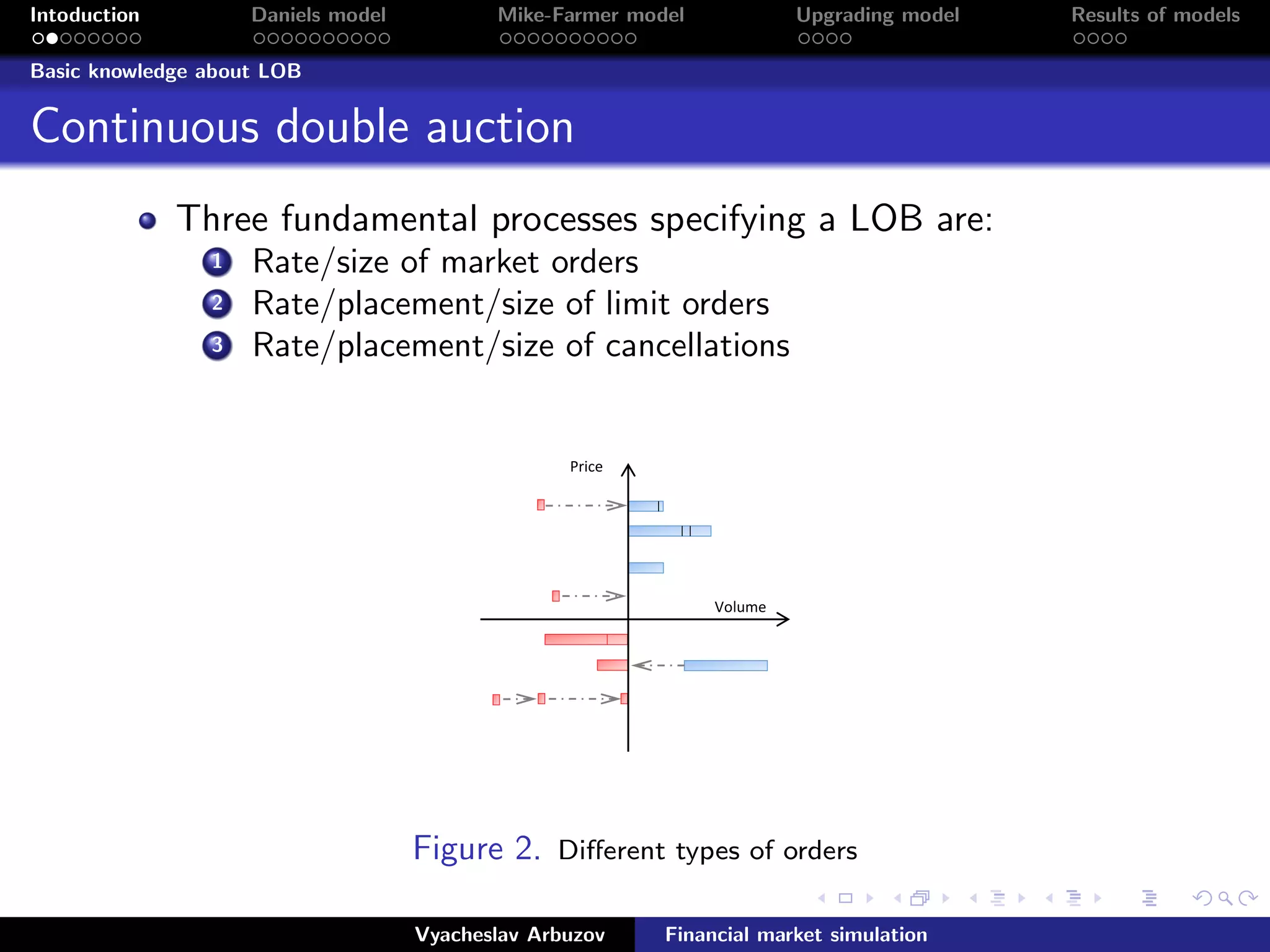

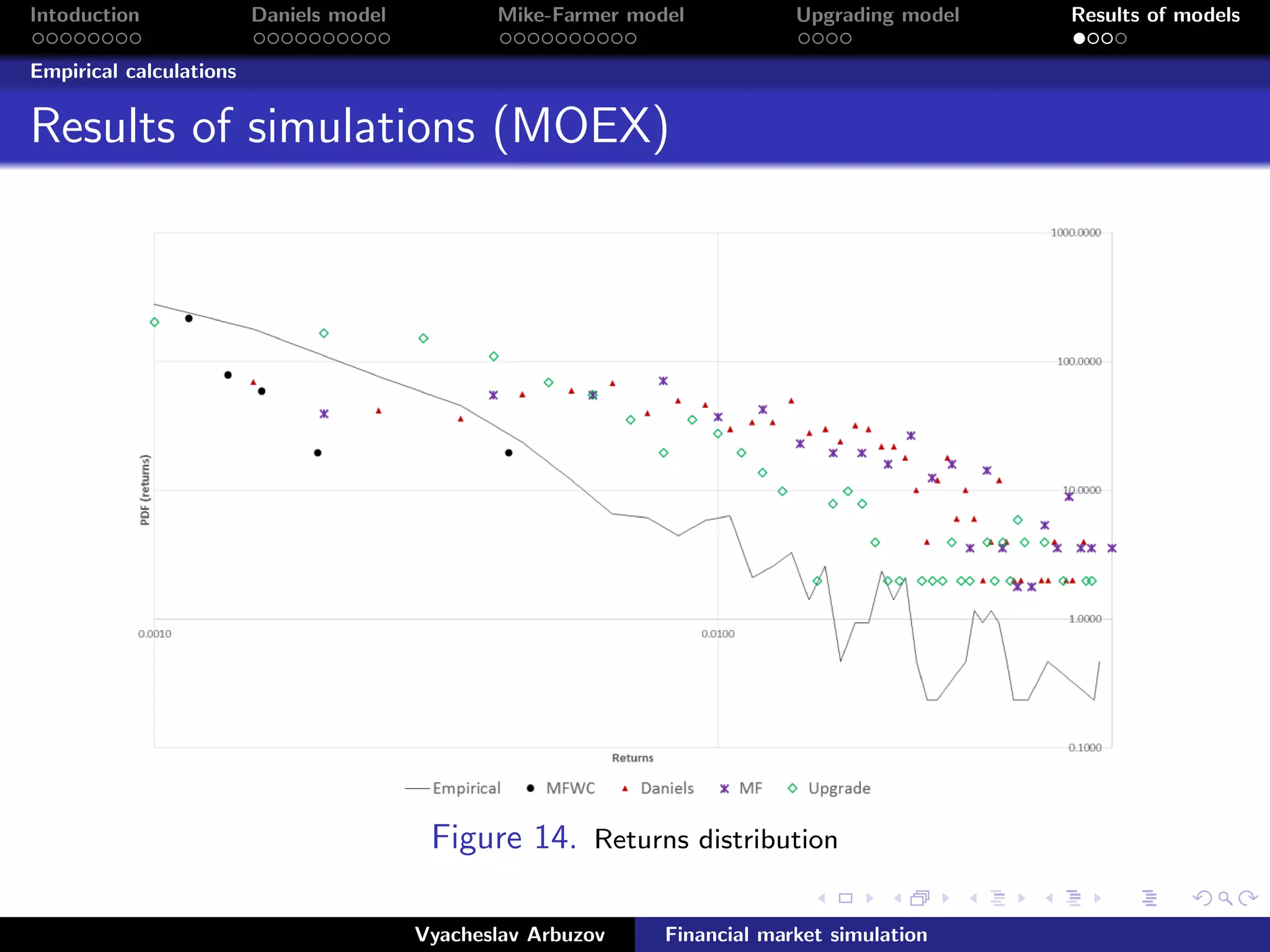

1. The document describes several zero intelligence models for simulating financial markets, including the Daniels model and Mike-Farmer model.

