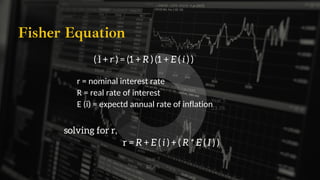

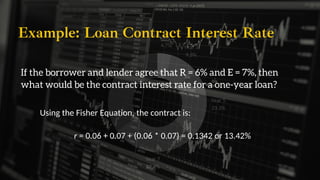

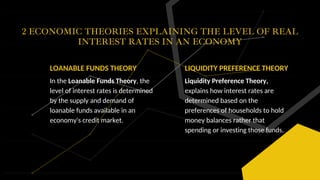

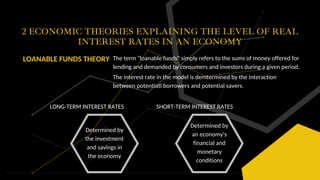

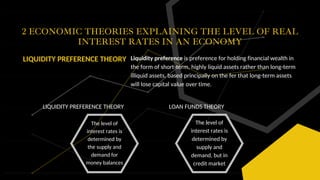

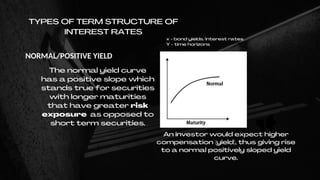

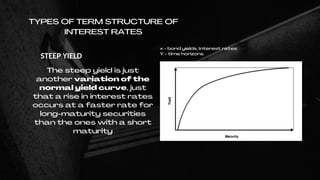

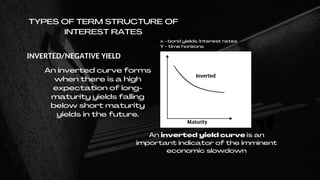

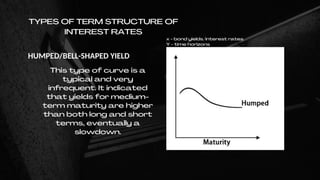

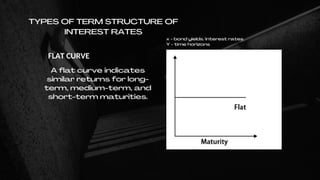

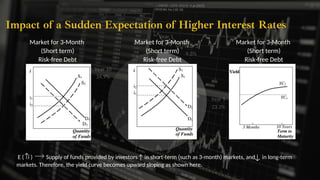

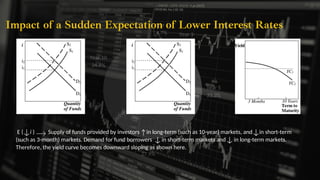

This document discusses interest rates, their determination and structure. It provides information on key theories for how interest rates are determined such as the loanable funds theory and liquidity preference theory. It also discusses factors that influence the term structure of interest rates like time period, risk, and transaction costs. Different types of term structures are outlined like normal positive yield curves and steep yield curves.