Finc 355Discussion QuestionPlease choose one aspect of this .docx

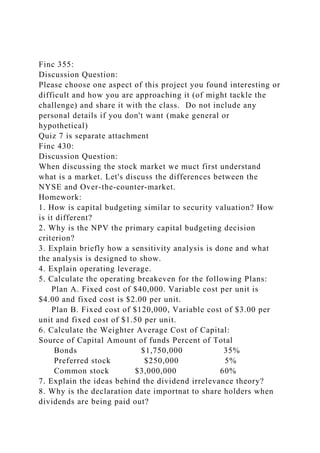

- 1. Finc 355: Discussion Question: Please choose one aspect of this project you found interesting or difficult and how you are approaching it (of might tackle the challenge) and share it with the class. Do not include any personal details if you don't want (make general or hypothetical) Quiz 7 is separate attachment Finc 430: Discussion Question: When discussing the stock market we muct first understand what is a market. Let's discuss the differences between the NYSE and Over-the-counter-market. Homework: 1. How is capital budgeting similar to security valuation? How is it different? 2. Why is the NPV the primary capital budgeting decision criterion? 3. Explain briefly how a sensitivity analysis is done and what the analysis is designed to show. 4. Explain operating leverage. 5. Calculate the operating breakeven for the following Plans: Plan A. Fixed cost of $40,000. Variable cost per unit is $4.00 and fixed cost is $2.00 per unit. Plan B. Fixed cost of $120,000, Variable cost of $3.00 per unit and fixed cost of $1.50 per unit. 6. Calculate the Weighter Average Cost of Capital: Source of Capital Amount of funds Percent of Total Bonds $1,750,000 35% Preferred stock $250,000 5% Common stock $3,000,000 60% 7. Explain the ideas behind the dividend irrelevance theory? 8. Why is the declaration date importnat to share holders when dividends are being paid out?

- 2. 9. How can a company reward shareholders, when the capital appreciation is non-existence? 10. What are the two ways shareholders benefit from owning stocks? FINC355 Professor Goohs – Retirement and Estate Planning Quiz 7 NAME ____________________________ Due Date: July 20, 2014 (in assignment folder) Please provide name above and provide answers in the chart below and submitting homework in MS Word in assignment folder for Quiz 7. (I’ll deduct points if you don’t). Problem Answer Example A 1 21 2 22 3 23

- 4. 13 33 14 34 15 35 16 36 17 37 18 38 19 39 20 40 1. In the absence of any additional agreement, when is the employee usually taxed on stock options that have no readily

- 5. ascertainable fair market value? A. when the option is issued B. when the option is exercised C. when the underlying stock reaches a target price D. when the underlying stock splits 2. If a stock option has no readily ascertainable fair market value at the time it is transferred to an executive, there is no taxable income to the executive at the date of the grant. A. True B. False 3. Executive Topdollar was given an option in 2011 to purchase 1,000 shares of Good Company stock at $200 per share, the 2011 market price. Topdollar can exercise the option anytime over the next 3 years. In 2013, Topdollar purchases 300 shares for a total of $60,000. The fair market value of the shares in 2013 is $100,000. Which of the following best describes the tax consequences of Topdollar’s stock option? A. Good Company gets a tax deduction of $40,000 B. Topdollar must pay ordinary income tax on $40,000 C. Topdollar must pay ordinary income tax on $60,000 D. A and B E. A and C 4. What benefit is gained by offering an ISO? (1) there may be AMT when an ISO is exercised (2) the ISO provides greater tax deferral than a nonstatutory option (3) income from sale of stock received at exercise may be eligible for preferential capital gain treatment (4) the company has little or no out-of-pocket cost with an ISO A. (1) only B. (1) and (2) only

- 6. C. (1) (2) and (3) only D. (2) (3) and (4) only 5. The incentive stock option (ISO) provides greater deferral of taxes to the executive than a nonstatutory stock option. A. True B. False 6. Only the first $_____ worth of ISO stock granted any one employee is entitled to favorable tax treatment. A. 10,000 B. 25,000 C. 50,000 D. 75,000 E. 100,000 7. An employee stock purchase plan generates little to no out- of-pocket cost to the company. A. True B. False 8. Hugh Green’s employer, Jolly Foods, granted Hugh a stock option under its employee stock purchase plan to buy 200 shares of Jolly Foods stock for $10 per share when the market price was $13 per share. A year and a half later, when the stock had a value of $15 per share, Hugh exercised his option. Fourteen months later, when the stock was $17 per share, Hugh sold his stock. In the year of sale, Hugh had to report _____ as wages and _____ as capital gains. A. $600, $800 B. $600, $1400

