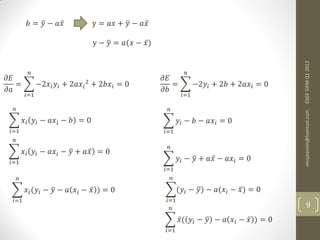

The document summarizes a session on financial econometric models. It will introduce models, their objectives of describing, modeling and forecasting data behavior. It will cover ordinary least squares regression, estimating intercepts and slopes to minimize residuals. It will also discuss calculating variances, covariances, correlation coefficients and assessing the quality of regressions. Examples using Excel functions like intercept, slope, var.p, covariance.p and stdev.p will be covered.

![> hist(Val$AMEX, breaks=20, main="Distribution

AMEX Returns")

> sd(Val$AMEX)

[1] 0.01915489

ESGF 5IFM Q1 2012

vinzjeannin@hotmail.com

> hist(Val$SPX, breaks=20, main="Distribution

SPXX Returns")

> sd(Val$SPX)

[1] 0.01468776 26](https://image.slidesharecdn.com/financialeconometricmodelsi-13274911680315-phpapp02-120125053516-phpapp02/85/Financial-Econometric-Models-I-26-320.jpg)

![These are obvious negatively skewed distributions

ESGF 5IFM Q1 2012

Reminders

3

− − 3

= =

− 2 3/2

vinzjeannin@hotmail.com

• Negative skew: long left tail, mass on the right, skew to the left

• Positive skew: long right tail, mass on the left, skew to the right

> skewness(Val$AMEX)

[1] -0.2453693

> skewness(Val$SPX) 27

[1] -0.4178701](https://image.slidesharecdn.com/financialeconometricmodelsi-13274911680315-phpapp02-120125053516-phpapp02/85/Financial-Econometric-Models-I-27-320.jpg)

![These are obvious leptokurtic distributions

ESGF 5IFM Q1 2012

Reminders

4

− − 4

= =

− 2 2

vinzjeannin@hotmail.com

> library(moments)

> kurtosis(Val$AMEX) What is their K?

[1] 5.770583 (excess kurtosis)

> kurtosis(Val$SPX)

[1] 5.671254 28

Subtract 3 to make it relative to the

normal distribution…](https://image.slidesharecdn.com/financialeconometricmodelsi-13274911680315-phpapp02-120125053516-phpapp02/85/Financial-Econometric-Models-I-28-320.jpg)

![By the way, what is the most platykurtic distribution in the nature?

Toss it!

ESGF 4IFM Q1 2012

Head = Success = 1 / Tail = Failure = 0

vinzjeannin@hotmail.com

> require(moments)

> library(moments)

> toss<-rbinom(10000000,1,0.5)

> mean(toss)

[1] 0.5001777

> kurtosis(toss)

[1] 1.000001

> kurtosis(toss)-3

[1] -1.999999

> hist(toss, breaks=10,main="Tossing a

coin 10 millions times",xlab="Result

of the trial",ylab="Occurence") 31

> sum(toss)

[1] 5001777](https://image.slidesharecdn.com/financialeconometricmodelsi-13274911680315-phpapp02-120125053516-phpapp02/85/Financial-Econometric-Models-I-31-320.jpg)