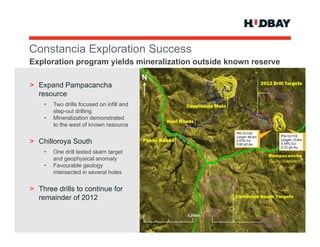

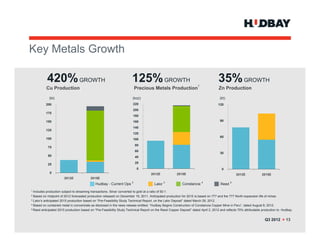

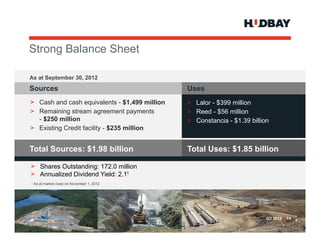

Hudbay Minerals Inc. held a Q3 2012 conference call to discuss its strategy of creating sustainable value through high quality, long-life mining deposits. The presentation discussed forward-looking production forecasts for its Constancia, Lalor and Reed projects and estimated capital costs. It also noted key assumptions around commodity prices, energy costs, permitting, and community relations that could impact projected results. Risk factors that could cause actual results to differ from projections included economic, operational, regulatory and community relationship challenges facing the mining industry.