The document outlines a financial statements project for ACG203, requiring students to analyze their chosen company's annual report and financials collaboratively. Key tasks include referencing specific sections in the report, calculating financial ratios, analyzing liquidity and profitability, and submitting a collective report and peer evaluations. Deadlines and presentation quality are also emphasized, alongside strict guidelines for teamwork and documentation.

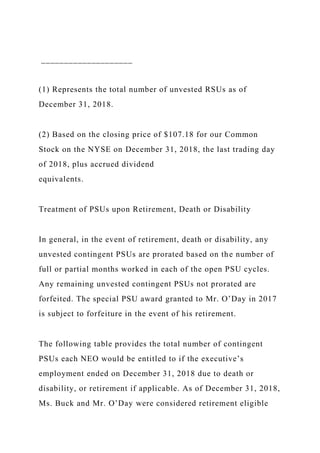

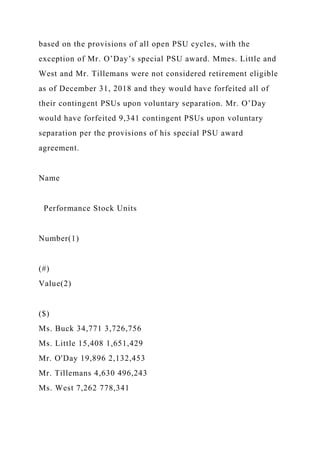

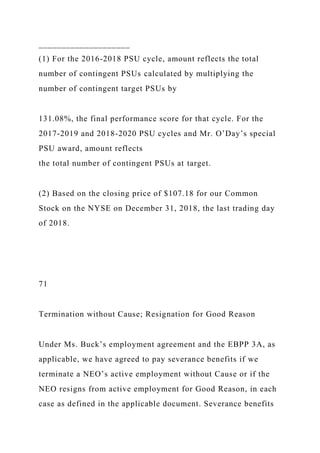

![· Did the writer go above and beyond in answering the

questions? Did the writer make connections between answers of

various questions?

· Is each chart presented on the same page and NOT split

between pages.

· Fatal Flaws - Your grade will be penalized for fatal flaws –

grammar, punctuation, awkward wording, word choice errors,

fragments, etc.

6/19/2019 Environmental Science: Active Learning Laboratories

and Applied Problem Sets - Pages 175 - 180

https://phoenix.vitalsource.com/#/books/9781119033172/cfi/6/7

8!/4/6/30/6/4/2/2/[email protected]:100 1/6

PRINTED BY: [email protected] Printing is for personal,

private use only. No part of this book may be

reproduced or transmitted without publisher's prior permission.

Violators will be prosecuted.

6/19/2019 Environmental Science: Active Learning Laboratories

and Applied Problem Sets - Pages 175 - 180

https://phoenix.vitalsource.com/#/books/9781119033172/cfi/6/7

8!/4/6/30/6/4/2/2/[email protected]:100 2/6

PRINTED BY: [email protected] Printing is for personal,

private use only. No part of this book may be

reproduced or transmitted without publisher's prior permission.

Violators will be prosecuted.](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-7-320.jpg)

![6/19/2019 Environmental Science: Active Learning Laboratories

and Applied Problem Sets - Pages 175 - 180

https://phoenix.vitalsource.com/#/books/9781119033172/cfi/6/7

8!/4/6/30/6/4/2/2/[email protected]:100 3/6

PRINTED BY: [email protected] Printing is for personal,

private use only. No part of this book may be

reproduced or transmitted without publisher's prior permission.

Violators will be prosecuted.

6/19/2019 Environmental Science: Active Learning Laboratories

and Applied Problem Sets - Pages 175 - 180

https://phoenix.vitalsource.com/#/books/9781119033172/cfi/6/7

8!/4/6/30/6/4/2/2/[email protected]:100 4/6

PRINTED BY: [email protected] Printing is for personal,

private use only. No part of this book may be

reproduced or transmitted without publisher's prior permission.