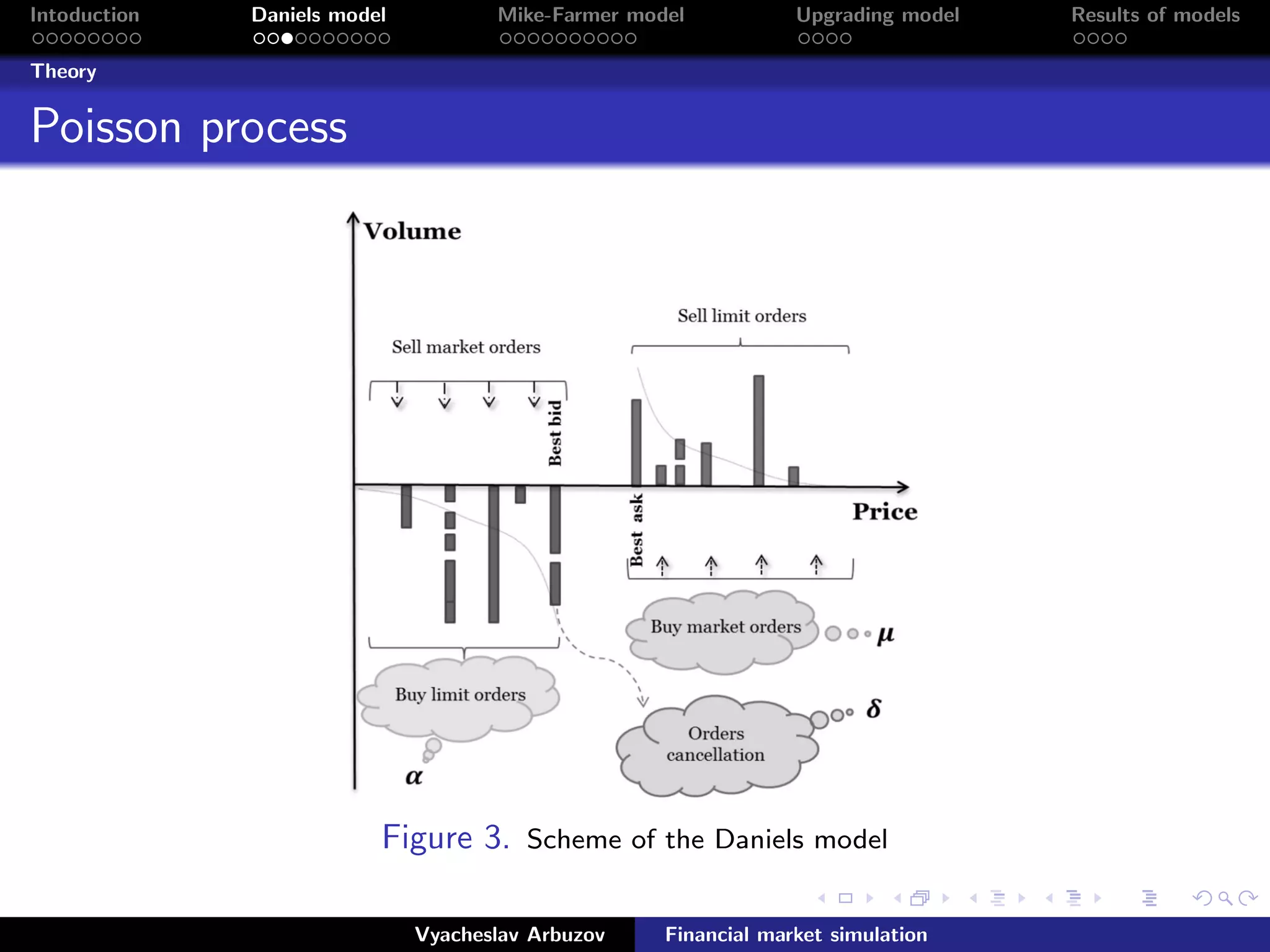

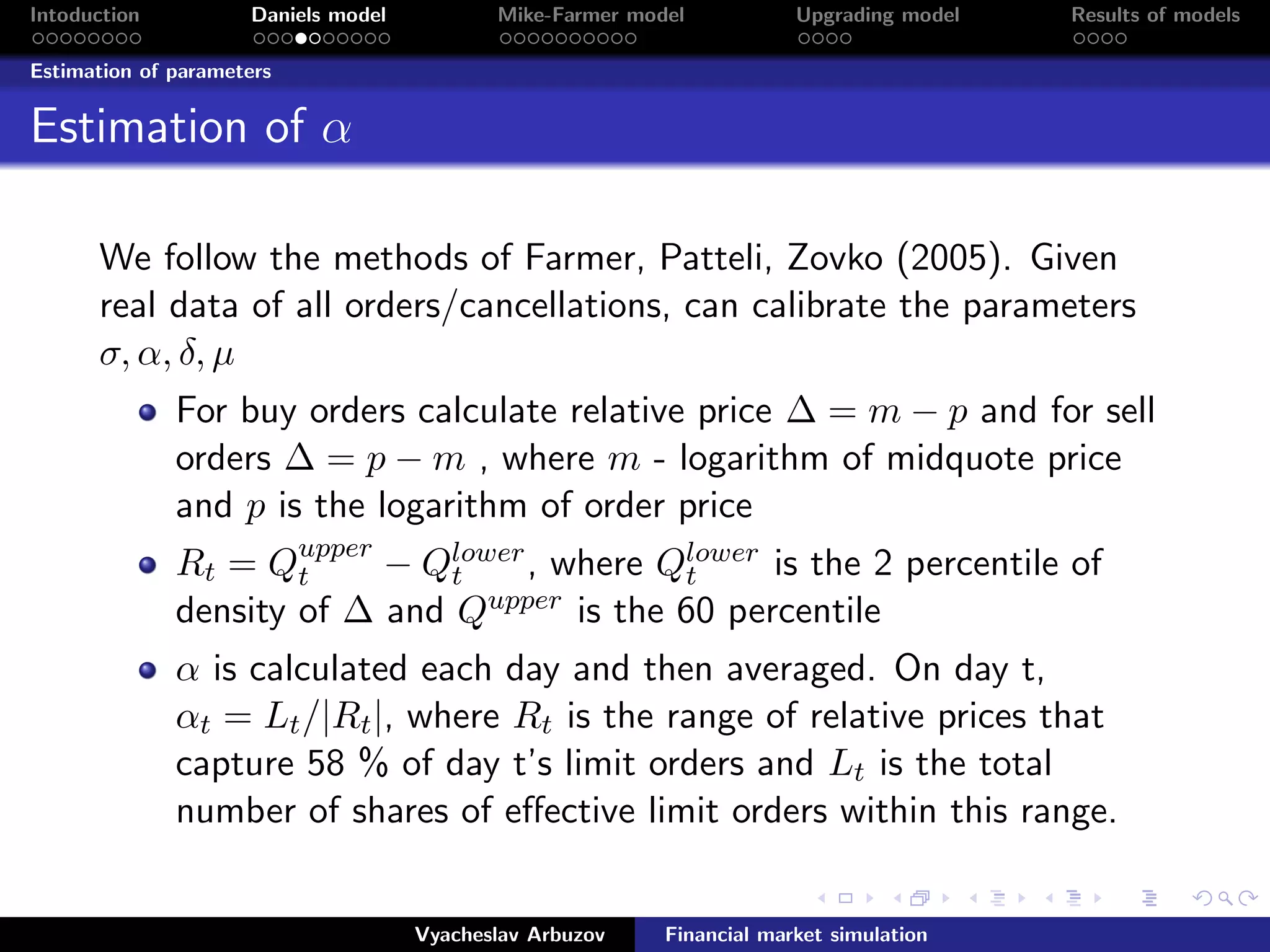

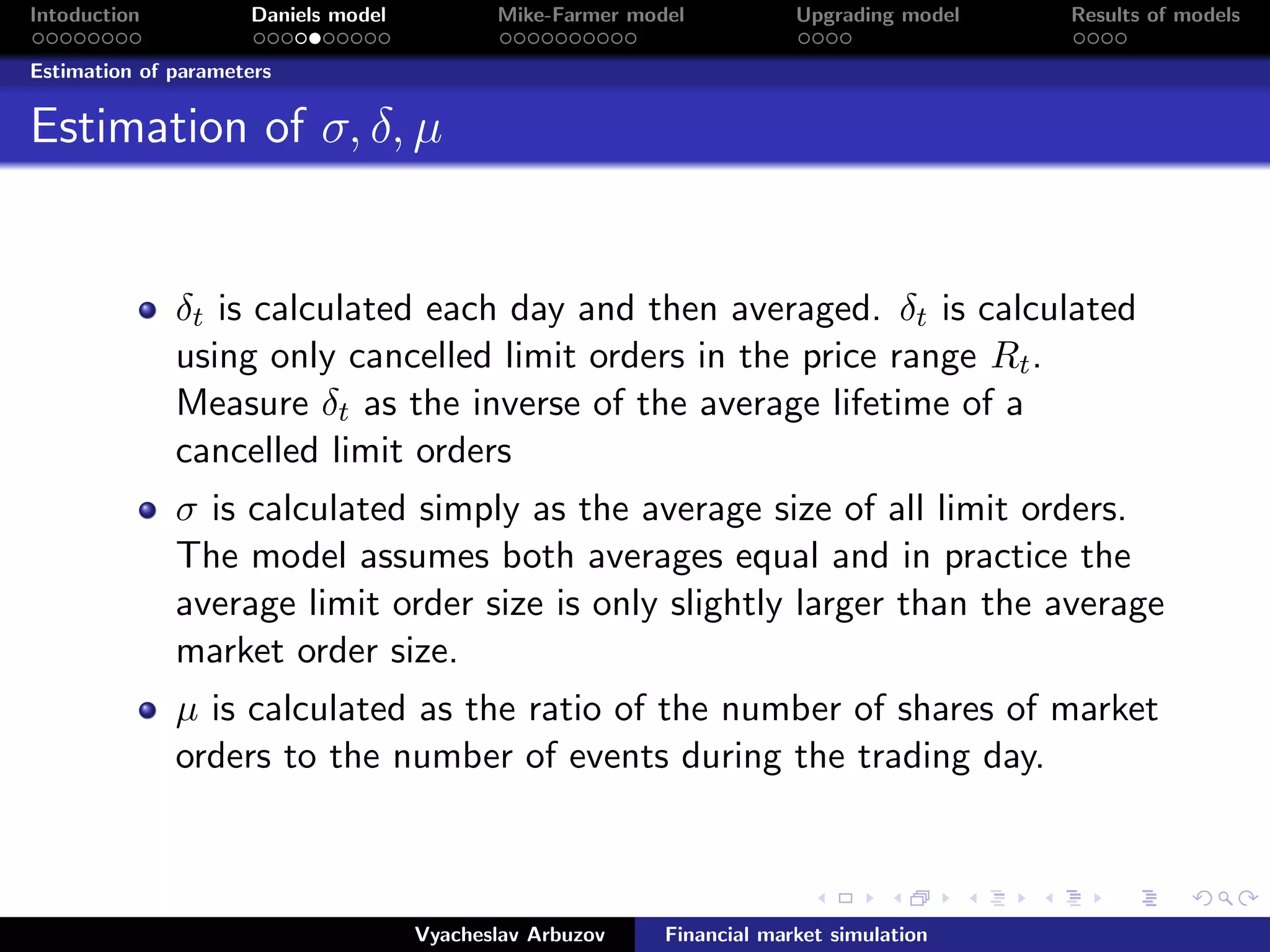

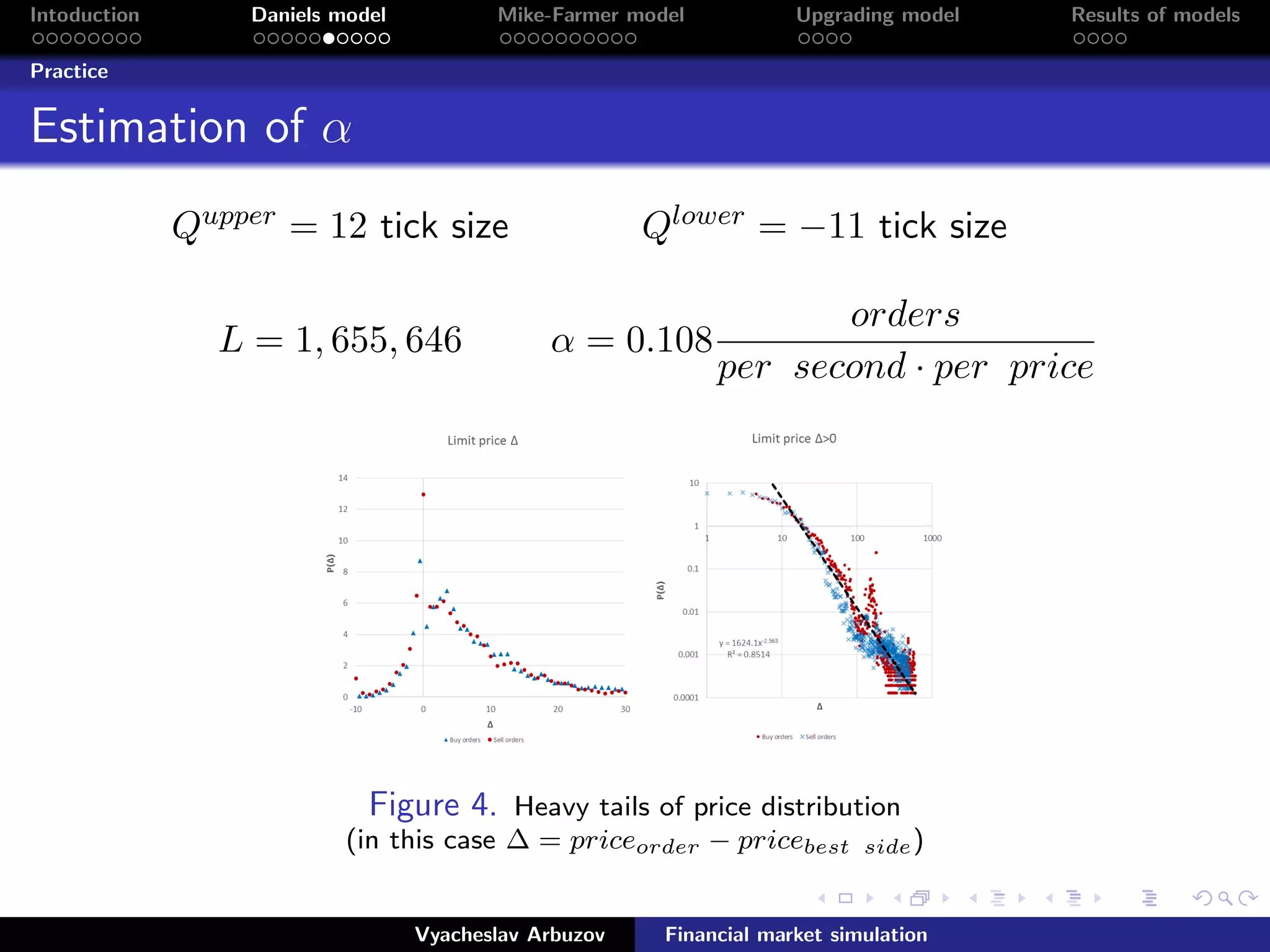

