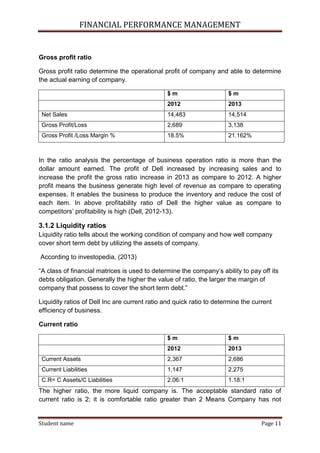

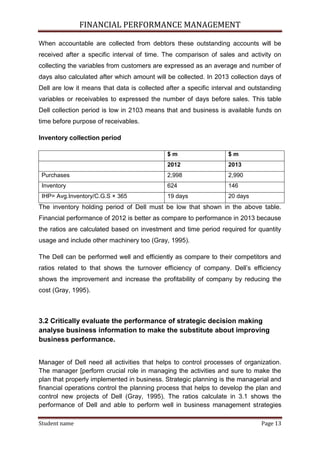

This document discusses Dell's financial performance management. It examines how Dell uses financial resources for strategic planning and assesses investment opportunities through methods like net present value. The document also looks at how Dell analyzes business performance using ratios and evaluates strategic decisions. It discusses how Dell allocates, manages and controls financial resources through budgeting and costing reports to improve organizational performance.