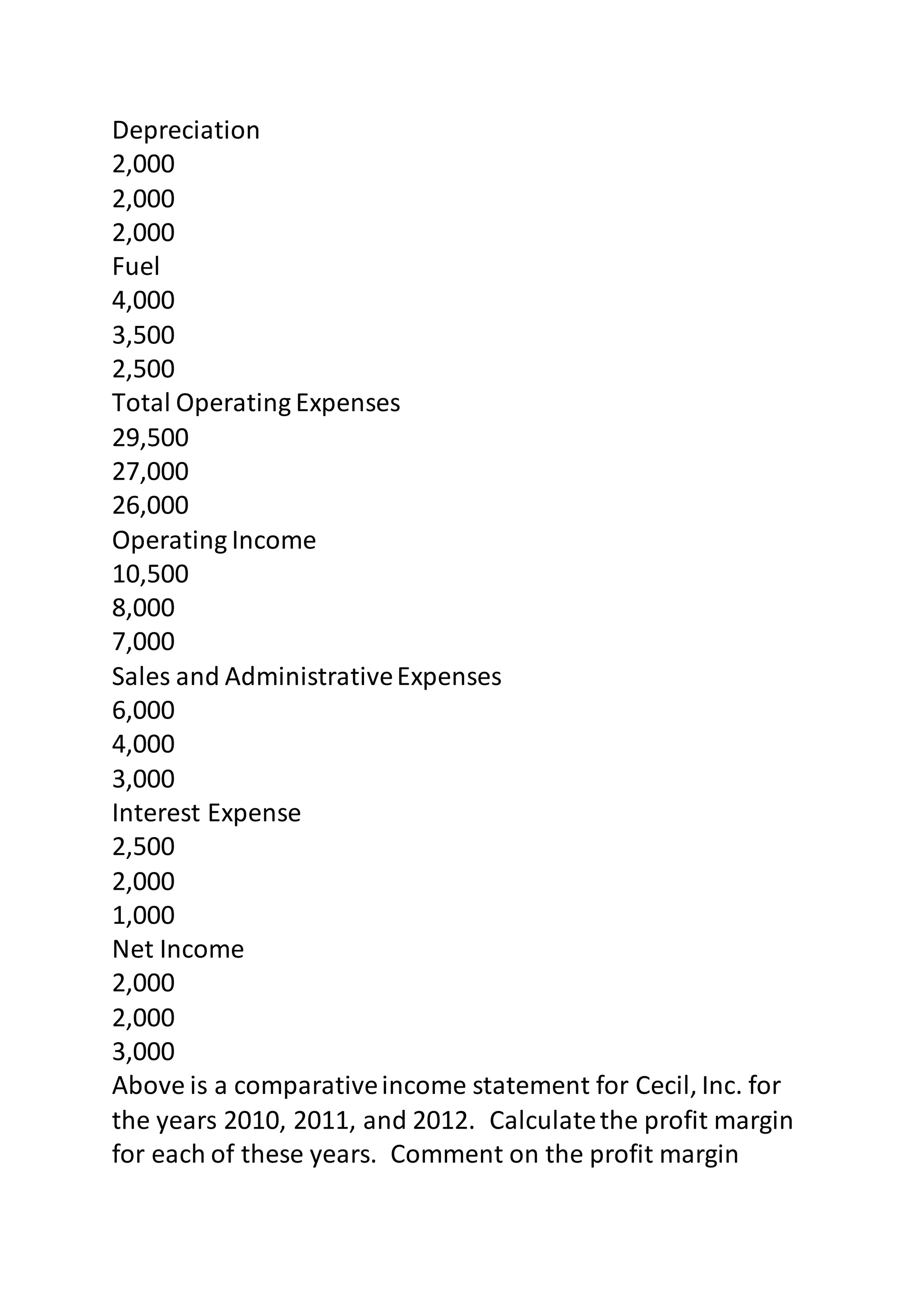

This document contains discussion questions and assignments for an accounting course across 5 weeks. It includes questions about the accounting equation, different types of accounts and how debits and credits impact them. It also addresses budgets, bank reconciliations, inventory costing methods, depreciation, current and long-term liabilities, ratio analysis, and recommendations for business entity types. The final assignment involves a five to seven page financial statement analysis of a public company.