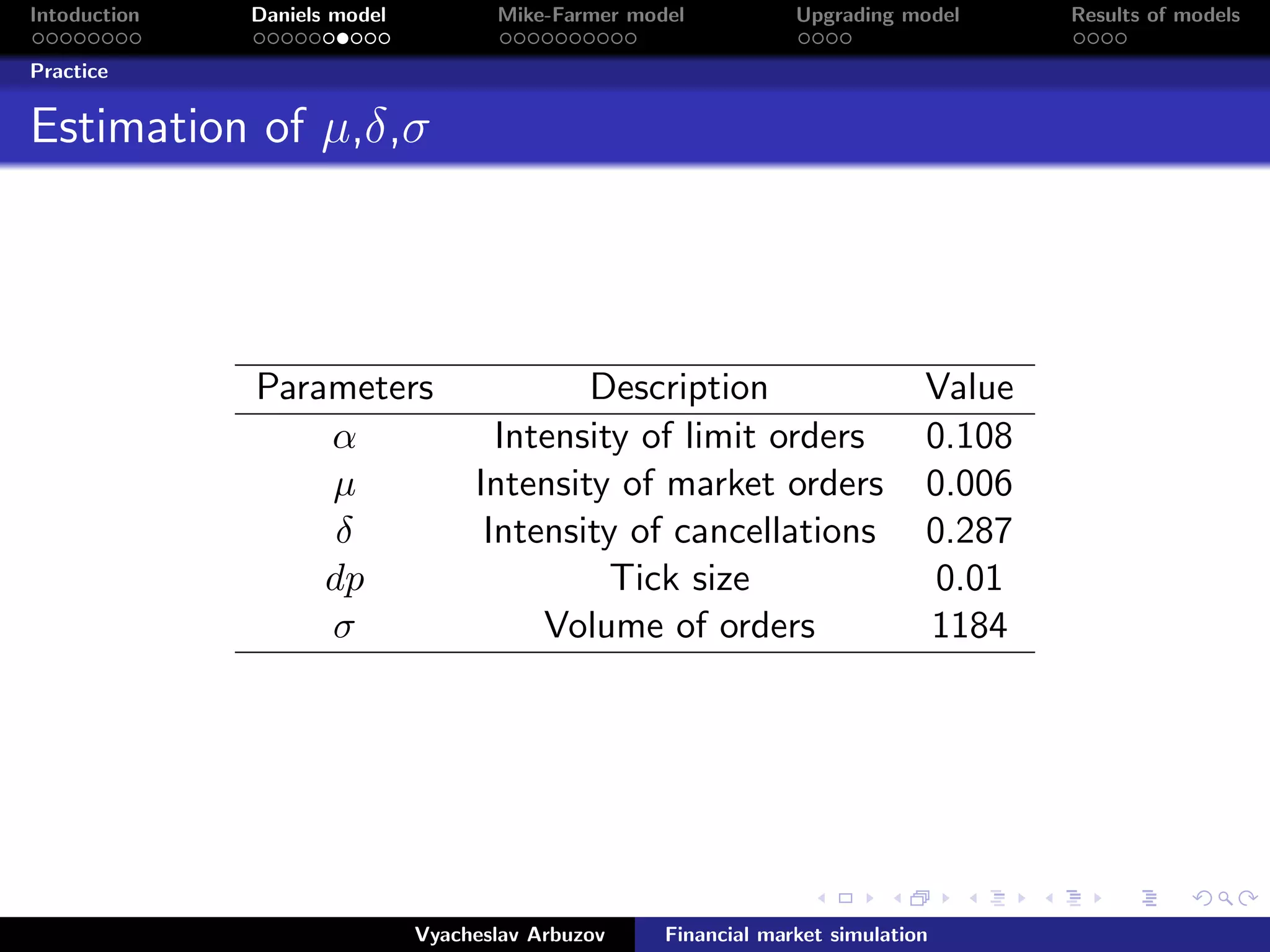

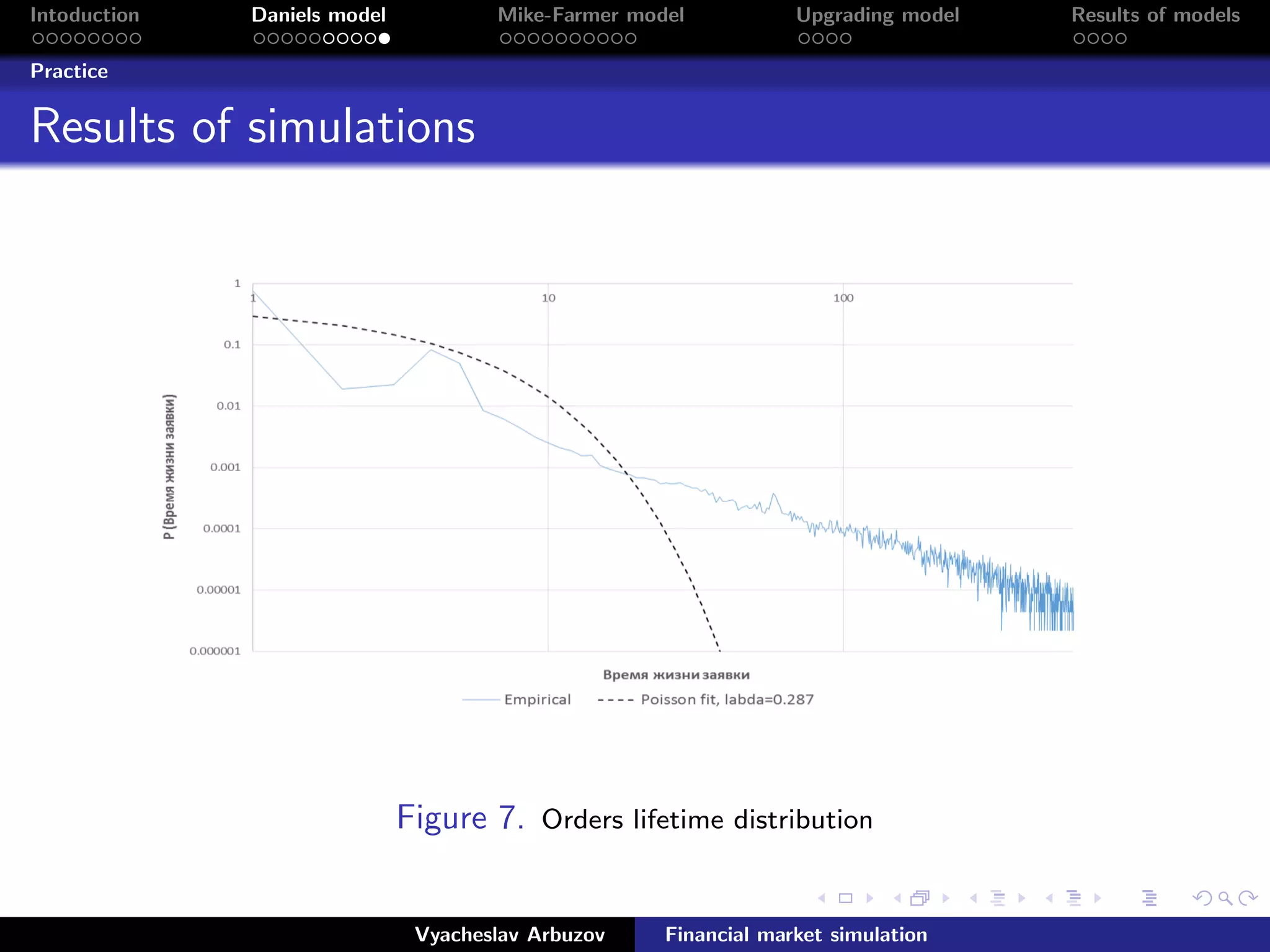

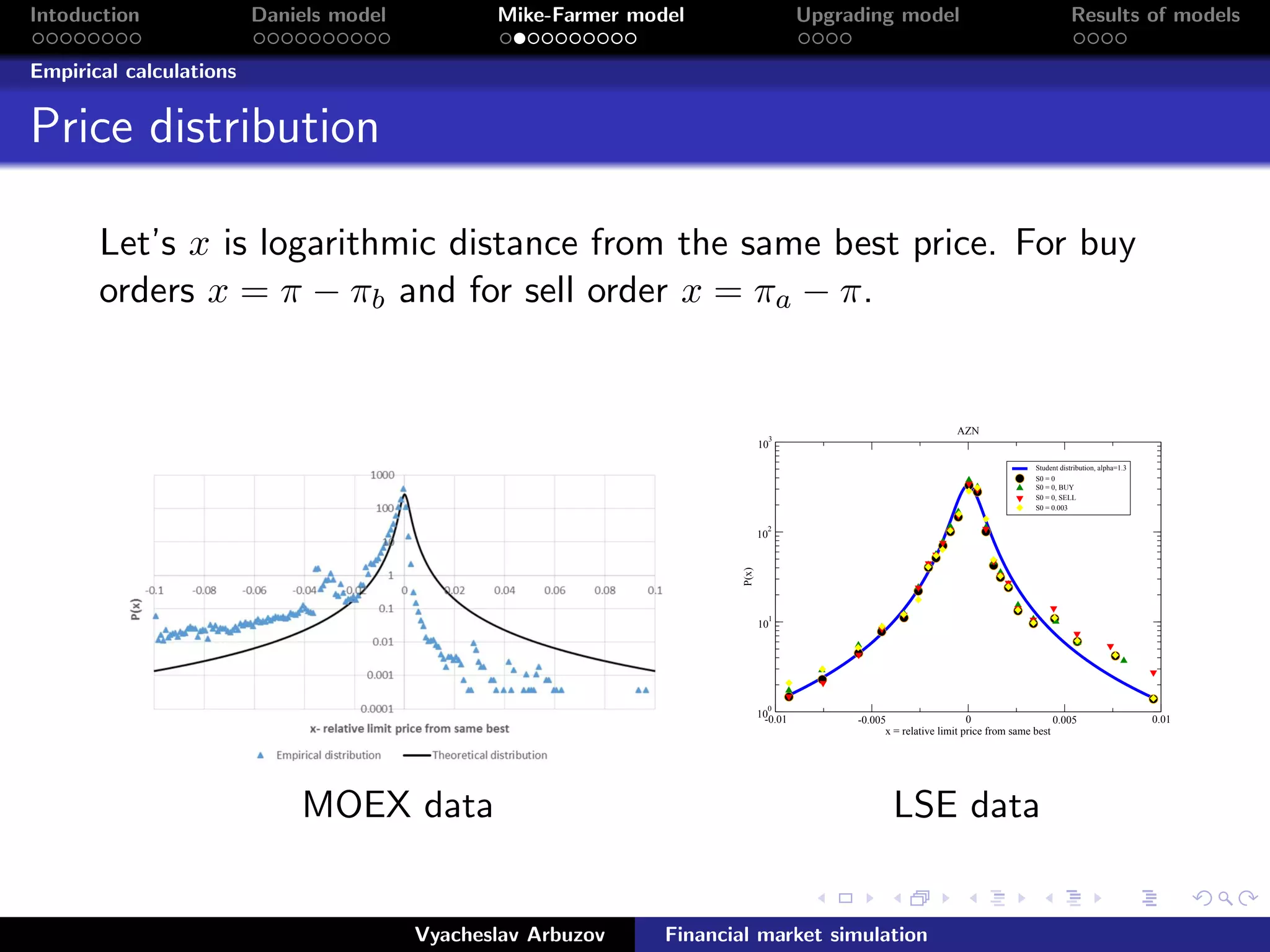

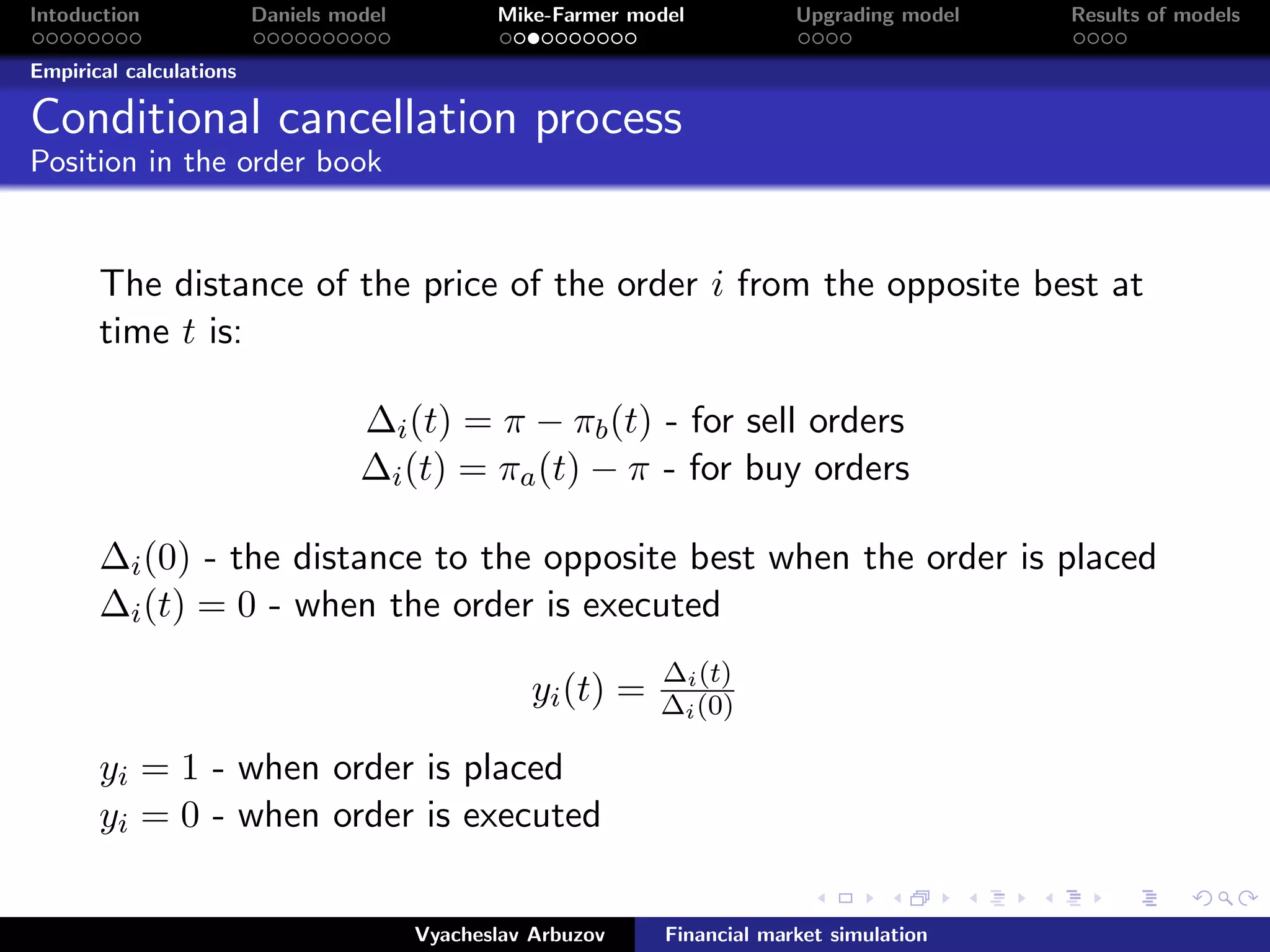

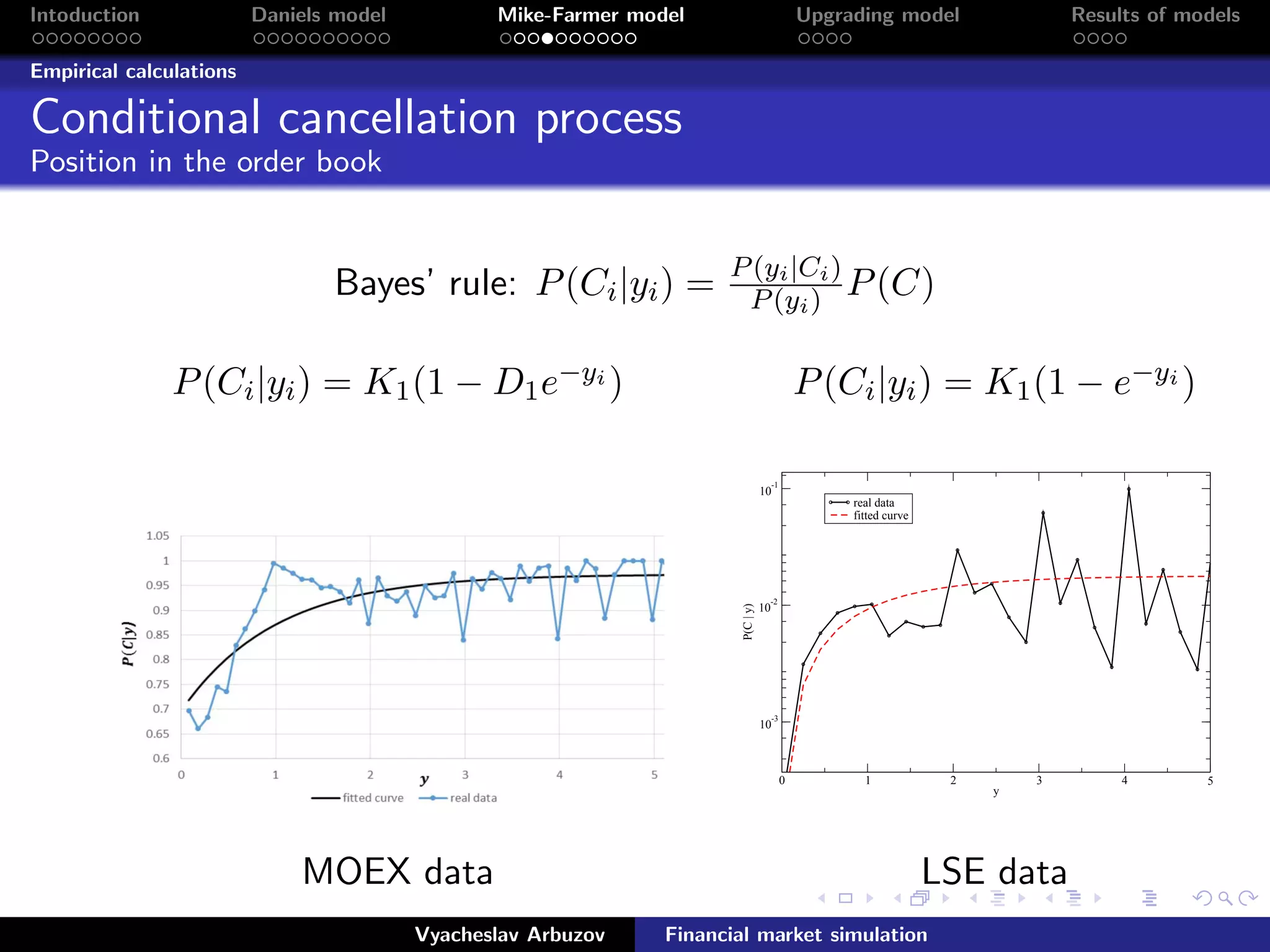