Violators will be prosecuted.

6/19/2019 Environmental Science: Active Learning Laboratories

and Applied Problem Sets - Pages 175 - 180

https://phoenix.vitalsource.com/#/books/9781119033172/cfi/6/7

8!/4/6/30/6/4/2/2/[email protected]:100 5/6

PRINTED BY: [email protected] Printing is for personal,

private use only. No part of this book may be

reproduced or transmitted without publisher's prior permission.](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-8-320.jpg)

![Violators will be prosecuted.

6/19/2019 Environmental Science: Active Learning Laboratories

and Applied Problem Sets - Pages 175 - 180

https://phoenix.vitalsource.com/#/books/9781119033172/cfi/6/7

8!/4/6/30/6/4/2/2/[email protected]:100 6/6

PRINTED BY: [email protected] Printing is for personal,

private use only. No part of this book may be

reproduced or transmitted without publisher's prior permission.

Violators will be prosecuted.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

For the fiscal year ended December 31, 2017

OR

Transition Report Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

For the transition period from to

Commission File Number 1-183](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-9-320.jpg)

![/UsePrologue false

/ColorSettingsFile ()

/AlwaysEmbed [ true

]

/NeverEmbed [ true

]

/AntiAliasColorImages false

/CropColorImages true

/ColorImageMinResolution 300

/ColorImageMinResolutionPolicy /OK

/DownsampleColorImages true

/ColorImageDownsampleType /Bicubic

/ColorImageResolution 100

/ColorImageDepth -1

/ColorImageMinDownsampleDepth 1

/ColorImageDownsampleThreshold 1.00000

/EncodeColorImages true

/ColorImageFilter /DCTEncode

/AutoFilterColorImages false

/ColorImageAutoFilterStrategy /JPEG

/ColorACSImageDict <<

/QFactor 0.15

/HSamples [1 1 1 1] /VSamples [1 1 1 1]

>>

/ColorImageDict <<

/QFactor 0.15

/HSamples [1 1 1 1] /VSamples [1 1 1 1]

>>

/JPEG2000ColorACSImageDict <<

/TileWidth 256

/TileHeight 256

/Quality 30

>>

/JPEG2000ColorImageDict <<

/TileWidth 256

/TileHeight 256](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-314-320.jpg)

![/Quality 30

>>

/AntiAliasGrayImages false

/CropGrayImages true

/GrayImageMinResolution 300

/GrayImageMinResolutionPolicy /OK

/DownsampleGrayImages true

/GrayImageDownsampleType /Bicubic

/GrayImageResolution 100

/GrayImageDepth -1

/GrayImageMinDownsampleDepth 2

/GrayImageDownsampleThreshold 1.00000

/EncodeGrayImages true

/GrayImageFilter /DCTEncode

/AutoFilterGrayImages false

/GrayImageAutoFilterStrategy /JPEG

/GrayACSImageDict <<

/QFactor 0.15

/HSamples [1 1 1 1] /VSamples [1 1 1 1]

>>

/GrayImageDict <<

/QFactor 0.15

/HSamples [1 1 1 1] /VSamples [1 1 1 1]

>>

/JPEG2000GrayACSImageDict <<

/TileWidth 256

/TileHeight 256

/Quality 30

>>

/JPEG2000GrayImageDict <<

/TileWidth 256

/TileHeight 256

/Quality 30

>>

/AntiAliasMonoImages false

/CropMonoImages true](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-315-320.jpg)

![/MonoImageMinResolution 1200

/MonoImageMinResolutionPolicy /OK

/DownsampleMonoImages true

/MonoImageDownsampleType /Bicubic

/MonoImageResolution 150

/MonoImageDepth -1

/MonoImageDownsampleThreshold 2.00000

/EncodeMonoImages true

/MonoImageFilter /CCITTFaxEncode

/MonoImageDict <<

/K -1

>>

/AllowPSXObjects false

/CheckCompliance [

/None

]