- 7. C. $1,000, $400 D. $300, $1,100 E. $1,100, $400 9. At what point does an employer normally receive a tax deduction for a restricted stock plan? A. the year in which the property becomes substantially vested B. two years following a Section 83(b) election C. when the employee purchases stock under the plan D. when the employee sells stock purchased under the plan 10. Employers can use a restricted stock plan to reduce the chance that a savvy executive would learn trade secrets and then go to work for a competitor. A. True B. False 11. Hank Zetter is an executive at Marco Fashions. Marco Fashions has given Hank a restricted stock plan that states if he fails to achieve $500,000 in sales each quarter for the next 10 years, he forfeits his claim on the stock in the plan. The IRS would view this provision as a substantial risk of forfeiture. a. True b. False 12. Cafeteria plans must include a cash option. A. True B. False 13. Because of administrative costs and complexity, cafeteria plans generally are used by larger employers.

- 8. A. True B. False 14. A flexible spending account is a type of cafeteria plan funded with salary reductions that an employee elects annually. A. True B. False 15. A flexible spending account can be used to pay health insurance premiums. A. True B. False 16. Erin Lauder elected in December of last year to have $300 a month redirected from her salary to her flexible spending account with her employer. In January of this year, Erin was in a car accident. Her medical expenses that were covered by her FSA plan amounted to $900, but she had deposited only $300 into her FSA so far this year. A. Erin can only get $300 reimbursement from her FSA in January B. Erin can get $900 from her FSA, but $600 will be taxed as ordinary income C. Erin can get $900, but she must be willing to accept $300 per month for 3 months D. Erin can get $900, but her employer is at risk of loss if Erin leaves the corporation before she has deposited an amount equivalent to her withdrawal E. Erin can get $900, but she must wait until the beginning of April when she has $900 deposited into her account 17. Bill Martin had $5,000 in his flexible spending account this year to cover dental, medical, and dependent care expenses.

- 9. During this year, his qualified expenses under the plan were $1,000 in dental expenses, $1,500 in medical expenses, and $2,000 in dependent care expenses. He anticipates $500 in dental, $2,000 in medical and $3,000 in dependent care expenses for next year. A. Bill can roll his unused dollars to the next plan year B. Bill forfeits $500 C. Bill’s dental and medical expenses are paid in full, but only part of the dependent care expenses are covered since $2,000 exceeds one-third of his contribution for the three types of expenses D. If Bill has an emergency related to a covered expense over $500, he can contribute more to his plan before the close of the plan year to cover the additional expenses E. Bill can withdraw unspent funds at year-end, add them to his ordinary income, and pay taxes accordingly 18. Group-term life insurance must cover all employees. A. True B. False 19. The death benefit from group-term life insurance is not tax- free to the beneficiary. A. True B. False 20. Benefits paid to the employee’s beneficiary under a DBO plan are taxable in full to the beneficiary as ordinary income. A. True B. False 21. Which of the following mistakes may cause an employer death benefit to be included in the employee’s estate?

- 10. A. the employee has no right to change the beneficiary B. the employee is a controlling (more than 50% shareholder) individual C. the death benefit is not tied to the employee’s promise to continue working for the employer D. the beneficiary is not a revocable trust established by the employee 22. Angus Deter, age 60, had a 60% interest in Amalgamated Manufacturing before his death this year. Corporate-owned key employee life insurance on Angus named Trisha, his 35-year- old wife, as the beneficiary of the $500,000 policy. Angus believed Trisha would share the proceeds with the corporation to ease any transition costs. Distribution of this life insurance policy A. can be accessed by the corporation B. can be accessed by Amalgamated’s creditors C. will be taxed as part of Angus’s estate as life insurance D. all of the above E. only a and b 23. Which of the following is (are) true regarding the alternative minimum tax (AMT)? A. corporations must pay the larger of regular tax or AMT B. AMT has favorable provisions for corporate-owned life insurance C. death proceeds to employer may be taxed under AMT D. A and C E. A and B 1