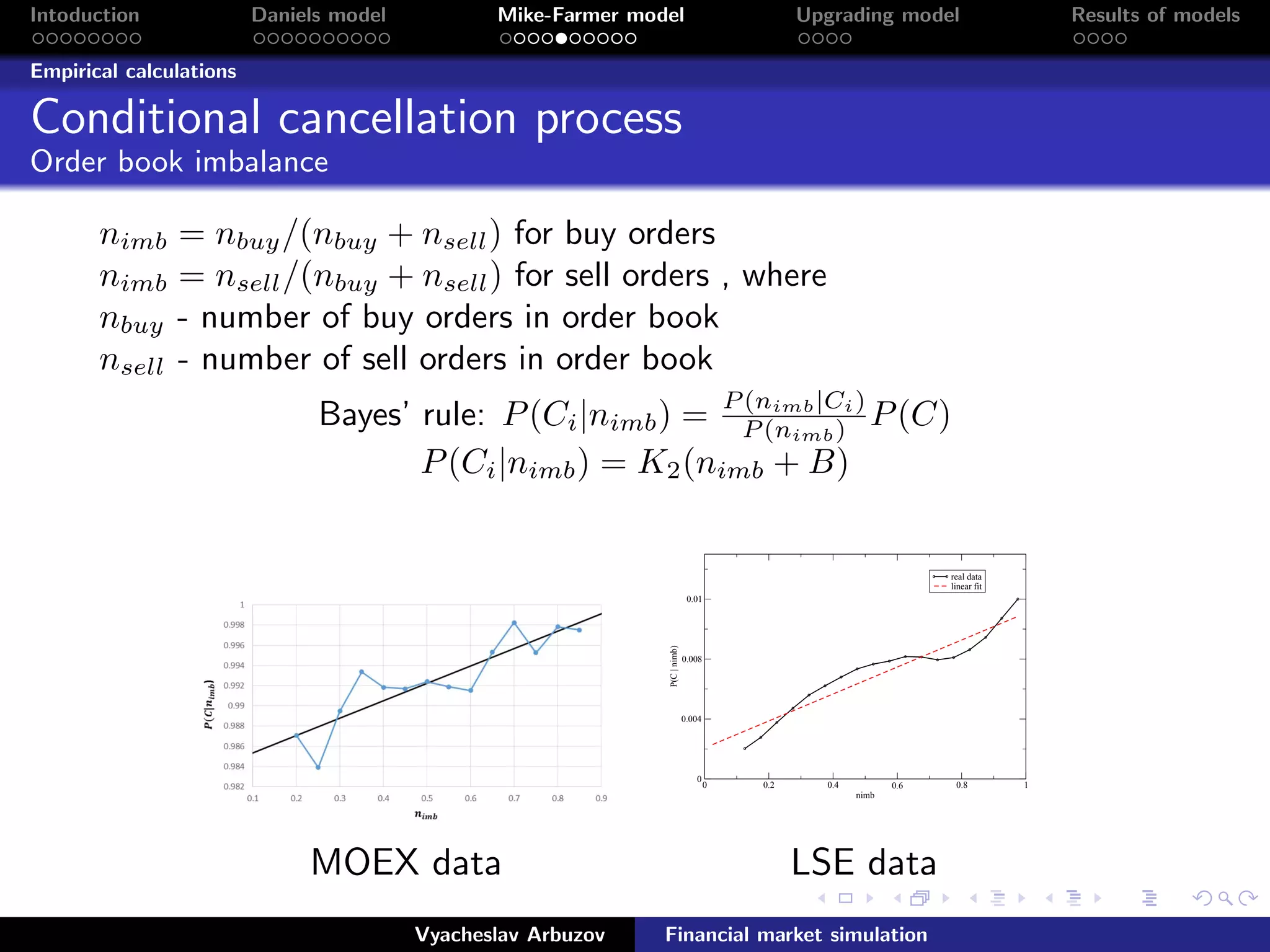

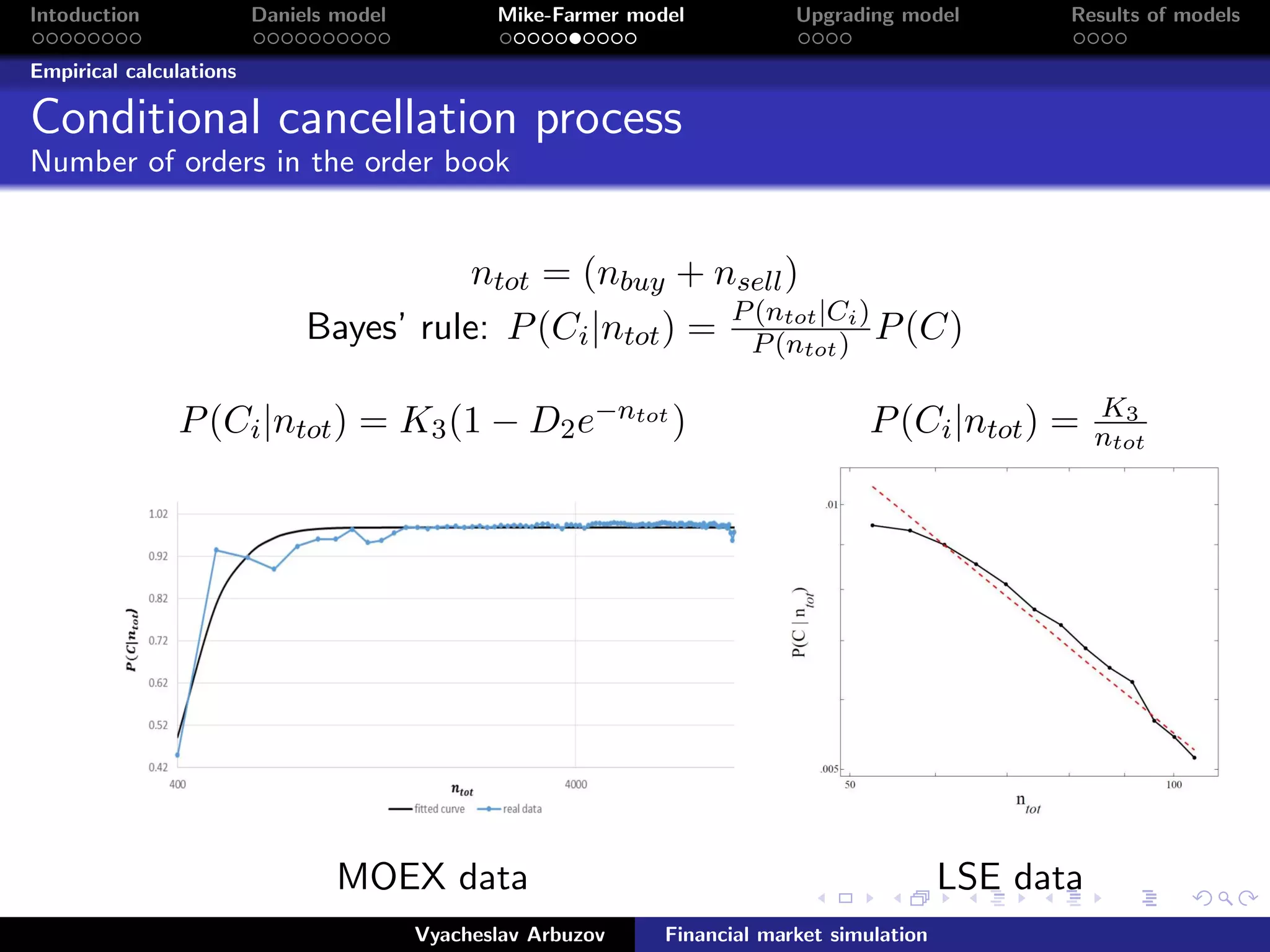

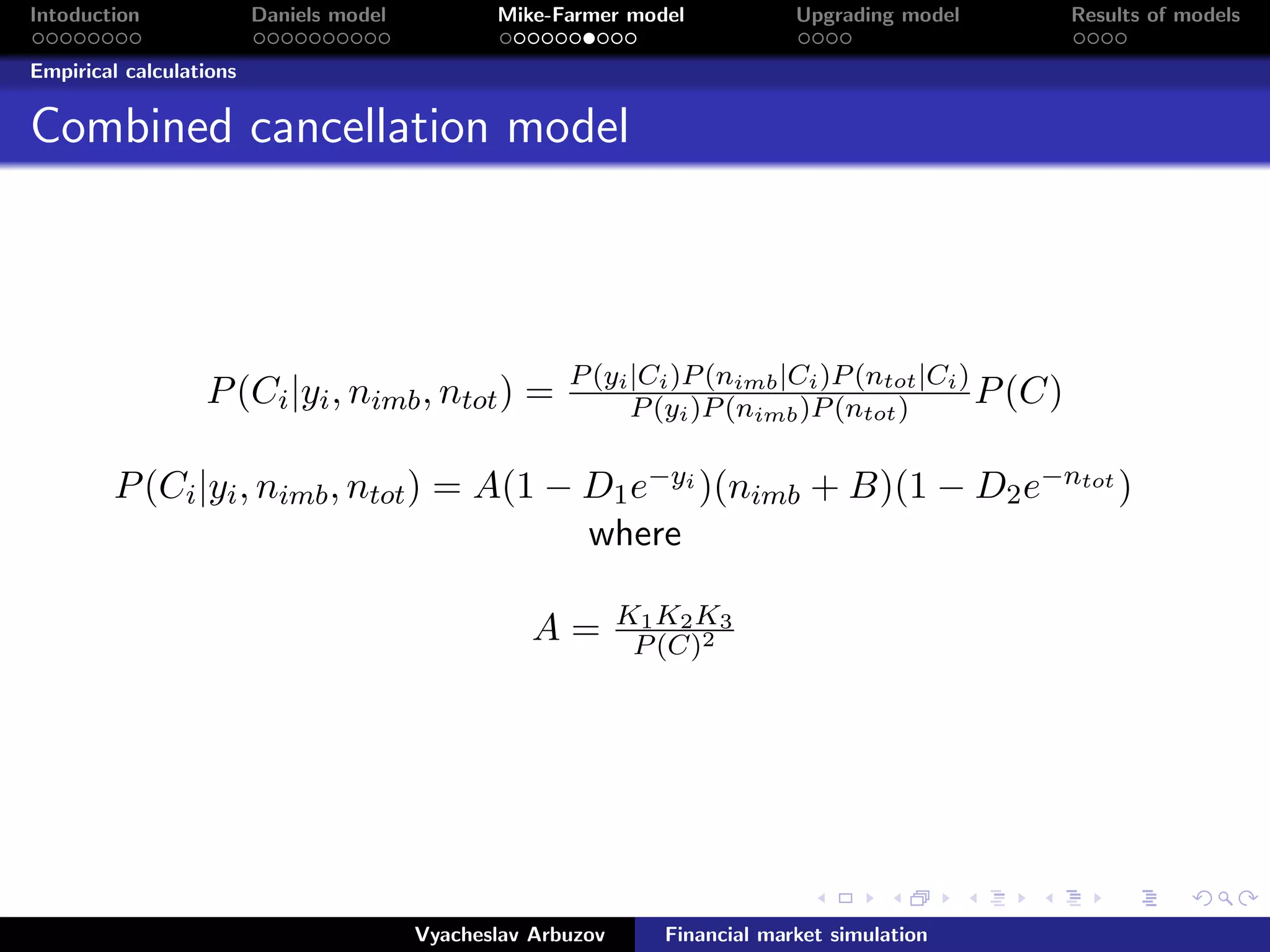

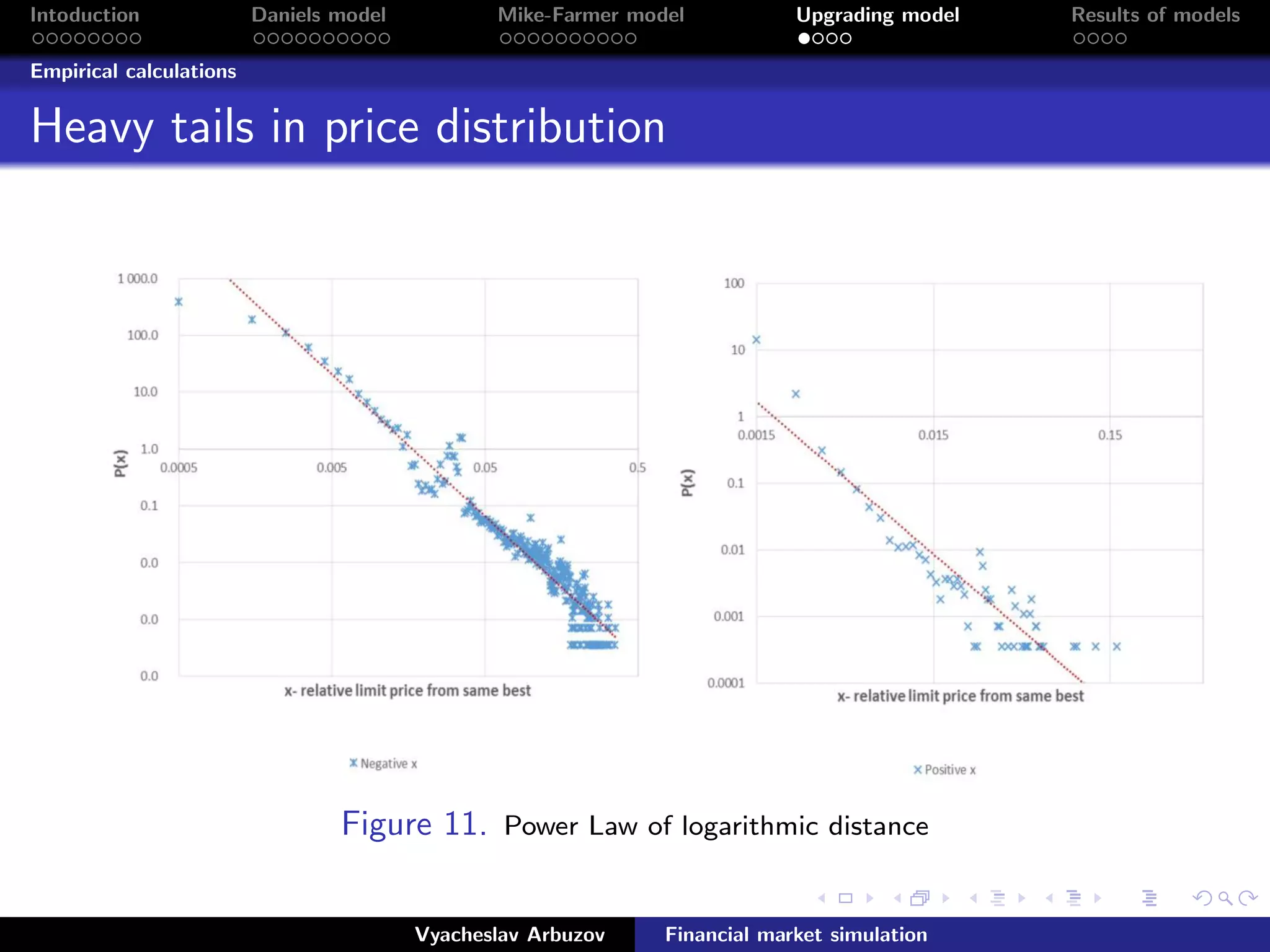

