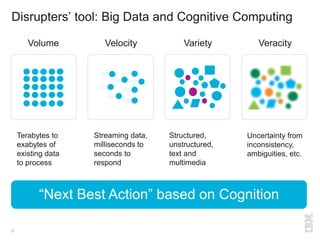

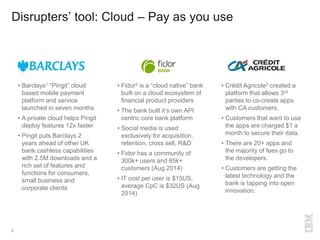

The document discusses the disruption in traditional banking due to the rise of digital banking and innovative technologies like big data and cloud computing. It highlights examples of banks such as Fidor and Barclays that are leveraging cloud services and community engagement to innovate and maintain competitiveness. Emphasizing the urgency for incumbents to adapt, it warns that failure to embrace these changes can lead to obsolescence.