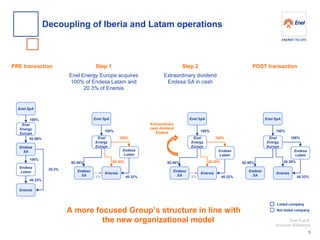

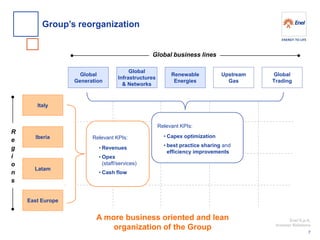

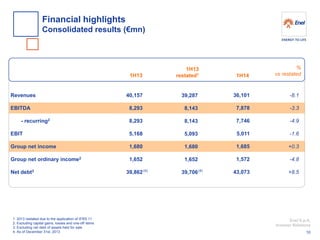

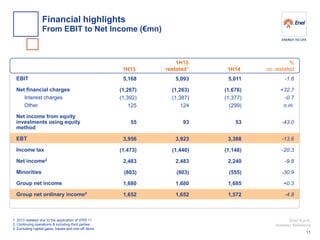

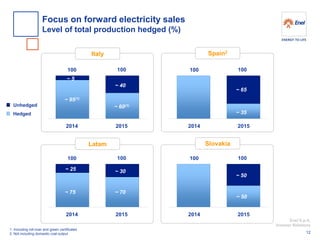

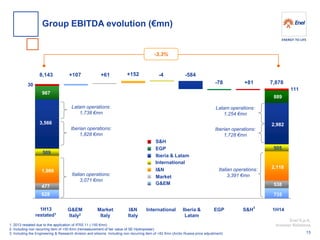

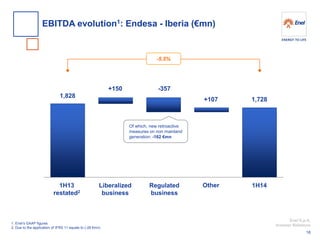

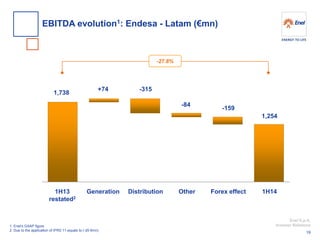

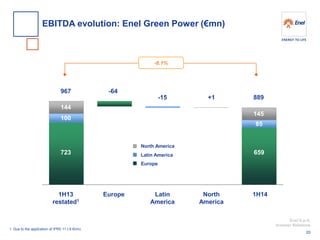

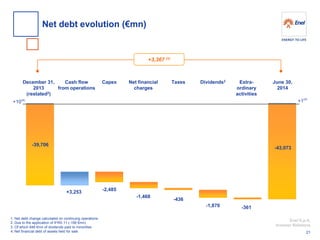

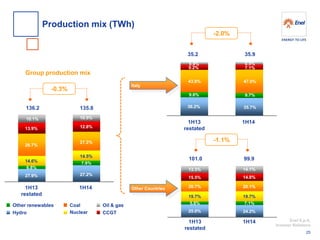

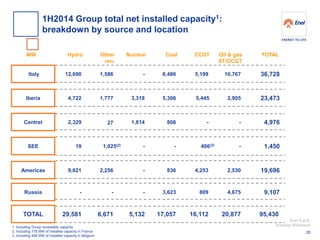

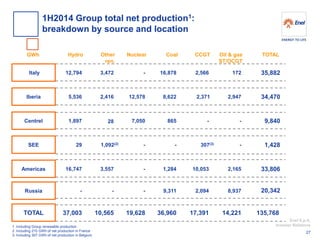

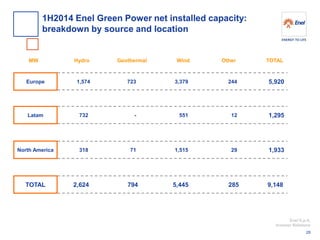

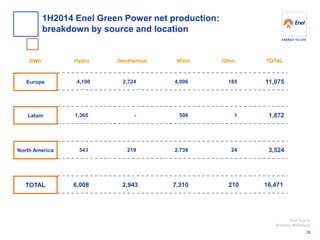

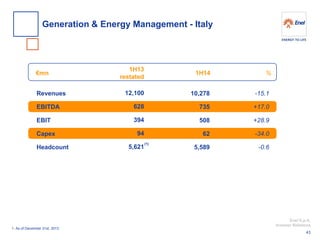

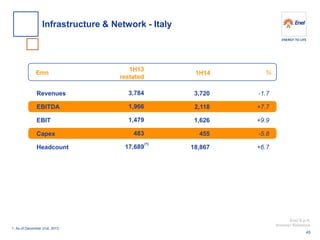

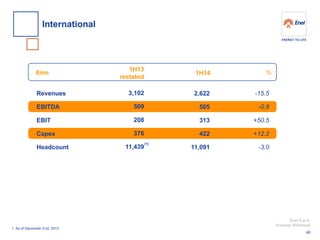

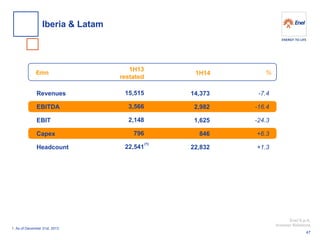

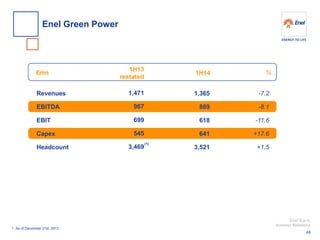

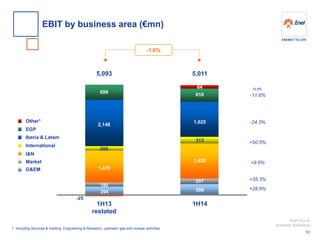

This document provides an overview of Enel S.p.A.'s 2014 interim results presentation. It discusses ongoing challenges in the Italian and Spanish energy markets and Enel's strategic actions, including ongoing asset disposal and decoupling of Iberian and Latin American operations. Key financial highlights show a decrease in revenues but stable recurring net income compared to the prior year.