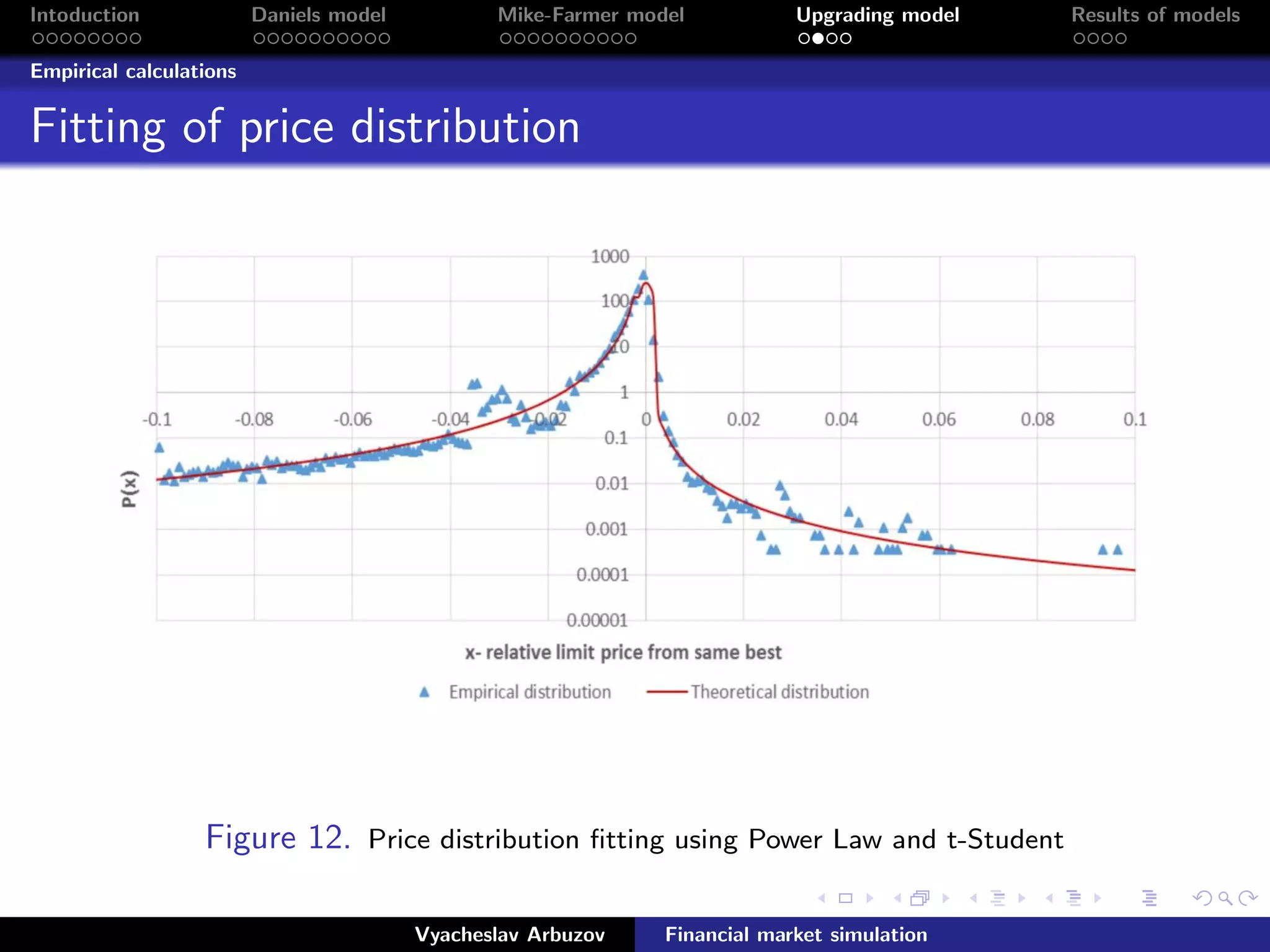

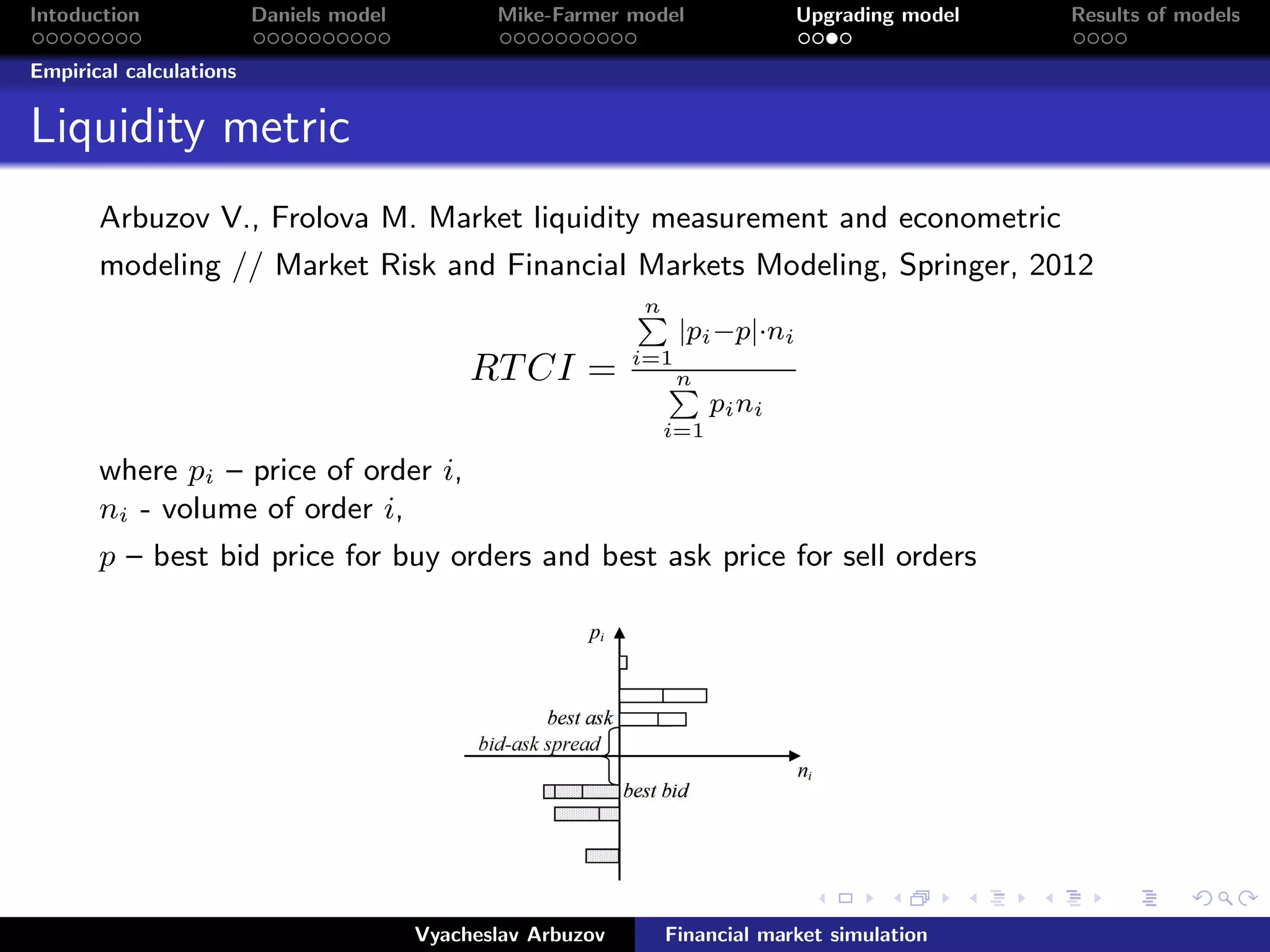

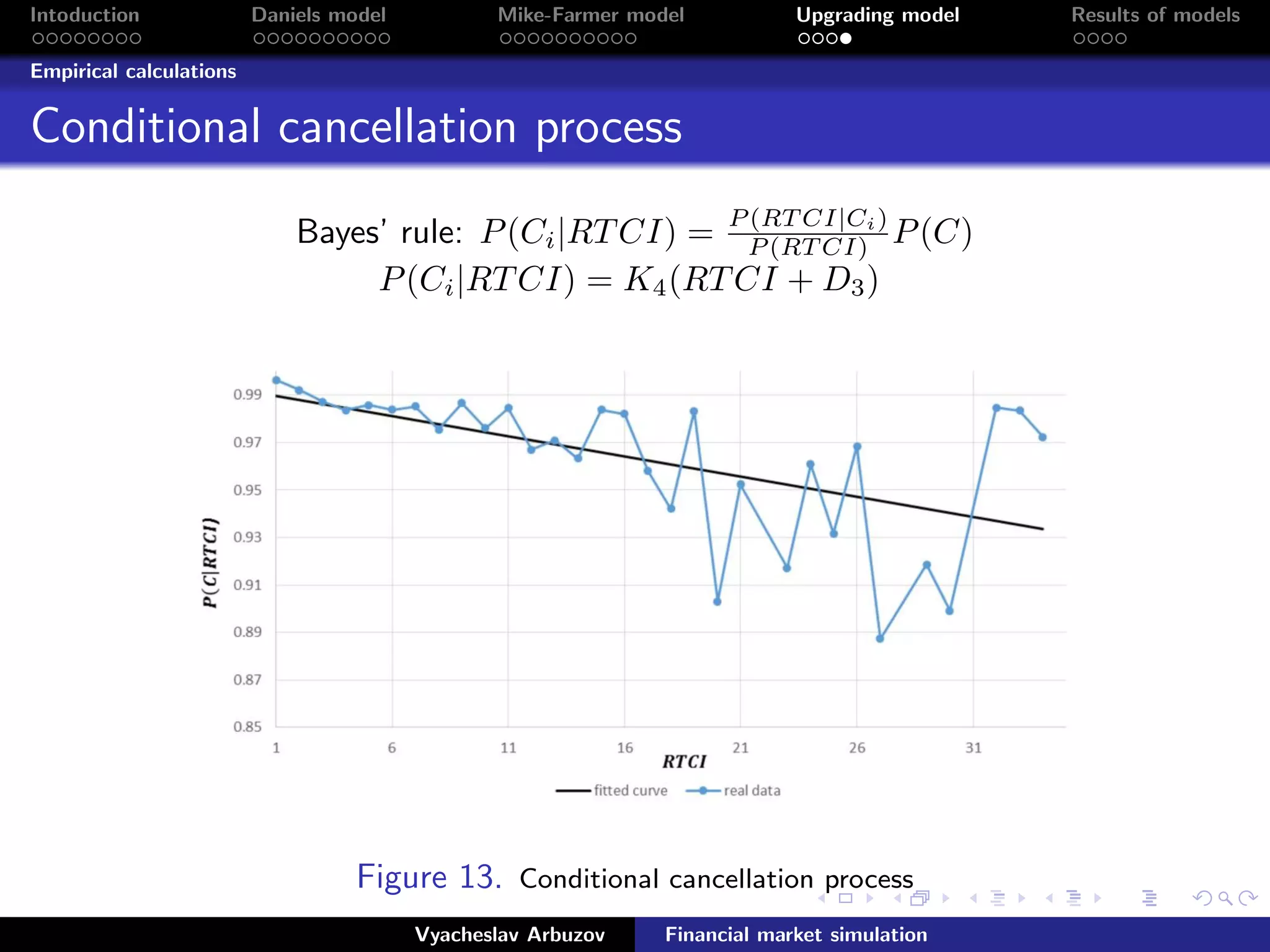

2. The Daniels model uses a Poisson process to simulate the random placement and cancellation of limit and market orders. The Mike-Farmer model builds on this by incorporating empirical patterns in order placement, cancellation rates, and price distributions.

