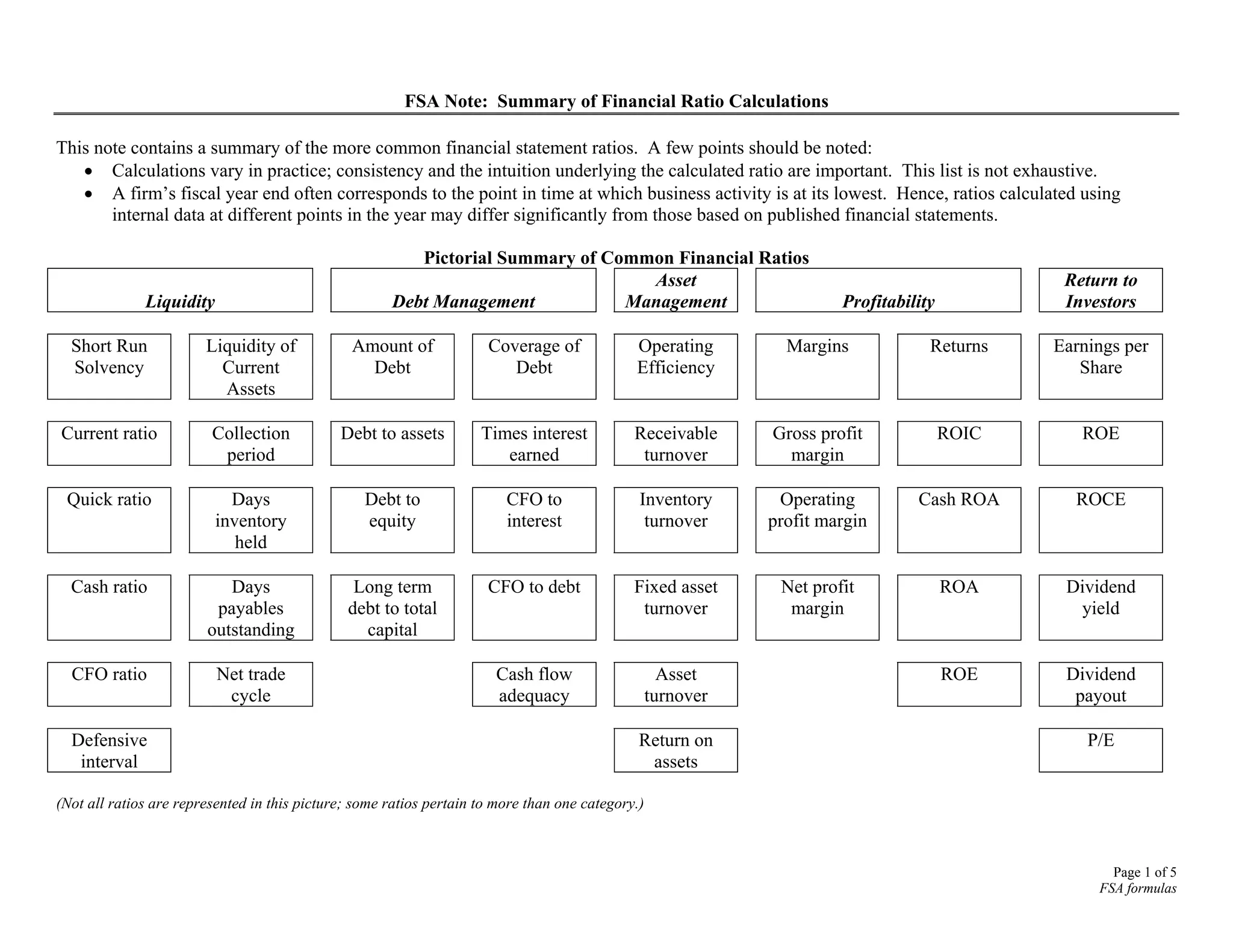

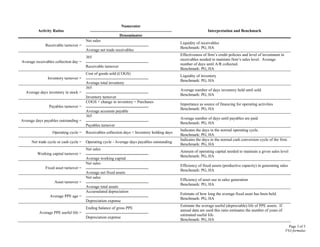

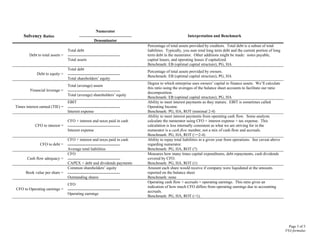

This document contains a summary of common financial ratios used to analyze a company's financial statements. It includes definitions of key liquidity, activity, profitability, and solvency ratios along with typical benchmarks. Formulas and interpretations are provided for ratios such as the current ratio, receivables turnover, return on equity, times interest earned, and debt to assets.