/PDFX1aCheck false

/PDFX3Check false

/PDFXCompliantPDFOnly false

/PDFXNoTrimBoxError true

/PDFXTrimBoxToMediaBoxOffset [

0.00000

0.00000

0.00000

0.00000

]

/PDFXSetBleedBoxToMediaBox true

/PDFXBleedBoxToTrimBoxOffset [

0.00000

0.00000

0.00000

0.00000

]

/PDFXOutputIntentProfile (None)

/PDFXOutputConditionIdentifier ()

/PDFXOutputCondition ()](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-316-320.jpg)

![061007400610020004100630072006f0062006100740069006c00

6c00610020006a0061002000410064006f0062006500200052006

5006100640065007200200035002e0030003a006c006c00610020

006a006100200075007500640065006d006d0069006c006c00610

02e>

/SVE

<FEFF0041006e007600e4006e00640020006400650020006800e

4007200200069006e0073007400e4006c006c006e0069006e0067

00610072006e00610020006f006d0020006400750020007600690

06c006c00200073006b006100700061002000410064006f006200

650020005000440046002d0064006f006b0075006d0065006e007

400200073006f006d002000e400720020006c00e4006d0070006c

0069006700610020006600f600720020007000720065007000720

06500730073002d007500740073006b0072006900660074002000

6d006500640020006800f600670020006b00760061006c0069007

400650074002e002000200053006b006100700061006400650020

005000440046002d0064006f006b0075006d0065006e007400200

06b0061006e002000f600700070006e0061007300200069002000

4100630072006f0062006100740020006f0063006800200041006

4006f00620065002000520065006100640065007200200035002e

00300020006f00630068002000730065006e006100720065002e>

/ENU (RRD Low Resolution (Letter Page Size))

>>

/Namespace [

(Adobe)

(Common)

(1.0)

]

/OtherNamespaces [

<<

/AsReaderSpreads false

/CropImagesToFrames true

/ErrorControl /WarnAndContinue

/FlattenerIgnoreSpreadOverrides false

/IncludeGuidesGrids false

/IncludeNonPrinting false](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-322-320.jpg)

![/IncludeSlug false

/Namespace [

(Adobe)

(InDesign)

(4.0)

]

/OmitPlacedBitmaps false

/OmitPlacedEPS false

/OmitPlacedPDF false

/SimulateOverprint /Legacy

>>

<<

/AddBleedMarks false

/AddColorBars false

/AddCropMarks false

/AddPageInfo false

/AddRegMarks false

/ConvertColors /ConvertToCMYK

/DestinationProfileName ()

/DestinationProfileSelector /DocumentCMYK

/Downsample16BitImages true

/FlattenerPreset <<

/PresetSelector /MediumResolution

>>

/FormElements false

/GenerateStructure false

/IncludeBookmarks false

/IncludeHyperlinks false

/IncludeInteractive false

/IncludeLayers false

/IncludeProfiles false

/MultimediaHandling /UseObjectSettings

/Namespace [

(Adobe)

(CreativeSuite)

(2.0)](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-323-320.jpg)

![]

/PDFXOutputIntentProfileSelector /DocumentCMYK

/PreserveEditing true

/UntaggedCMYKHandling /LeaveUntagged

/UntaggedRGBHandling /UseDocumentProfile

/UseDocumentBleed false

>>

]

>> setdistillerparams

<<

/HWResolution [2400 2400]

/PageSize [612.000 792.000]

>> setpagedevice

NOTICE OF 201 ANNUAL MEETING

AND PROXY STATEMENT

201 ANNUAL REPORT

TO STOCKHOLDERS

May 2 , 201

10:00 a.m., Eastern Daylight Time

GIANT Center

550 West Hersheypark Drive

Hershey, Pennsylvania

Michele Buck](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-324-320.jpg)

