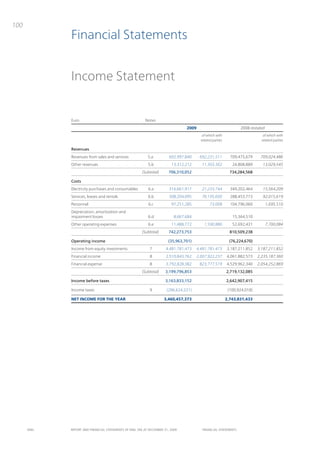

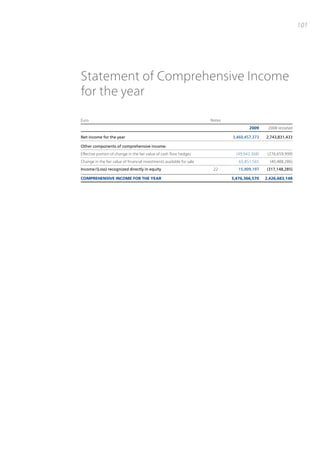

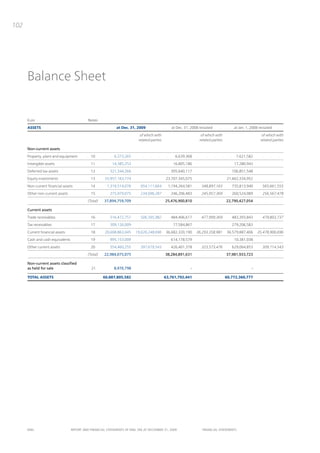

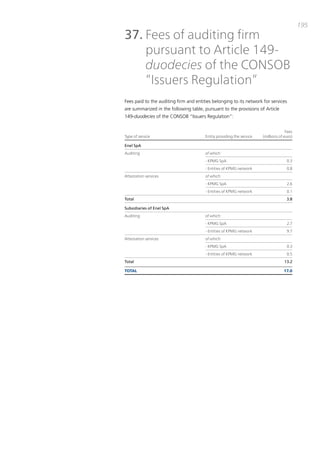

The document is the Report and Financial Statements of Enel SpA for the year ended December 31, 2009. It includes reports on operations, corporate governance, declarations by management, and financial statements. Enel SpA is an Italian power company with subsidiaries involved in electricity generation, energy management, infrastructure and networks, engineering, renewable energy, and other services across Europe and Latin America. Key governance bodies include the Board of Directors, Board of Auditors, and Independent Auditors.