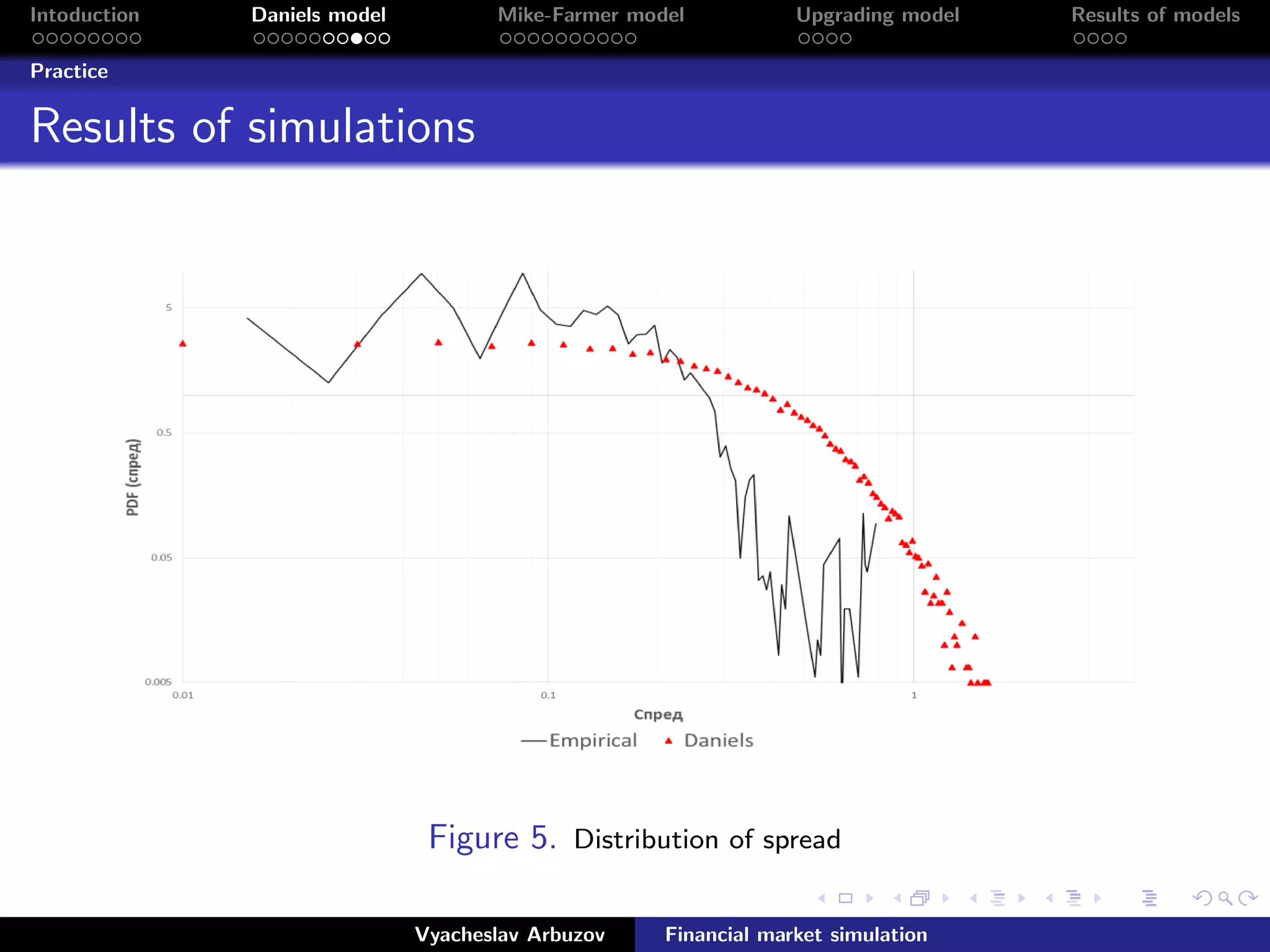

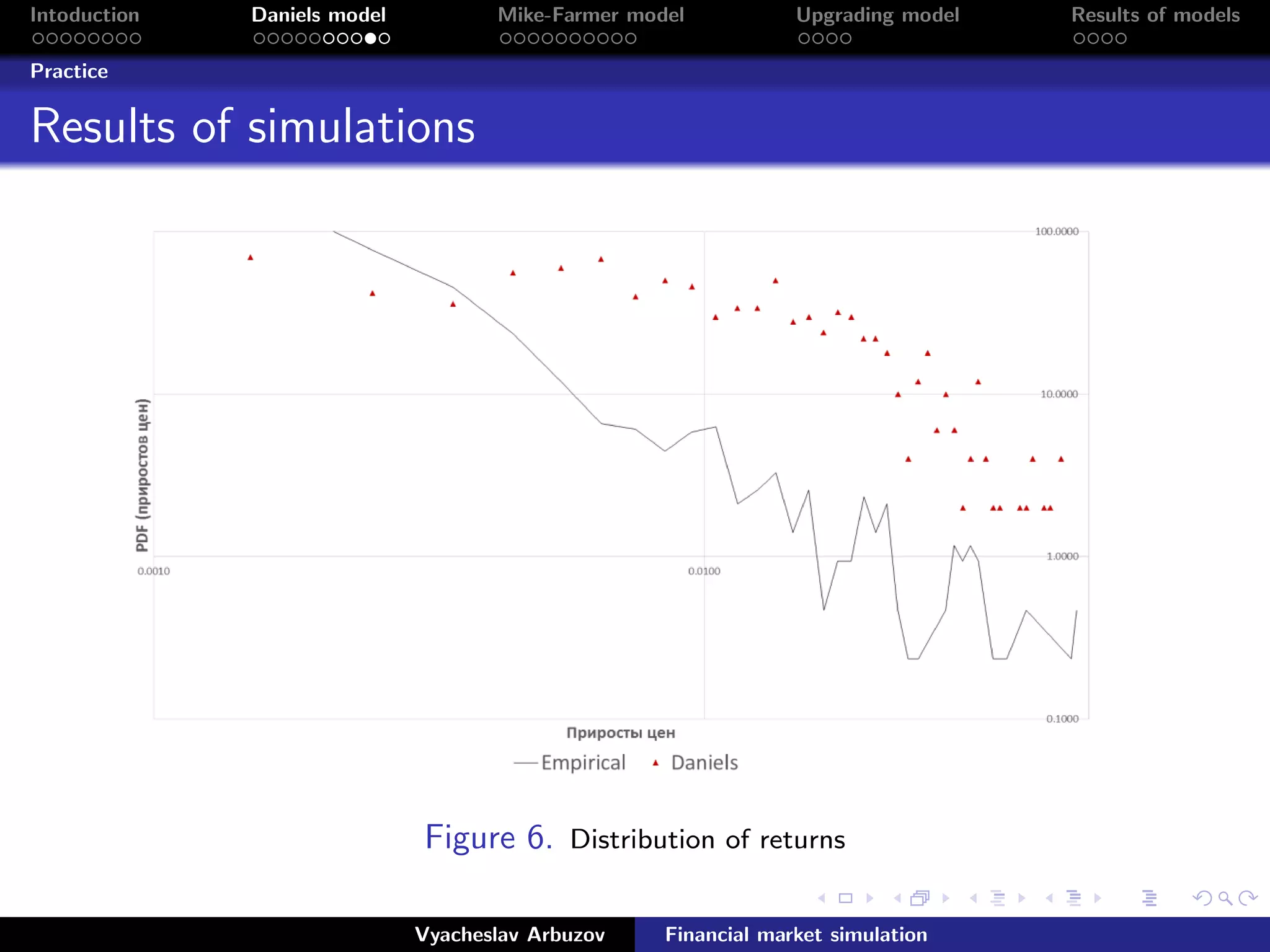

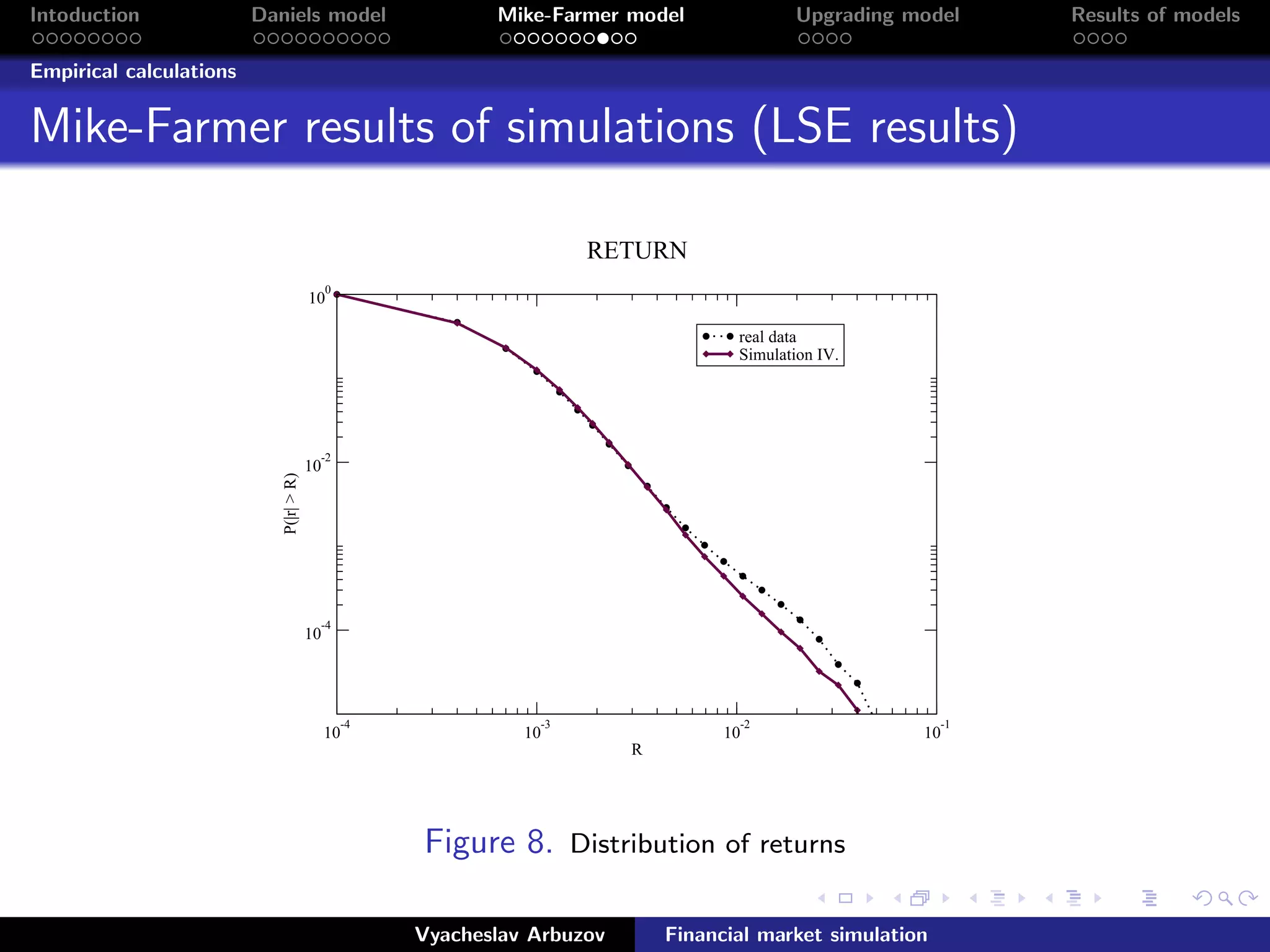

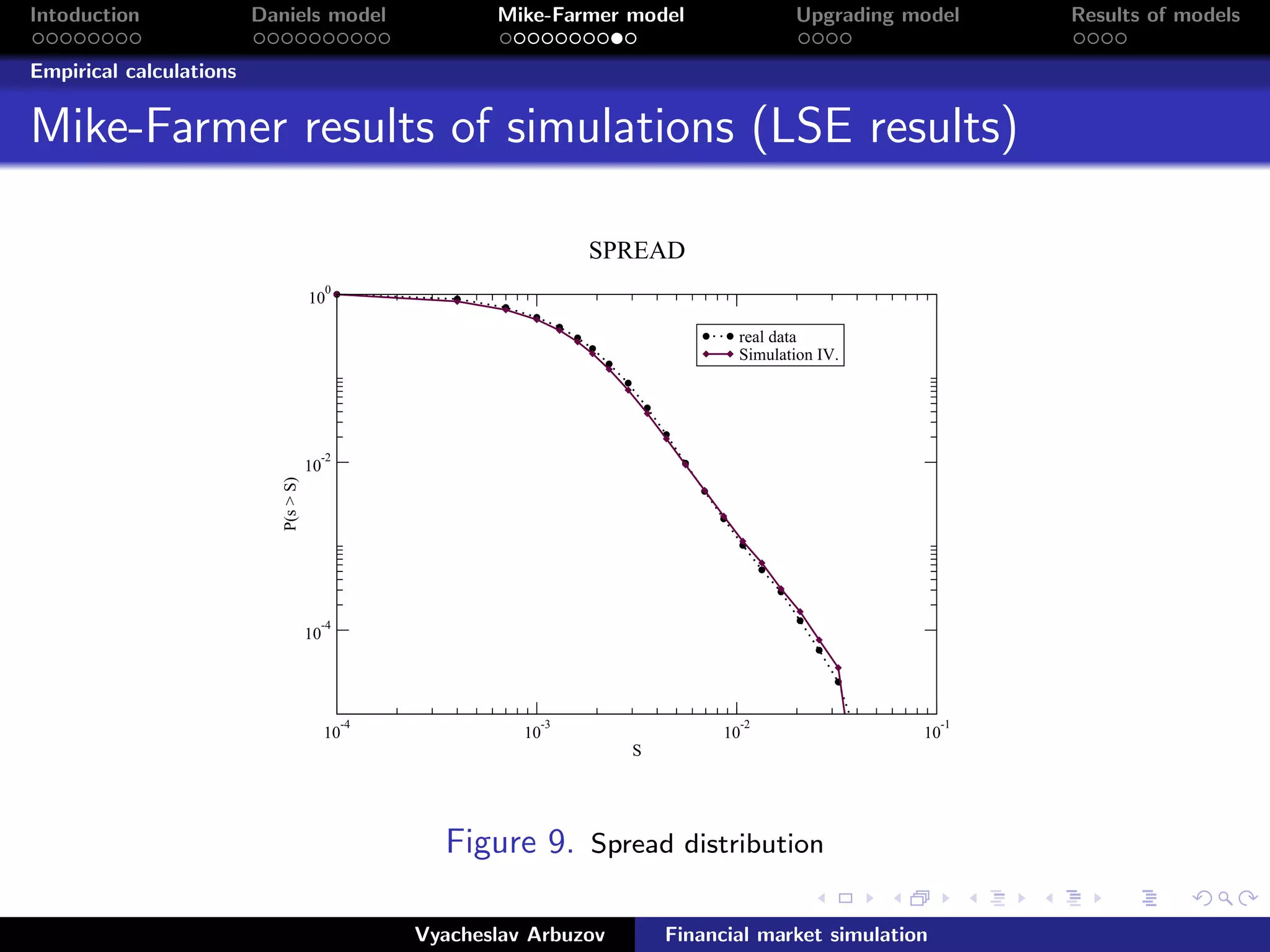

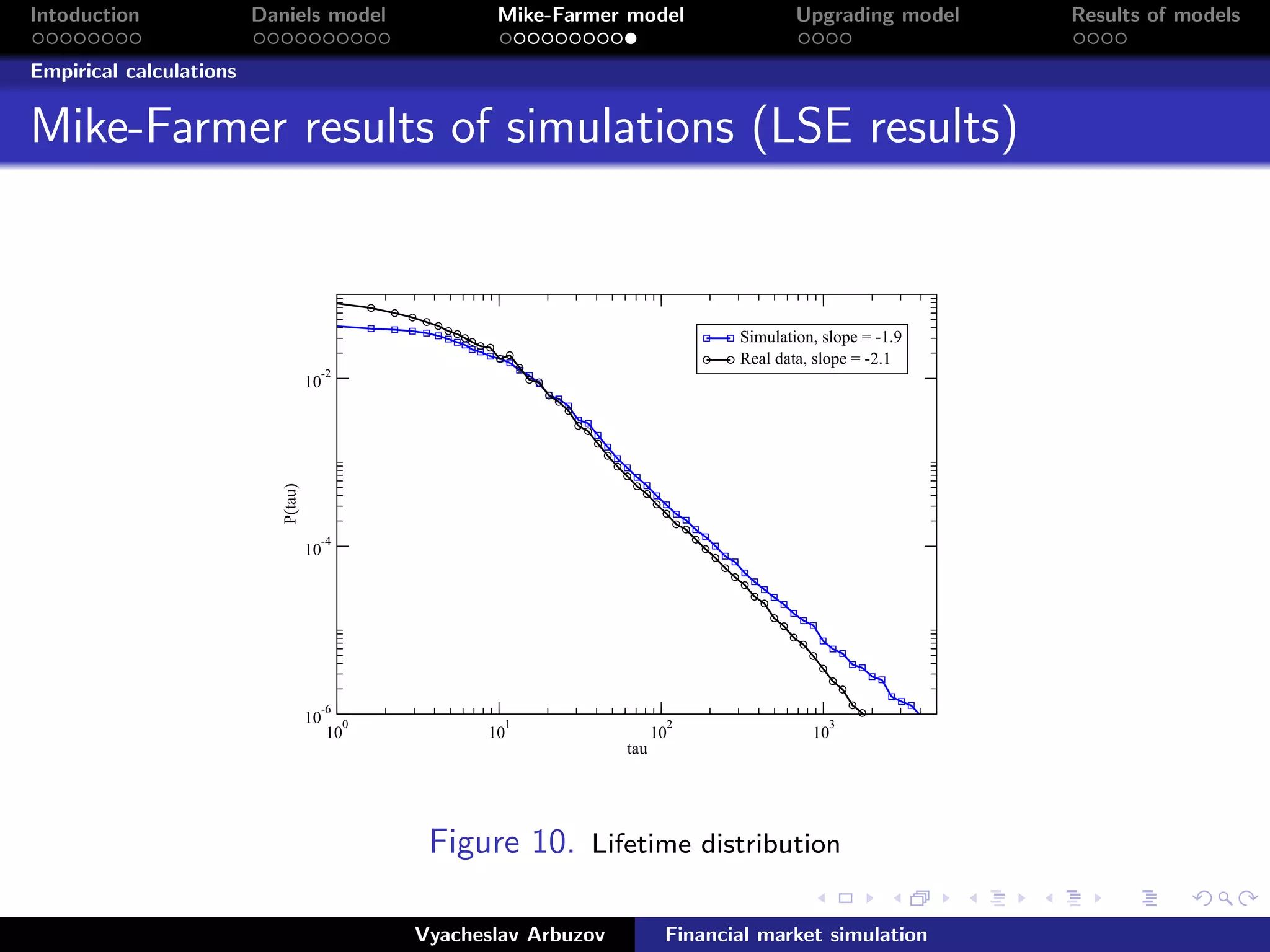

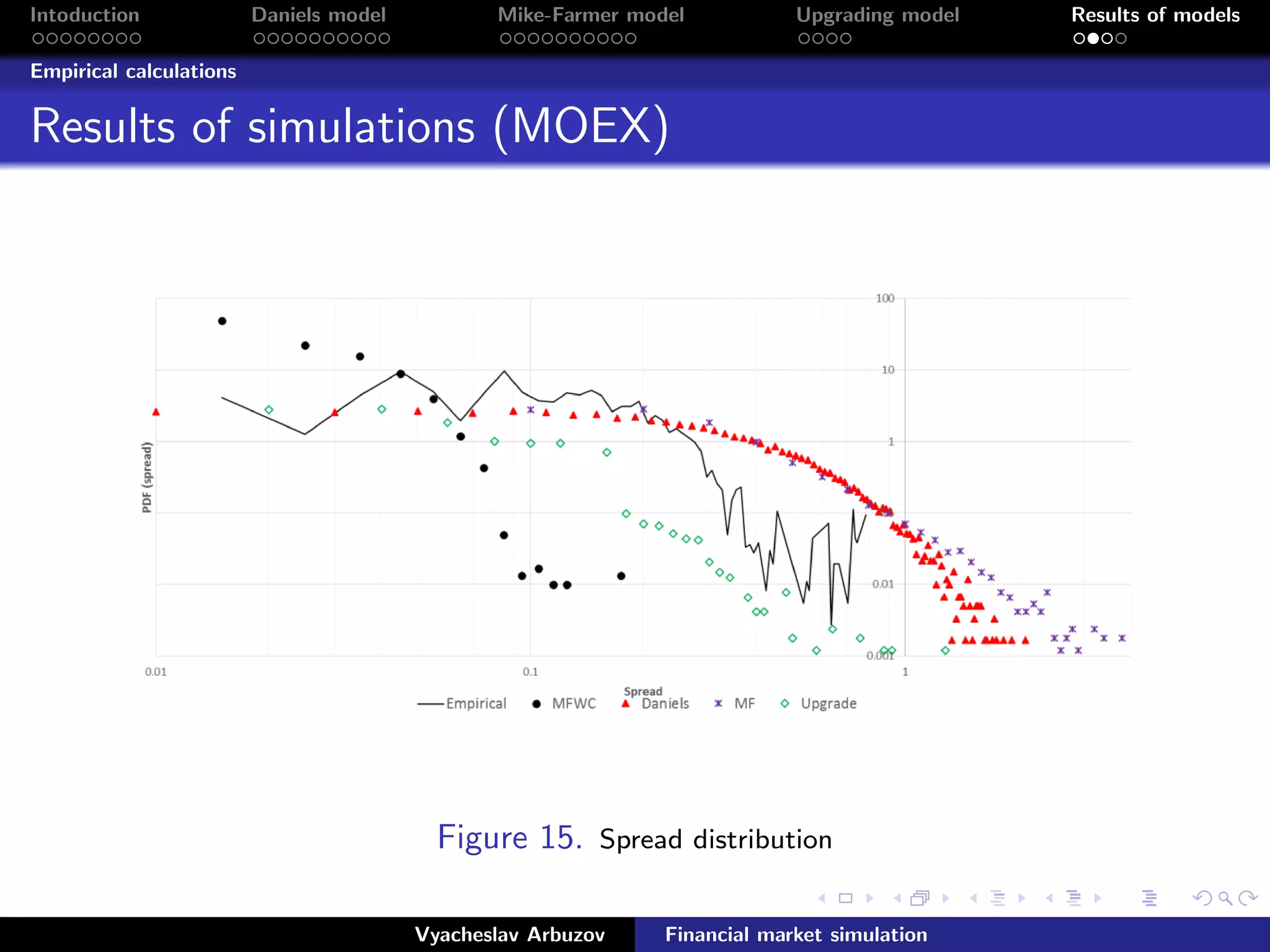