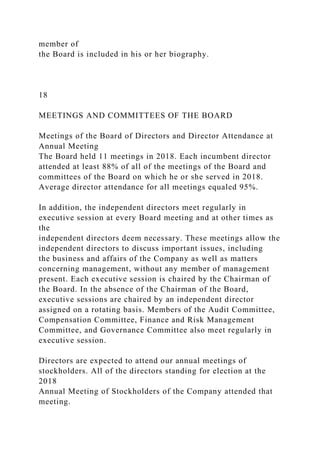

![responsibilities, access to management and outside advisors,

compensation, continuing education, oversight of management

succession and stockholding requirements. They also provide a

process for directors to annually evaluate the performance of

the Board.

The Governance Committee is responsible for overseeing and

reviewing the Board’s Corporate Governance Guidelines at least

annually and recommending any proposed changes to the Board

for approval. The Corporate Governance Guidelines are

available on the Investors section of our website at

www.thehersheycompany.com.

Code of Conduct

The Board has adopted a Code of Conduct that applies to all of

our directors, officers and employees worldwide. Adherence to

this Code of Conduct assures that our directors, officers and

employees are held to the highest standards of integrity. The

Code

of Conduct covers areas such as conflicts of interest, insider

trading and compliance with laws and regulations. The Audit

Committee oversees the Company’s communication of, and

compliance with, the Code of Conduct. The Code of Conduct,

including amendments thereto or waivers granted to a director

or officer, if any, can be viewed on the Investors section of our

website at www.thehersheycompany.com.

Stockholder and Interested Party Communications with

Directors

Stockholders and other interested parties may communicate with

our directors in several ways. Communications regarding

accounting, internal accounting controls or auditing matters

may be emailed to the Audit Committee at

[email protected] or addressed to the Audit Committee at the

following address:](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-365-320.jpg)

![Audit Committee

c/o Secretary

The Hershey Company

19 East Chocolate Avenue

P.O. Box 819

Hershey, PA 17033-0819

Stockholders and other interested parties also can submit

comments, confidentially and anonymously if desired, to the

Audit

Committee by calling the Hershey Concern Line at (800) 362-

8321 or by accessing the Hershey Concern Line website at

www.HersheysConcern.com.

13

Stockholders and other interested parties may contact any of the

independent directors, including the Chairman of the Board, as

well as the independent directors as a group, by writing to the

specified party at the address set forth above or by emailing the

independent directors (or a specific independent director,

including the Chairman of the Board) at

[email protected] Stockholders and other interested parties may

also contact any of the independent

directors using the Hershey Concern Line telephone number or

website noted above.

Communications to the Audit Committee, any of the

independent directors and the Hershey Concern Line are

processed by the

Office of General Counsel. The Office of General Counsel

reviews and summarizes these communications and provides

reports

to the applicable party on a periodic basis. Communications](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-366-320.jpg)

![/TransferFunctionInfo /Preserve

/UCRandBGInfo /Preserve

/UsePrologue false

/ColorSettingsFile ()

/AlwaysEmbed [ true

]

/NeverEmbed [ true

]

/AntiAliasColorImages false

/CropColorImages true

/ColorImageMinResolution 300

/ColorImageMinResolutionPolicy /OK

/DownsampleColorImages true

/ColorImageDownsampleType /Bicubic

/ColorImageResolution 100

/ColorImageDepth -1

/ColorImageMinDownsampleDepth 1

/ColorImageDownsampleThreshold 1.00000

/EncodeColorImages true

/ColorImageFilter /DCTEncode

/AutoFilterColorImages false

/ColorImageAutoFilterStrategy /JPEG

/ColorACSImageDict <<

/QFactor 0.15

/HSamples [1 1 1 1] /VSamples [1 1 1 1]](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-1162-320.jpg)

![>>

/ColorImageDict <<

/QFactor 0.15

/HSamples [1 1 1 1] /VSamples [1 1 1 1]

