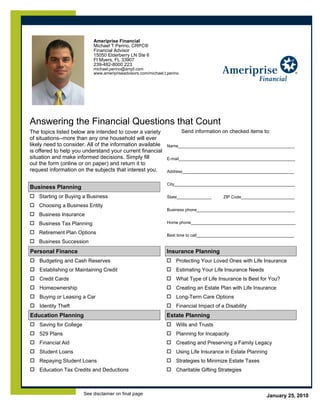

This document is a form from Ameriprise Financial advisor Michael Perino providing information on financial planning topics and requesting the recipient check off topics of interest. The form covers issues like business planning, personal finance, insurance, education, retirement, social security, taxes, investments, and life events. It requests the recipient provide their contact information and check items to receive more information on. It includes a disclaimer that the information is for education only and not specific advice, and to consult experts on tax or legal issues.