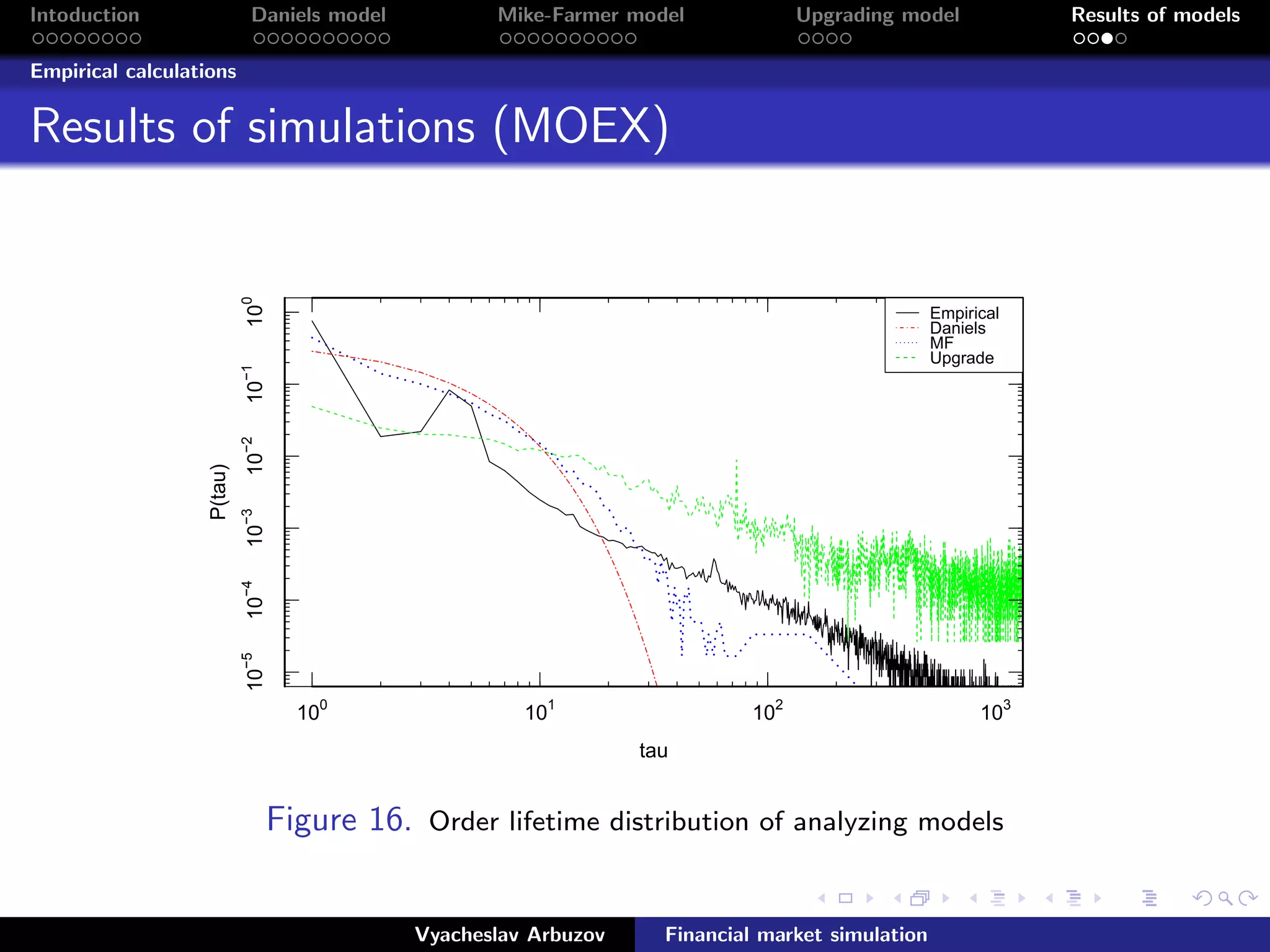

3. Both models are estimated using real order book data and their results are shown to closely match distributions of returns, spreads, and order lifetimes from the actual data.