>>

/JPEG2000ColorACSImageDict <<

/TileWidth 256

/TileHeight 256

/Quality 30

>>

/JPEG2000ColorImageDict <<

/TileWidth 256

/TileHeight 256

/Quality 30

>>

/AntiAliasGrayImages false

/CropGrayImages true

/GrayImageMinResolution 300

/GrayImageMinResolutionPolicy /OK

/DownsampleGrayImages true

/GrayImageDownsampleType /Bicubic

/GrayImageResolution 100

/GrayImageDepth -1

/GrayImageMinDownsampleDepth 2

/GrayImageDownsampleThreshold 1.00000](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-1163-320.jpg)

![/EncodeGrayImages true

/GrayImageFilter /DCTEncode

/AutoFilterGrayImages false

/GrayImageAutoFilterStrategy /JPEG

/GrayACSImageDict <<

/QFactor 0.15

/HSamples [1 1 1 1] /VSamples [1 1 1 1]

>>

/GrayImageDict <<

/QFactor 0.15

/HSamples [1 1 1 1] /VSamples [1 1 1 1]

>>

/JPEG2000GrayACSImageDict <<

/TileWidth 256

/TileHeight 256

/Quality 30

>>

/JPEG2000GrayImageDict <<

/TileWidth 256

/TileHeight 256

/Quality 30

>>

/AntiAliasMonoImages false

/CropMonoImages true

/MonoImageMinResolution 1200](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-1164-320.jpg)

![/MonoImageMinResolutionPolicy /OK

/DownsampleMonoImages true

/MonoImageDownsampleType /Bicubic

/MonoImageResolution 150

/MonoImageDepth -1

/MonoImageDownsampleThreshold 2.00000

/EncodeMonoImages true

/MonoImageFilter /CCITTFaxEncode

/MonoImageDict <<

/K -1

>>

/AllowPSXObjects false

/CheckCompliance [

/None

]

/PDFX1aCheck false

/PDFX3Check false

/PDFXCompliantPDFOnly false

/PDFXNoTrimBoxError true

/PDFXTrimBoxToMediaBoxOffset [

0.00000

0.00000

0.00000

0.00000

]](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-1165-320.jpg)

![/PDFXSetBleedBoxToMediaBox true

/PDFXBleedBoxToTrimBoxOffset [

0.00000

0.00000

0.00000

0.00000

]

/PDFXOutputIntentProfile (None)

/PDFXOutputConditionIdentifier ()

/PDFXOutputCondition ()

/PDFXRegistryName ()

/PDFXTrapped /False

/CreateJDFFile false

/Description <<

/CHS

<FEFF4f7f75288fd94e9b8bbe5b9a521b5efa76840020004100640

06f006200650020005000440046002065876863900275284e8e9a

d88d2891cf76845370524d53705237300260a853ef4ee54f7f7528

0020004100630072006f0062006100740020548c0020004100640

06f00620065002000520065006100640065007200200035002e00

3000204ee553ca66f49ad87248672c676562535f00521b5efa7684

00200050004400460020658768633002>

/CHT

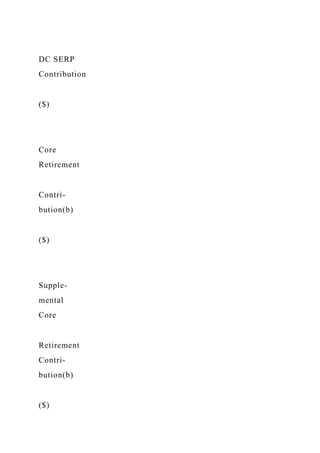

<FEFF4f7f752890194e9b8a2d7f6e5efa7acb76840020004100640](https://image.slidesharecdn.com/financialstatementsprojectacg203summer20191instruct-230110120415-6fe6477d/85/Financial-Statements-Project-ACG203-Summer-20191Instruct-docx-1166-320.jpg)